source

source

Economics, as a branch of the more general theory of human action, deals with all human action, i.e., with mans purposive aiming at the attainment of ends chosen, whatever these ends may be.--Ludwig von Mises

Saturday, July 31, 2010

History of Capitalism

The history of capitalism as it has operated in the last two hundred years in the realm of Western civilization is the record of a steady rise in the wage earners' standard of living. The inherent mark of capitalism is that it is mass production for mass consumption directed by the most energetic and far-sighted individuals, unflaggingly aiming at improvement. Its driving force is the profit motive, the instrumentality of which forces the businessman constantly to provide the consumers with more, better, and cheaper amenities. An excess of profits over losses can appear only in a progressing economy and only to the extent to which the masses' standard of living improves. Thus capitalism is the system under which the keenest and most agile minds are driven to promote to the best of their abilities the welfare of the laggard many.

In the field of historical experience it is impossible to resort to measurement. As money is no yardstick of value and want satisfaction, it cannot be applied for comparing the standard of living of people in various periods of time. However, all historians whose judgment is not muddled by romantic prepossessions agree that the evolution of capitalism has multiplied capital equipment on a scale which far exceeded the synchronous increase in population figures. Capital equipment both per capita of the total population and per capita of those able to work is immensely larger today than fifty, a hundred, or two hundred years ago. Concomitantly there has been a tremendous increase in the quota the wage earners receive out of the total amount of commodities produced, an amount that in itself is much bigger than in the past.

The ensuing rise in the masses' standard of living is miraculous when compared with the conditions of ages gone by. In those merry old days, even the wealthiest people led an existence that must be called straightened when compared with the average standard of the American or Australian worker of our age. Capitalism, says Marx, unthinkingly repeating the fables of the eulogists of the Middle Ages, has an inevitable tendency to impoverish the workers more and more. The truth is that capitalism has poured a horn of plenty upon the masses of wage earners, who frequently did all they could to sabotage the adoption of those innovations that render their life more agreeable. How uneasy an American worker would be if he were forced to live in the manor of a medieval lord and to miss the plumbing facilities and the other gadgets he simply takes for granted!

The improvement in his material well-being has changed the worker's valuation of leisure. Better supplied with the amenities of life as he is, he sooner reaches the point at which he looks upon any further increment in the disutility of labor as an evil that is no longer outweighed by the expected further increment in labor's mediate gratification. He is eager to shorten the hours of daily work and to spare his wife and children the toil and trouble of gainful employment. It is not labor legislation and labor-union pressure that have shortened hours of work and withdrawn married women and children from the factories; it is capitalism, which has made the wage earner so prosperous that he is able to buy more leisure time for himself and his dependents. The 19th century's labor legislation by and large achieved nothing more than to provide a legal ratification for changes that the interplay of market factors had brought about previously. As far as it sometimes went ahead of industrial evolution, the quick advance in wealth soon made things right again. As far as the allegedly prolabor laws decreed measures that were not merely the ratification of changes already effected or the anticipation of changes to be expected in the immediate future, they hurt the material interests of the workers.

The term "social gains" is utterly misleading. If the law forces workers who would prefer to work 48 hours a week not to give more than 40 hours of work, or if it forces employers to incur certain expenses for the benefit of employees, it does not favor workers at the expense of employers. Whatever the provisions of a social-security law may be, their incidence ultimately burdens the employee, not the employer. They affect the amount of take-home wages; if they raise the price the employer has to pay for a unit of performance above the potential market rate, they create institutional unemployment. Social security does not enjoin upon the employers the obligation to expend more in buying labor. It imposes upon the wage earners a restriction concerning the spending of their total income. It curtails the worker's freedom to arrange his household according to his own decisions.

Whether such a system of social security is a good or a bad policy is essentially a political problem. One may try to justify it by declaring that the wage earners lack the insight and the moral strength to provide spontaneously for their own future. But then it is not easy to silence the voices of those who ask whether it is not paradoxical to entrust the nation's welfare to the decisions of voters whom the law itself considers incapable of managing their own affairs; whether it is not absurd to make those people supreme in the conduct of government who are manifestly in need of a guardian to prevent them from spending their own income foolishly. Is it reasonable to assign to wards the right to elect their guardians? It is no accident that Germany, the country that inaugurated the social-security system, was the cradle of both varieties of modern disparagement of democracy, the Marxian as well as the non-Marxian.

What Stimulus Impact?

If any of that were remotely close to being true then, as a matter of simple accounting, rising federal spending would have shown up as a huge offset to falling GDP in 2009, and also as a major component of the modest increase in GDP growth in early 2010. On the contrary, the table below shows that the increase in federal nondefense spending contributed only two-tenths of one percent (0.2) to the change in GDP in 2009. That was no better than 2008 when the Recovery Act did not exist. If nondefense spending had not increased at all in 2009 (unlike 2008) then GDP would have fallen 2.8% rather than 2.6% — scarcely the difference between a recession and a “second Depression.” If nondefense federal spending had not increased at all in 2010, the economy still would have grown at a 3.6% pace in the first quarter, 2.1% in the second. Cutbacks in state and local spending were a trivial damper on GDP growth last year, contrary to recent speculation, and real state and local spending rose significantly in this year’s second quarter (unlike the first).

This is just an exercise in crude Keynesian accounting, not economics. Yet it nonetheless makes the stimulus bill look like a huge waste of money. The reason Keynesian accounting is no substitute for economics is that governments can only spend other peoples’ money. To claim that such spending is a net addition to “aggregate demand” is to ignore those other people — namely, current and future taxpayers.

