Economics, as a branch of the more general theory of human action, deals with all human action, i.e., with mans purposive aiming at the attainment of ends chosen, whatever these ends may be.--Ludwig von Mises

Thursday, April 29, 2010

Wednesday, April 28, 2010

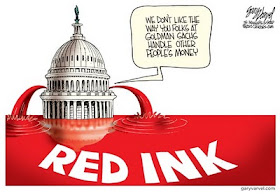

Financial Reform and the Briar Patch

Stigler’s capture theory of regulation is playing itself out again in the financial market regulation that is currently being considered by Congress.

read more here

Tuesday, April 27, 2010

Monday, April 26, 2010

Economists: Stimulus No Impact

In latest quarterly survey by the National Association for Business Economics, the index that measures employment showed job growth for the first time in two years -- but a majority of respondents felt the fiscal stimulus had no impact.

source

Saturday, April 24, 2010

Friday, April 23, 2010

Thursday, April 22, 2010

Wednesday, April 21, 2010

Tuesday, April 20, 2010

Monday, April 19, 2010

Sunday, April 18, 2010

Friday, April 16, 2010

Thursday, April 15, 2010

Common Fallacies about Macroeconomics

The bulk of it has been bad for the same reasons. Most of the people who purport to possess expertise about the economy rely on a common set of presuppositions and modes of thinking. I call this pseudointellectual mishmash “vulgar Keynesianism.” It’s the same claptrap that has passed for economic wisdom in this country for more than fifty years and seems to have originated in the first edition of Paul Samuelson’s Economics...

Vulgar Keynesians are nothing if not policy activists...The eras they esteem as the most glorious ones in U.S. politicoeconomic history are Roosevelt’s first term as president and Lyndon B. Johnson’s first few years in the presidency. In these periods, we witnessed an outpouring of new government measures to spend, tax, regulate, subsidize, and generally create economic mischief on an extraordinary scale. The Obama administration’s ambitious plans for government action on many fronts fill vulgar Keynesians with hope that a third such Great Leap Forward has now begun.

The vulgar Keynesian does not understand that extreme policy activism may work against economic prosperity by creating what I call “regime uncertainty,” a pervasive uncertainty about the very nature of the impending economic order, especially about how the government will treat private-property rights in the future.

source

Did FDR End the Depression?

'He got us out of the Great Depression." That's probably the most frequent comment made about President Franklin Roosevelt, who died 65 years ago today. Every Democratic president from Truman to Obama has believed it, and each has used FDR's New Deal as a model for expanding the government.

It's a myth. FDR did not get us out of the Great Depression—not during the 1930s, and only in a limited sense during World War II.

Let's start with the New Deal. Its various alphabet-soup agencies—the WPA, AAA, NRA and even the TVA (Tennessee Valley Authority)—failed to create sustainable jobs. In May 1939, U.S. unemployment still exceeded 20%. European countries, according to a League of Nations survey, averaged only about 12% in 1938. The New Deal, by forcing taxes up and discouraging entrepreneurs from investing, probably did more harm than good.

What about World War II? We need to understand that the near-full employment during the conflict was temporary. Ten million to 12 million soldiers overseas and another 10 million to 15 million people making tanks, bullets and war materiel do not a lasting recovery make. The country essentially traded temporary jobs for a skyrocketing national debt. Many of those jobs had little or no value after the war.

No one knew this more than FDR himself. His key advisers were frantic at the possibility of the Great Depression's return when the war ended and the soldiers came home. The president believed a New Deal revival was the answer—and on Oct. 28, 1944, about six months before his death, he spelled out his vision for a postwar America. It included government-subsidized housing, federal involvement in health care, more TVA projects, and the "right to a useful and remunerative job" provided by the federal government if necessary...

Congress—both chambers with Democratic majorities—responded by just saying "no." No to the whole New Deal revival: no federal program for health care, no full-employment act, only limited federal housing, and no increase in minimum wage or Social Security benefits.

Instead, Congress reduced taxes. Income tax rates were cut across the board. FDR's top marginal rate, 94% on all income over $200,000, was cut to 86.45%. The lowest rate was cut to 19% from 23%, and with a change in the amount of income exempt from taxation an estimated 12 million Americans were eliminated from the tax rolls entirely...

Congress substituted the tonic of freedom for FDR's New Deal revival and the American economy recovered well. Unemployment, which had been in double digits throughout the 1930s, was only 3.9% in 1946 and, except for a couple of short recessions, remained in that range for the next decade.

The Great Depression was over, no thanks to FDR. Yet the myth of his New Deal lives on. With the current effort by President Obama to emulate some of FDR's programs to get us out of the recent deep recession, this myth should be laid to rest.

Top 400 American Taxpayers

• The top 400 paid 2.05% of all individual income taxes in 2007.

• Only 220 of the top 400 were in the top marginal tax bracket.

• Average tax rate of the 400 = 16.6% — the lowest since the IRS began tracking the 400 in 1992.

• Minimum annual income to make the top 400 = $138.8 million.

• Top 400 reported $137.9 billion in income; they paid $22.9 billion in federal income taxes.

• 81.3% of income was from capital gains, dividends or interest. Salaries and wages? Just 6.5%.

• The top 400 list changes from year to year: 1992-2007, it contained 3,472 different taxpayers (out of a maximum 6400).

source

Wednesday, April 14, 2010

Tuesday, April 13, 2010

Monday, April 12, 2010

Is the Recession Over?

source

My thoughts: Many sources and conventional wisdom are pointing to the recession ending in June 2009. There seems to be some doubt coming from the NBER. NBER also takes it time, often over 1 year before declaring a trough. Likely we will have a double dip or a very long recession. Jobs seem to be the key.

Sunday, April 11, 2010

Friday, April 9, 2010

Thursday, April 8, 2010

Social Security: An Investment Loser

To find the dividing line between net gainers and losers, we created a projection assuming an individual with a salary equaling the top taxable Social Security limit for 45 years (to get an idea of this amount, consider the limit was $3,000 dollars in 1940 and $106,800 in 2010 – both nice salaries). Our test dummy paid the maximum Social Security taxes every year.

On the other hand, upon retirement, he would receive maximum benefits. According to the Social Security Administration, maximum taxation is a prerequisite to maximum payouts. Next, we added Social Security benefits received over 13 years (derived from the average U.S. life expectancy of about 78). Finally, we calculated the difference between taxes paid over 45 years and the payouts received for 13. The results were shocking.

Before 2007, our projected retirees were net gainers from Social Security. 2007 retirees were the first net losers at –$411. By 2011, retirees will be –$40,403 in the red.

sourceHealthcare Reform Summarizied

read the essay

Wednesday, April 7, 2010

Tuesday, April 6, 2010

Bruce Caldwell on Hayek and the Economic Meltdown

Bruce Caldwell:

the Austrian /public choice one-two punch: we usually do not have the necessary knowledge to intervene effectively, and the political process is such that, even if we did, we still likely would get bad policy, and this together with an ever growing government sector.

read the paper