Friday, July 30, 2010

China Now #2 Economy in the World

Depending on how fast its exchange rate rises, China is on course to overtake the United States and vault into the No.1 spot sometime around 2025, according to projections by the World Bank, Goldman Sachs and others.

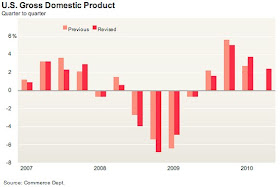

GDP Revisions: The Graph

And annualized real GDP is still 0.85% below the pre-recession peak. This means that real GDP would have to grow at a 3.4% rate over the nextquarter to reach the recession peak.

source

GDP Revisions

| Quarter | GDP | GDP Revised | Change |

|---|---|---|---|

| 2007-I | 1.2% | 0.9% | -0.3% |

| 2007-II | 3.2% | 3.2% | 0.0% |

| 2007-III | 3.6% | 2.3% | -1.3% |

| 2007-IV | 2.1% | 2.9% | 0.8% |

| 2008-I | -0.7% | -0.7% | 0.0% |

| 2008-II | 1.5% | 0.6% | -0.9% |

| 2008-III | -2.7% | -4.0% | -1.3% |

| 2008-IV | -5.4% | -6.8% | -1.4% |

| 2009-I | -6.4% | -4.9% | 1.5% |

| 2009-II | -0.7% | -0.7% | 0.0% |

| 2009-III | 2.2% | 1.6% | -0.6% |

| 2009-IV | 5.6% | 5.0% | -0.6% |

| 2010-I | 2.7% | 3.7% | 1.0% |

| 2010-II | 2.4% |

The recession was worse in 2008 than originally estimated.

Q1 2010 was revised up, but Q3 and Q4 2009 were revised down. So the recovery is a little weaker than originally estimated.

GDP 2nd Quarter 2010: 2.4%

In the first of three estimates for U.S. economic growth in the second quarter, the Commerce Department reported that real Gross Domestic Product slowed to an annualized rate of 2.4 percent, down from an upwardly revised rate of 3.7 percent in the first quarter, primarily due to a widening trade deficit and declining consumer spending.

source

GDP Revised Downward

GDP rose at a 2.4% rate from April to June. First-quarter growth was revised up, but estimates all the way back to 2007 were revised lower.

The U.S. economy slowed in the second quarter of this year and the government said the recession was deeper than earlier believed, adding to concerns over the recovery's strength...

In the first quarter, the economy grew by 3.7%, revised up from an originally reported 2.7% increase. But growth estimates all the way back to the start of 2007 were revised lower...

The government revision of data over the past three years showed that the economy's exit from its deep slump was weaker than previously estimated. In the final quarter of 2009, for example, GDP rose at an annualized rate of 5.0% as consumer spending didn't grow as much as previously thought. The earlier estimate was that GDP increased by 5.6%...

For all of 2009, the government said the U.S. economy contracted by 2.6%, compared to the previously estimated 2.4% decline. In the whole of 2008, GDP was flat, instead of rising 0.4% as previously estimated. In 2007, the world's largest economy expanded by 2.1%, down from an originally reported 1.9% increase.

Thursday, July 29, 2010

My Tax Burden

Calculate to estimate your 2011 income tax under three scenarios:

1. Congress allows all of the Bush tax cuts to expire;

2. Congress acts to extend into 2011 all of the Bush tax cuts; and

3. Congress passes the tax laws suggested by President Obama's budget, letting some tax cuts expire, extending some, and enacting some new tax laws.

go to the site

How the Great Recession was Brought to an End

Here is their conclusion:

The financial panic and Great Recession were massive blows to the U.S. economy. Employment is still some 8 million below where it was at its pre-recession peak, and the unemployment rate remains above 9%. The hit to the nation’s fiscal health has been equally disconcerting, with budget deficits in fiscal years 2009 and 2010 of close to $1.4 trillion.

These unprecedented deficits reflect both the recession itself and the costs of the government’s multi-faceted response to it. The total direct costs, including the TARP, the fiscal stimulus, and other efforts, such as addressing the mortgage-related losses at Fannie Mae and Freddie Mac, are expected to reach almost $1.6 trillion. Adding in nearly $750 billion in lost revenue from the weaker economy, the total budgetary cost of the crisis is projected to top $2.35 trillion, about 16% of GDP. For historical comparison, the savings-and-loan crisis of the early 1990s cost some $350 billion in today’s dollars: $275 billion in direct costs plus $75 billion due to the associated recession. This sum was equal to almost 6% of GDP at that time.

It is understandable that the still-fragile economy and the massive budget deficits have fueled criticism of the government’s response. No one can know for sure what the world would look like today if policymakers had not acted as they did—our estimates are just that, estimates. It is also not difficult to find fault with isolated aspects of the policy response. Were the bank and auto industry bailouts really necessary? Do extra UI benefits encourage the unemployed not to seek work? Should not bloated state and local governments be forced to cut wasteful budgets? Was the housing tax credit a giveaway to buyers who would have bought homes anyway? Are the foreclosure mitigation efforts the best that could have been done? The questions go on and on.

While all of these questions deserve careful consideration, it is clear that laissez faire was not an option; policymakers had to act. Not responding would have left both the economy and the government’s fiscal situation in far graver condition. We conclude that Ben Bernanke was probably right when he said that “We came very close in October [2008] to Depression 2.0.”11

While the TARP has not been a universal success, it has been instrumental in stabilizing the financial system and ending the recession. The Capital Purchase Program gave many financial institutions a lifeline when there was no other. Without the CPP’s equity infusions, the entire system might have come to a grinding halt. TARP also helped shore up asset prices, and protected the system by backstopping Fed and Treasury efforts to keep large financial institutions functioning. TARP money was also vital to ensuring an orderly restructuring of the auto industry at a time when its unraveling would have been a serious economic blow. TARP funds were not used as effectively in mitigating foreclosures, but policymakers should not stop trying.

The fiscal stimulus also fell short in some respects, but without it the economy might still be in recession. Increased unemployment insurance benefits and other transfer payments and tax cuts put cash into households’ pockets that they have largely spent, supporting output and employment. Without help from the federal government, state and local governments would have slashed payrolls and programs and raised taxes at just the wrong time. (Even with the stimulus, state and local governments have been cutting and will cut more.) Infrastructure spending is now kicking into high gear and will be a significant source of jobs through at least this time next year. And business tax cuts have contributed to increased investment and hiring.

When all is said and done, the financial and fiscal policies will have cost taxpayers a substantial sum, but not nearly as much as most had feared and not nearly as much as if policymakers had not acted at all. If the comprehensive policy responses saved the economy from another depression, as we estimate, they were well worth their cost.

read the entire paper

My thoughts: blah, blah, blah. Wow. Our wonderful policymakers can prevent us from drowning, but they never keep us from falling into the deep end of the pool. Malaise is the word, not recovery. Or perhaps, dead cat bounce.

John Maynard Keynes, Defunct Economist

When Keynes burst on the scene, most economists were against government economic interventionism. Still, there was a growing influence of Marxist ideas, evidenced by the inroads of welfarism in Europe, especially in Great Britain and Germany. And favorable reports of “success” in Mussolini’s Italy and Stalin’s Russia influenced the political direction of the United States...

Keynes was a revolutionary who provided a rationale for intellectual and political leaders who were increasingly enamored with Marxist political objectives but somewhat constrained by conventional economic wisdom...

Keynes’s theories provided intellectual support for the economic policies of Franklin Roosevelt, which were welcomed by a public desperate for change in the dire circumstances following the crash in 1929. They provided cover for massive government spending, abandoning the gold standard, and political control of market functions — all contrary to the economic wisdom that had taken two centuries to develop and had led to unparalleled prosperity in the United States.

The great economists of the 20th century, Ludwig von Mises, Friedrich Hayek, Milton Friedman, Henry Hazlitt, and Murray Rothbard, all clearly and thoroughly discredited Keynes. Hayek and Friedman both won Nobel Prizes in economics. In 1931 Hayek challenged Keynes in a famous series of debates, which focused on Keynes’s Treatise on Money. In the decades since, history has proven the correctness of Hayek’s views. Roosevelt’s New Deal was a failure and prolonged the Depression by about six years, as various research studies have shown. And though popular for several decades, Keynes eventually fell out of favor. Until now, when he is the “defunct economist” who provides the intellectual cover for Obama, just as he did for Roosevelt...

Wednesday, July 28, 2010

Jim Rogers: New Recession in 2012

However, he said that due to the extraordinary measures already adopted by central banks and governments around the world, the arsenal of available tools to combat the next recession is somewhat lacking.

With reference to Ben Bernanke, chairman of the US Federal Reserve, he said: "Is Mr Bernanke going to print more money than he already has? No, the world would run out of trees."

sourceChance of Double-Dip US Recession is High

"For me a double-dip is another recession before we've healed from this recession ... The probability of that kind of double-dip is more than 50 percent," Shiller said. "I actually expect it."

A War Between Free Enterprise and Big Government.

click here for the 51 minute interview

The Battle then outlines three big facts:

First, there is a fundamental disagreement about America’s future between a socialist, redistributionist minority (the 30% coalition) and a massive free enterprise, work ethic, opportunity oriented majority (the 70% majority). For years I have spoken and written that “we are the majority”. It is a concept I learned from Ronald Reagan in the 1970s. Now Brooks provides the ammunition to factually explain why the 70% should govern America as a reflection of our legitimate majority status.

Second, there is an elite system of power which enables the 30% coalition to dominate the 70% majority. There are the seeds of an extraordinary history book buried in a few paragraphs of The Battle. How did the coalition of word users come to so thoroughly dominate the coalition of workers and doers? How did the elites on academic campuses come to define legitimacy for the news media, the Hollywood system, the Courts, and the bureaucracy? Brooks makes clear that the dominance of the hard left in these worlds is a fact. He sets the stage for someone (maybe another AEI scholar) to develop the historic explanation of how this usurpation of the people by the elite came to be.

Third, this is a conflict over values in which those who represent redistributionist, left wing materialism have stolen the language of morality while those who favor freedom, individual opportunity, the right to pursue happiness and personal liberty have been maneuvered into a series of banal and ultimately unattractive positions in the public debate. Brooks’ outline of a morally dominant culture of freedom shaming the materialistic, statist, coercive culture of redistribution is as important for our generation as Hayek’s The Road to Serfdom was for the Reagan-Thatcher generation.

source

Marc Faber on the Economy and Assorted Topics

On reality: My views are not all that negative. I think they're just realistic. I want to face reality. You have people like Paul Krugman who thinks we should have another bubble to pull us out of this. He actually said that. But he said the same thing in 2001. And you know how that turned out.

On unintended consequences: The Fed doesn't seem to have learned anything at all from its mistakes. Their current policy of cutting rates to zero is designed to create sustainable growth, but they've created larger and larger volatility in markets. There are many unintended consequences of their actions.

The oil bubble of 2008 is a good example. In 2008, the price of oil went ballistic, but the U.S. was already in a recession [it began in Dec. 2007]. There was no rational reason oil should have gone ballistic. The Fed's easy money just fueled a bubble. It was like a $500 billion tax on consumers courtesy of the Fed. That's the added amount that it cost you, and it helped push consumers over a cliff in late 2008.

On the Fed: The Fed doesn't pay any attention to asset bubbles when they grow. That's their official policy. But they flood the system with cash when bubbles burst. They only care about bubbles when they crash. It's a very asymmetric response and it has many unintended consequences.

Letting bubbles inflate and then fighting them when they burst actually worked for a while. That's what makes it dangerous. It worked in the '90s. But you shouldn't read too much into this: This period was assisted by unusually favorable conditions. From 1981 until early last decade, commodities were in a bear market after a bubble in the '70s and early '80s. And interest rates were falling throughout the '80s and '90s, too. They almost never stopped falling. That made Fed policy look like it was working.

Bubbles can still happen without expansionary monetary policy. In the 19th century, you had bubbles in railroads, for example. But today, the Fed has created a bubble in everything -- in every single asset class. This is an achievement even for a central bank. Stocks. Commodities. Bonds. Real estate. Gold. Everything goes up when the Fed prints. The only asset that goes down is the U.S. dollar.

On deflation: I'm a believer that the stock market lows of March 2009 will not be revisited. You have people like Robert Prechter who think the Dow will collapse to 700 because of debt deleveraging. Debt deleveraging could happen, but the Dow will not fall because of monetary policy. The Fed will keep everything inflated in nominal terms. And if the Dow does go to 700, you'll have more to worry about than your investments. All the banks will be bust. The government will be bust. You don't want cash if massive deflation happens. On the contrary: It will be worthless. You have to think very carefully about hardcore deflation.

On credit addiction: In a credit-addicted economy, you don't need credit to actually fall for there to be problems. All you need is a slowdown in the growth rate, and you get big problems. Now, the government and the Fed are aware of this, so they are creating debt through fiscal deficits and monetization. That creates a hugely volatile environment. In 2008, government credit creation was inferior to private credit contraction, and asset markets tanked. In 2009, government credit creation was higher than private contraction, and asset markets went ballistic. Lately, government credit creation has slowed, and asset markets have gone down. Now, the Fed is aware of this, and it's only a matter of time before it throws more money into the system. I guarantee this.

On what the Fed will do from here on out: The easiest way to fix our debt problems is with 6% inflation per year. That bails out everyone in debt. Interest rates will stay at 0% in real terms forever, in my opinion. If inflation is 5% per year, the Fed will keep interest rates at 5%; that's how you get 0% real interest rates. Now, we could have debt contraction in the private sector, but it doesn't matter. It will be more than an offset with government debt creation. So it's not a good idea to be all in cash and out of stocks. Cash is very dangerous when central banks want real interest rates at 0%.

On the rest of the world: The U.S. today is much worse off than it was 10 or 20 years ago compared with the rest of the world. The Asians should thank the Federal Reserve for this. The Fed practically created the emerging market economies. The Chinese pegged its currency to the dollar in 1994, and until 1998 not much happened. When the Fed began printing and boosting asset prices in 1998, there was this huge debt growth, and U.S. consumers began spending at a massive rate. That increased our trade deficit from $200 billion to $800 billion. Of course, trade deficits have to be offset by trade surpluses in other countries. So the Chinese began ratcheting up production. Then their employment went up. Their wages went up. Entrepreneurs began investing more money in capital spending. The Fed is not the only factor that led to strong emerging market growth, but it certainly was a major factor in it.

On delusions of grandeur: In the U.S., we still think that we are the largest consumer market in the world. For some services we are, but in general this is the wrong way to look at things.

There are huge differences in how statistics between countries are produced. For one, the U.S. is the most leveraged. Other countries factor this in. Also, consumption in the U.S. is 70% of GDP, but it's almost all on domestic services. Spending on actual goods is only 20% of consumption. In the U.S., we spend $600 billion a year on defense. But $300 billion of this goes to personnel and retiree costs. In China, the cost of personnel is basically nothing. When you adjust for purchasing power, China probably spends about what the U.S. does on military capital.

We also think that we have all the knowledge of the world. We think that's our edge. But knowledge in countries with much larger populations have the edge. Research now is being done in Asia because it's cheaper there. Companies like Intel, IBM, and Microsoft are researching in Asia. It's just so much cheaper there. And they are smarter than the U.S. in many ways, too.

Keynesians and Repeating Mistakes of the Past

It was said of the Bourbons that they forgot nothing and learned nothing. The same could easily be said of some of today’s latter-day Keynesians. They cannot and never will forget the policy errors made in the US in the 1930s. But they appear to have learned nothing from all that has happened in economic theory since the publication of their bible, John Maynard Keynes’s The General Theory of Employment, Interest and Money, in 1936.The British government, following the advice of Winston Churchill, who was Chancellor of the Exchequer, in 1925 restored the gold standard at the pre-World War I ratio, despite the fact that the wartime monetary inflation had driven up the price of goods. Gold should not have been priced at the pre-War price. But Churchill had decided that national pride was at stake. He pretended that the debasing of the pound sterling had not been government policy.

Niall Ferguson

There was an outflow of gold from the Bank of England. Speculators thought the price of gold in pounds would have to be officially hiked. To keep this outflow from forcing the Bank of England to suspend payment, thereby confirming the forecasts of the speculators, the head of the Bank of England met with the head of the New York Federal Reserve in 1926 and persuaded him to inflate the dollar, so as not to make the dollar too valuable in relation to the pound. This would have caused investors to sell pounds and buy dollars. The U.S. government would then have sent pounds to Britain and asked for payment in gold. The New York FED did what the Bank of England asked. It inflated the dollar. The result was the stock market boom from 1926–1929.

The head of the New York FED died in 1928. His successor recognized that a stock market bubble was in process. The FED ceased inflating. Short-term interest rates rose. This popped the stock market bubble in October of 1929.

The government then intervened. It raised tariffs. It began massive deficit spending. It began to interfere with pricing, so as to keep prices and wages high. In short, it adopted Keynesian policies, which made the economy much worse.read the entire essay

Business and Self-Regulation

Case in point: The announcement last week by four oil companies - Chevron, ConocoPhillips, ExxonMobil and Shell - that they are setting up a $1 billion joint venture to design, build and operate a rapid-response system to contain spills as deep as and deeper than BP’s Deepwater Horizon disaster.

Their goal is a system that can start mobilizing within 24 hours of an oil spill. They hope to have it up and running within 18 months.

I suppose one might ask why oil companies didn’t do this before. But it seems a vivid contrast with the apparently hapless performance of the Minerals Management Service, recently renamed the Bureau of Ocean Energy Management, Regulation and Enforcement, which seems to have sat on out-of-date response plans for years and which was not able to call in equipment and personnel to respond to the April 20 BP spill for weeks or months...

Consider Underwriters Laboratories, founded in 1894, whose UL stickers come attached to regulator products. Or the Society of Automotive Engineers, founded in 1905, which sets standards for the automobile and other industries.

Government hasn’t had to step in because UL and SAE work well without them. Federal regulators couldn’t plug the BP well. The oil companies’ joint venture promises to be able to do so.

Another case in point, which is different and more diffuse: the “capital strike.” In the wake of the uncertainty raised by the Obama Democrats’ huge increase in regulations and pending increases in taxes, businesses are sitting on cash and not hiring, banks are buying Treasury bonds and not lending, investors are not investing and consumers aren’t buying. The economy languishes...

Two lessons seem apparent here. One is that private firms can do things government regulators can’t do. The other is that if you choke the golden goose enough, it stops producing eggs - and you have to get your hands off its neck.

Debate: More Stimulus?

Eighteen months after President Barack Obama administered a massive dose of spending increases and tax cuts to a weak economy, a brawl has broken out among economists and politicians about whether fiscal-stimulus medicine is curing the illness or making it worse...One side says Mr. Obama's $862 billion fiscal stimulus prevented an even graver recession. Cutting the deficit right now, this side insists, would send the economy into a tailspin. The other side questions the benefits of the stimulus and argues addressing long-term deficits now is crucial to avoid higher interest rates and even bigger economic problems down the road.

And then there is a camp in the middle—defending last year's stimulus, but urging a deficit-cutting plan now...

"Too many are searching for answers in the discredited economic playbook of borrow-and-spend Keynesian policies," Rep. Paul Ryan, a Wisconsin Republican who is pushing a long-run deficit cutting plan, said this month. "I reject the false premise that only forceful and sustained government intervention in the economy can secure this country's renewed prosperity."...

Richard Trumka, president of the AFL-CIO union alliance, says if the government starts cutting deficits now, "We'll slip back into recession and possibly depression."...

But today, neither side can say with certainty whether the latest stimulus worked, because nobody knows what would have happened in its absence.

Fed Chairman Ben Bernanke backed fiscal stimulus in early 2009. Now he says the economy still needs fiscal stimulus, but says it must be accompanied with a credible plan to reduce future deficits. Like the Obama administration, he doesn't think that plan should be implemented until the economy is on more solid footing...

The case that government deficit spending can be vital at times of recessions dates to John Maynard Keynes, the British economist whose teachings dominated economics for decades after the Great Depression. "Pyramid-building, earthquakes, even wars may serve to increase wealth," Mr. Keynes said in his 1936 classic, "The General Theory of Employment, Interest and Money."

A counter-revolution led by Milton Friedman, of the University of Chicago, de-emphasized the role of government and gave rise to Ronald Reagan and Britain's Margaret Thatcher. Keynes lost favor during the stagflation of the late 1970s and early 1980s. The Fed and its manipulation of interest rates came to be seen as the best way for governments to manage the short-term ups and downs of the economy...

The Obama administration is stocked with heirs of Mr. Keynes, including academics Christina Romer and Mr. Summers. Ms. Romer famously projected in January 2009 that without government support, the unemployment rate would reach 9%, but with support the government could keep it under 8%. It's 9.5% today...

Underlying the debate is a long-running argument about how much of a lift the government gets from spending more or taxing less. Keynesians argue that when the economy is distressed, a dollar spent by the government multiplies in value. It gives a worker income the private sector has failed to produce, which he spends, creating demand for goods and services.

Ms. Romer argued last year that this "multiplier" for government meant every dollar spent created about $1.50 worth of demand...

Robert Barro, a Harvard economist, found even smaller multipliers: A government dollar spent creates about 80 cents worth of growth, or possibly less, he says. Government spending, he says, crowds out private sector spending that would otherwise be taking place...

Carmen Reinhart, a University of Maryland economist who has studied the fiscal aftermath of financial crises, says more stimulus could be counterproductive because it could lead the public to expect even higher taxes in the future...

"We are not in an easy position," she says. "Credibility is going to be difficult to achieve."

My thoughts: Central planning does not work. It does not matter if the method of central planning is fiscal policy or monetary policy. Politicians do not understand how economies work.

A recession is better understood as a "market correction". When a cluster of errors occurs from artificially low interest rates, this generates an unsustainable boom. Once the boom occurs the bust is inevitable. The Fed created the boom. Ben Bernanke will eventually be known as the worst Fed chairman ever. The Creature from Jekyll Island hopefully will die a quicker death due to the incompetence of Bernanke.

Keynesian economics never truly died, it was merely displaced by the monetarist economics of Milton Friedman and the Chicago School. Mainstream economic thought came to believe that monetary policy was most effective and that Keynesian solutions should be reserved for when monetray policy could not produce the desired effects.

Both Keynesians and monetarists do not truly understand how economies work. For the Keynesians, you can't spend yourself into prosperity. Pyramid-building, earthquakes, and wars are the solution to economic problems. Pyramid-building (also known as public works) is an unnecessary function of government that only serves to put the nation into deeper debt. Earthquakes and wars kill people and destroy capital, which is the opposite of what is needed for economic growth. For the monetarist, attempting to paper over a bubble that was originally created by easy money policy is insane. You don't solve problems by doing the same thing that caused the problem to begin with.

Tuesday, July 27, 2010

Monday, July 26, 2010

Chicago Fed National Activity Index June 2010

Led by deterioration in production- and employment-related indicators, the Chicago Fed National Activity Index declined to –0.63 in June, down from +0.31 in May. Three of the four broad categories of indicators that make up the index made negative contributions in June, while the sales, orders, and inventories category made the lone positive contribution.

http://www.calculatedriskblog.com/2010/07/chicago-fed-economic-activity-declined.html

New Home Sales for June 2010

Ignore all the month to previous month comparisons. May was revised down sharply and that makes the increase look significant. Here is the bottom line: this was the worst June for new home sales on record.

source

Sunday, July 25, 2010

Saturday, July 24, 2010

Sheldon Richman on Dodd-Frank Financial Legislation

President Obama has signed the financial industry regulatory overhaul – officially, the Dodd-Frank Wall Street Reform and Consumer Protection Act. Predictably, what he said about it cannot possibly be true.

For example: “[T]hese reforms represent the strongest consumer financial protections in history. And these protections will be enforced by a new consumer watchdog with just one job: looking out for people – not big banks, not lenders, not investment houses – looking out for people as they interact with the financial system.”

And: “[B]ecause of this law, the American people will never again be asked to foot the bill for Wall Street’s mistakes. There will be no more tax-funded bailouts — period. If a large financial institution should ever fail, this reform gives us the ability to wind it down without endangering the broader economy. And there will be new rules to make clear that no firm is somehow protected because it is ‘too big to fail,’ so we don’t have another AIG.”

Note that Obama did not promise to spare the taxpayers from having to foot the bill for the government’s mistakes. He and the members in Congress know better than to make that howler of a promise. Nevertheless, the magnitude of the whoppers being told about this law is astounding.

The government cannot deliver on pledges to protect consumers in the financial markets and to shield taxpayers from bailouts. In the first instance — consumer protection — financial instruments are inherently complex and government attempts to shelter less-sophisticated investors and borrowers from all danger would either require control of products to the point of prohibiting things people want or inundating them with information until they ignore all of it because of the sheer volume. Alas, what the new law will provide consumers is a false sense security – and that’s worse than none at all...

Most generally, the new law exhibits the standard governmental hubris. Who truly believes that an army of necessarily myopic bureaucrats can ever know enough to 1) anticipate a systemic crisis and 2) do something intelligent about it in a timely way? The more centralized the power the more vulnerable we average taxpayers are. Mistakes are system-wide. The virtue of a freed market is not that it’s unregulated (it’s not) but that its radically decentralized...

It’s Dodd, by the way, who said of his bill, “No one will know until this is actually in place how it works.” And Frank is ready to submit new legislation to fix any mistakes in the law. We’re about to have a laboratory experiment of the law of unintended consequences.

Obama said: “For years, our financial sector was governed by antiquated and poorly enforced rules that allowed some to game the system and take risks that endangered the entire economy.” The implication is now we have up-to-date rules that will be vigorously enforced. But he can’t possibly know that. Why not? Because in writing the law, Congress did not write the rules. It merely handed that job off to unelected, unaccountable bureaucrats in a variety of agencies.read the entire essay

Friday, July 23, 2010

BP Gulf Oil Spill

BP clearly is culpable. And the

Many other factors also contributed to the accident, however.

First among them is the important issue of ownership. BP did not own the Deepwater Horizon, but leased it from another company,A second contributor to the disaster is the federal law limiting liability for damages caused by offshore oil spills...

Third, BP may have been misled in calculating its exposure to risk by MMS computer models that predict the likely path of large-scale oil spills in the

Fourth, BP and other oil companies have been forced to drill in ultra-deep waters as a result of federal laws and

There is plenty of blame to go around for the Deepwater Horizon disaster. But don't jump to the conclusion that the best way to prevent future catastrophes is simply through further regulation.

More regulation will not necessarily work any better than existing regulation. What will work is getting the incentives right — through clearly defined ownership, responsibility and liability — and exploiting proven oil reserves onshore and in shallow waters offshore.

Bailouts: Will They Be Repaid?

As President Obama today signed into law the Dodd-Frank financial regulation bill, two words were left unspoken: Fannie and Freddie. Yet they not only played a major role in creating the housing bubble that led to the meltdown of 2008, they stand today as the primary remaining bailout debtors to the U.S. treasury.

As shown in this chart, the two bankrupt mortgage giants owe almost half — 45% — of the outstanding bailout money from the federal treasury...“The fight over the changes to U.S. financial regulation was bruising,” writes The Wall Street Journal in a July 17 editorial. “The coming debate over what to do with Fannie Mae and Freddie Mac promises to be even more contentious.” Especially if congressional leaders show no willingness to stop showering Fannie and Freddie with taxpayer funds.

source

Peter Schiff: Financial Reform will Fail

1. The bill doesn’t get to the root causes of the crisis. Schiff blames former Federal Reserve Chairman Alan Greenspan’s ‘too low for too long’ interest rate policy, combined with government-guaranteed mortgages for the rise and fall of the housing market. “That’s continuing today, it’s untouched by this bill. In fact, the Fed is more reckless today with zero percent interest rates than when they were one percent,” he tells Aaron in this clip. Plus, with so many private lenders out of business, the government is guaranteeing an even greater percentage of the mortgage market and has given Fannie Mae and Freddie Mac an unlimited line of credit until 2012.

2. The law fails to end ‘Too Big to Fail.’ “This law now guarantees that in the future even if they don’t want to bailout these banks they actually have to,” Schiff protests. “Designating a federally supervised wind-down process for major financial firms, the new structure signals to creditors that lending money to large financial firms will provide more security than loaning to firms too small to qualify for the program. As a result, these firms will enjoy continued advantages in the marketplace which will ensure the continued industry dominance.”

In contrast to Schiff's warning, the law does the following, according to Reuters:

“The bill would set up an "orderly liquidation" process that the government could use in emergencies, instead of bankruptcy or bailouts, to dismantle firms on the verge of collapse.

“The goal is to end the idea that some firms are 'too big to fail' and avoid a repeat of 2008, when the Bush administration bailed out AIG and other firms but not Lehman Brothers. Lehman's subsequent bankruptcy froze capital markets.

“Under the new rule, firms would have to have 'funeral plans' that describe how they could be shut down quickly.”

3. More regulation means higher costs for smaller financial services firms, reducing competition. “All the new regulations that are going to be written pursuant to this bill are going to add dramatically to the cost of doing business that is going to disproportionally hit the smaller firms who don’t have the economies of scale,” Schiff says, including his own firm in that mix.

Thursday, July 22, 2010

Doug Casey on the Greater Depression

“We’re just in the eye of the hurricane now. It seems calm. But the other side of the storm is going to hit soon. And it’s going to be much worse…”

Doug proceeded to list all the reasons this storm will cause more devastation than the ’30s tempest.

For one thing, people have much more debt. There was relatively little consumer debt in the ’20s. Credit cards hadn’t been invented yet. And if you wanted to buy something from a store you had to pay for it in advance. They had ‘lay-away’ plans. You could pay a little each month. Then, when you’d finished paying for it, they’d give you the merchandise. Generally, people still believed in saving money.

Other reasons:

There was no expensive social-welfare establishment.

There were few bailouts and few boondoggles.

The US government had little debt and was relatively little-involved in the economy.

The US had a positive trade balance.

The US was still a growing, dynamic economy…and the world’s leading exporter.

And the US wasn’t involved in any foreign wars. Its military expenses were trivial compared to those of today.

People wanted to invest in the US. The US dollar was backed by gold.

“Now, smart Americans are getting their money out of the US,” said Doug. “This time it’s going to be much worse.”

Doug Casey on Fixing the Economy

“1. Central banks, starting with the Fed, should be abolished. They serve no useful purpose. The US has 260 million ounces of gold. That can be used to back what’s left of the currency. What price, I don’t know – $10,000 an ounce?

“2. Urgently disband 95% of the government. I would go all the way, but I’m a gradualist. It’s not radical – it just means going back to the original ideas of the Constitution

“3. Withdraw troops from all countries around the world. End the insane wars in Iraq and Afghanistan. Cut the military back about 95% too. All these V-2 rockets and carriers are just junk, expensive junk. Their main purpose is going to be excellent dive sites for people of the next century.

“4. Abolish, totally, absolutely, the whole income tax and whole IRS.

“5. US government should default on the debt. That’s the honest way to handle it. They will likely do it subvertly with inflation over time, but I would prefer overtly.

“What are the chances this is going to happen? Slim to none, and slim’s out of town. It ain’t going to happen. Thus, they chose an uncontrolled collapse, not a controlled one.”

Bernake on the Economy

Instead, his semi-annual testimony offered little new policy direction, focusing on expectations that economic growth would allow the Fed to eventually pull money out of the system and raise short term rates, as the economy improves.

And while he acknowledged growing signs of weakness in the recovery, he gave a vote of confidence that the economy would avoid falling into another recession in the near term.

"We don't think a double-dip [recession] is a high probability," he said...

Bernanke said the Fed still has tools necessary to spur growth, even with interest rates unable to go any lower. But he gave few details about what the Fed might do if it decides the economy needs more help.

Bureau of Consumer Financial Protection

source

sourceThe law gives the government authority to take over and liquidate failing financial firms, injects transparency into transactions involving financial instruments called derivatives and will restrict banks from making risky bets with their own capital. It directs agencies to write hundreds of new rules...

Mr. Obama's choice, expected soon, will be a momentous one because the first director will have great influence over agency's direction, wielding a roughly $500 million annual budget that doesn't require approval from Congress.The new consumer regulator will be funded by the Federal Reserve and have independent powers to write and enforce rules governing how loans and other financial products are offered, bearing on everything from the type of mortgages people can get to the fees on their credit cards.

The agency will be able to enforce its rules against any bank with more than $10 billion of assets, as well as all large mortgage lenders, student-loan companies and payday-loan firms. It will have an army of examiners to probe these companies' practices. Small banks will have to follow the new rules written by the agency but they will be examined by other federal regulators.

The bureau's policies and rules could be overturned by other regulators only if they "would put the safety and soundness of the U.S. banking system or the stability of the financial system of the U.S. at risk."...

Supporters said the government needed new powers to protect Americans from abusive financial practices such as hidden fees in the fine print, which they argue helped cause the financial crisis. Opponents said the agency was a sign of "nanny state" that treats regulators as better equipped than citizens to make decisions...

My thoughts: What could go wrong with a 2,000 bill with "barely understandable fine print"?

Financial Reform: Barely Understandable Fine Print

President Obama signed into law on Wednesday a sweeping expansion of federal financial regulation….

A number of the details have been left for regulators to work out, inevitably setting off complicated tangles down the road that could last for years…complex legislation, with its dense pages on derivatives practices….

“If you’ve ever applied for a credit card, a student loan, or a mortgage, you know the feeling of signing your name to pages of barely understandable fine print,” Mr. Obama said.

Financial Reform Won't Stop Next Crisis

Perhaps it should come as no surprise that Sen. Christopher Dodd and Rep. Barney Frank, the bill's primary authors, would fail to end the numerous government distortions of our financial and mortgage markets that led to the crisis. Both have been either architects or supporters of those distortions. One might as well ask the fox to build the henhouse.

Nowhere in the final bill will you see even a pretense of rolling back the endless federal incentives and mandates to extend credit, particularly mortgages, to those who cannot afford to pay their loans back. After all, the popular narrative insists that Wall Street fat cats must be to blame for the credit crisis. Despite the recognition that mortgages were offered to unqualified individuals and families, banks will still be required under the Dodd-Frank bill to meet government-imposed lending quotas...

The legislation's worst oversight is to ignore completely the role of loose monetary policy in driving the housing bubble. A bubble of such historic magnitude as the one we went through can only occur in an environment of extremely cheap and plentiful credit. The ultimate provider and price-setter of that credit was the Federal Reserve. Could anyone truly have believed that more than three years of a negative real federal-funds rate — where one is essentially being paid to borrow — would not end in tears?

As the Federal Reserve's monetary policy is largely aimed at short-term borrowing, the Fed also drove the spread between short- and long-term borrowing to historic heights. This created irresistible incentives for households and companies to borrow short — sometimes as short as overnight — and lend long. Many households chose adjustable-rate mortgages that would later reset as interest rates rose, increasing monthly payments. For banks, this spread provided an opportunity for handsome profits by simply speculating on the yield curve.

Financial Reform Bill Signed into Law

The legislation will vastly reform the way big financial firms do business.

This is "reform that will prevent the kind of shadowy deals that led to this crisis, reform that would never again put taxpayers on the hook for Wall Street's mistakes," the president said last week.

The bill aims to strengthen consumer protection, rein in complex financial products and head off more bank bailouts...

The legislation would establish a Consumer Financial Protection Bureau inside the Federal Reserve that could write new rules to protect consumers from unfair or abusive practices in mortgages and credit cards.

The bill creates a new council of regulators, lead by the Treasury Department, that would set new standards for how much cash banks must keep on hand to prevent them from triggering a financial crisis. It would also establish new procedures for shutting down giant financial firms that are collapsing.

The measure would put new limits on Wall Street banks' speculative bets for their own accounts and their ability to own hedge funds, while leaving the door open for some investment activities.

Wednesday, July 21, 2010

War Does Not Fix an Economy

War is a great way to destroy things, but it's a terrible way to grow an economy.What is often overlooked is that war creates hardship, and not just for those who endure the violence. Yes, US production increased during the Second World War, but very little of that was of use to anyone but soldiers. Consumers can't use a bomber to take a family vacation.

The goal of an economy is to raise living standards. During the War, as productive output was diverted to the front, consumer goods were rationed back home and living standards fell. While it's easy to see the numerical results of wartime spending, it is much harder to see the civilian cutbacks that enabled it.

The truth is that we cannot spend our way out of our current crisis, no matter how great a spectacle we create. Even if we spent on infrastructure rather than war, we would still have no means to fund it, and there would still be no guarantee that the economy would grow as a result.

What we need is more savings, more free enterprise, more production, and a return of American competitiveness in the global economy. Yes, we need Rosie the Riveter – but this time she has to work in the private sector making things that don't explode. To do this, we need less government spending, not more.

Tuesday, July 20, 2010

Crony Capitalism and Regulatory Capture

source

What is happening to this country when the Republic of Congo is better for business than the United States? One big factor is regime uncertainty.

Regime uncertainty is the opposite of the rule of law. It is the rule of the whims of the people in charge and what mood they are in on any particular day. It is usually associated with third world dictatorships and plays a major role in why some countries remain poor. When a business cannot predict whether a government will issue a permit, confiscate or nationalize their capital investments, tax them into bankruptcy, or arbitrarily stall their operations, they tend to do business elsewhere. This type of government hostility is not conducive to wealth creation and it is tragic to see it chasing away businesses here when we need the jobs and productivity more than ever.

When the rule of law is respected, it provides business with some measure of predictability so they can plan and operate smoothly. When it is not respected, there are just too many variables, too much risk of loss or waste.

Of course, disregard of the rule of law creates other problems too. For the larger and better-connected businesses, it creates the opportunity of regulatory capture. If the government becomes too unpredictable, one business survival strategy is to become so involved in government and regulatory bodies that they effectively gain control over the very entities that are supposed to keep them in line. In other words, if you can’t beat the government, become the government. A business that achieves regulatory capture is also able to write and implement laws and regulations that it can deal with, but its competitors cannot. The eventual outcome is that companies use regulation to drive everyone else out of business until a monopoly is achieved, putting consumers at its mercy.

Meanwhile, the people develop a false sense of security, assuming that the many regulatory bodies in place are protecting them. Without respect for the rule of law, however, those bodies and their regulations are more likely protecting and enabling big business at the expense of small business and the consumer.

We see this not only with big oil, but big banking, big defense contractors, you name it. This is why, especially in a crisis, we should uphold the Constitution. It is the ultimate consumer protection from crony corporatism.