Economics, as a branch of the more general theory of human action, deals with all human action, i.e., with mans purposive aiming at the attainment of ends chosen, whatever these ends may be.--Ludwig von Mises

Monday, August 31, 2009

Sunday, August 30, 2009

Currency in Circulation

Obama's Budget Deficits

Friday, August 28, 2009

Student: Questions, Comments, and Suggestions

Parents: Questions, Comments, and Suggestions

Thursday, August 27, 2009

Bill Bonner on America, Empire, and the Economy

Ossama bin Laden kindly sent a videotape explaining to him how to do it. The United States would have to spend its way to disaster, he said. The United States would have to undertake costly, futile wars…while actually expanding domestic spending too. GWB signed the single most expensive bill of all time – a health care measure – while simultaneously sinking the empire in its single most expensive war, one that would last longer and cost more than WWII.

But George W. Bush was just the beginning. Now, he’s back in Texas. And the empire is still in business. What can the Fates do to us now? Give us Obama and Bernanke! Obama continues the imperial wars. And, with Bernanke as his sidekick, the two of them now set out to destroy the empire’s finances. When they are finished, the dollar will no longer be the world’s reserve money. US Treasuries will no longer be the safest, surest credit in the world. And Americans will no longer be the planet’s richest people.

That is our prediction. Prove us wrong!...

In short, Ben Bernanke is no hero. And the economy is not recovering.

read the entire essay

Wednesday, August 26, 2009

Tuesday, August 25, 2009

Economic Forecasts

CBO Unemployment 9.3% Real GDP -2.5%

OMB Unemployment 9.3% Real GDP -2.8%

2010

CBO Unemployment 10.2% Real GDP 1.7%

OMB Unemployment 9.8% Real GDP 2.0%

2011

CBO Unemployment 9.1% Real GDP 3.5%

OMB Unemployment 8.6% Real GDP 3.8%

2012

CBO Unemployment 6.4% Real GDP 4.7%

OMB Unemployment 7.7% Real GDP 4.3%

The Obama administration said Tuesday that it now expects the 10-year budget deficit to reach $9 trillion, or about $2 trillion more than it estimated earlier in the year...

A 10-year deficit of that magnitude means the debt held by the public -- the accumulation of all annual deficits over the decades -- would reach 82% of gross domestic product. That's double the 41% recorded in 2008...

read the CNN story

Obama Nominates Bernanke for Second Term

"We need Ben to continue the work he's doing, and that is why I've said that we cannot go back to an economy based on overleveraged banks, inflated profits, and maxed-out credit cards," Mr. Obama said.

source

full text of Obama's remarks

Bernanke's remarks

Bernanke to be Reappointed Chairman of the Fed

As Fed Governor Bernanke supported the flawed policies of Alan Greenspan - he never recognized the housing bubble or the lack of oversight - and there is no question, as Fed Chairman, Bernanke was slow to understand the credit and housing problems. And I'd prefer someone with better forecasting skills.

Game theory would have it this is the safe pick, the one that you cannot get into trouble for, even if things go bad later.

A new Fed Chair, in the event something went awry down the road would lead blame back to the White House.

Monday, August 24, 2009

Sunday, August 23, 2009

Ribs

Budget Deficit

Big Government, Big Recession

This is certainly a novel theory of the business cycle. To be taken seriously, however, any such explanation of recessions and recoveries must be tested against the facts. It is not enough to assert the U.S. economy would have experienced a "second Great Depression" were it not for the Obama stimulus plan...

CNNMoney recently calculated that the stimulus plan has spent just $120 billion — less than 1% of GDP — mostly on temporary tax cuts ($53 billion) and additional Medicaid, food stamps and unemployment benefits...

President Obama clearly believes Big Government is the antidote to this and perhaps all recessions. At his first news conference in February, the president said, "The federal government is the only entity left with the resources to jolt our economy back to life." Yet that raises a key question: If the U.S. economy could not recover without a big "jolt" of deficit spending, then how did the economy recover from recessions in the distant past, when the federal government was very small?...

Ms. Romer also noted that "recessions have not become noticeably shorter" in the era of Big Government. In fact, she found the average length of recessions from 1887 to 1929 was 10.3 months. If the current recession ended in August, then the average postwar recession lasted one month longer — 11.3 months. The longest recession from 1887 to 1929 lasted 16 months. But there have been three recessions since 1973 that lasted at least that long...

The economy's natural recuperative powers before the 1930s proved superior to recent tinkering by Big Government economists, politicians and central bankers...

In short, bigger government appears to produce only bigger and longer recessions.

read the entire essay

Saturday, August 22, 2009

Cartoon: Unemployment

Is the Recession Over?

Manufacturing: Jobs, Output, and Productivity

More and more manufacturing output with fewer and fewer workers should be considered a positive trend for the U.S. economy, not a negative development. We should think of it the same way as the trend in farming over the last 150 years - we're much better off as a country, with a much higher standard of living, with 3% of Americans working on farms compared to 150 years ago when about 65% of Americans toiled on farms. If we can continue to produce more manufacturing output with fewer workers, we'll be better off as a country, not worse off.

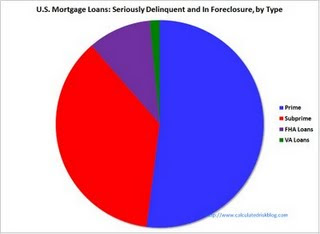

1 in 8 Mortgages are Behind

Prime loans, however, accounted for 58% of foreclosure starts, up from 44% last year. Meanwhile, subprime mortgages accounted for 33% of foreclosure starts, down from 49%. Prime fixed-rate mortgages, usually considered among the safest of all loan types, accounted for one in three foreclosure starts, up from one in five.

Prime loans, however, accounted for 58% of foreclosure starts, up from 44% last year. Meanwhile, subprime mortgages accounted for 33% of foreclosure starts, down from 49%. Prime fixed-rate mortgages, usually considered among the safest of all loan types, accounted for one in three foreclosure starts, up from one in five.read the WSJ article

US Mortgage Market

Peter Schiff Interview

Speaking in an exclusive interview with Dan Mangru of www.Moneynews.com Schiff said: "As painful as it is, this recession is necessary.”

“We’re never going to have a vibrant economy if we keep concentrating on reflating a busted bubble".

“The government is taking money away from people who are doing it right and giving it to people who are doing it wrong. That’s a recipe for disaster,” said Schiff.

“Why should successful companies be punished to bail out unsuccessful companies?”

Capitalism is about the survival of the fittest, but government stimulus are making it the survival of the unfit, he said.

Can anything be done to save the US economy? We will go through a serious retrenchement brought about by the sins of the past, but the US can rebound.

"Capitalism is a dynamic system," but we need to unleash it, Schiff said.

"We need to get the governement out of the way," he says because their acions are digging a deeper hole rather than allowing the market to fill the hole up.

“We stimulated our way out of that (2001-2002) recession into this depression,” he says.

Schiff said the theory that the world economies are linked like a train and that the US is the engine, is wrong. “I think the world represents the engine and the US the caboose,” he said.

Why? Because the US takes more out than it puts in.

“The world has been spending a lot of energy dragging a caboose that consumes more than it produces and borrows more than it saves.” The rest of the world gives subsidies to the US, Schiff said.

Schiff says the stock market is in a bear market rally. The recent bull run is driven by the fact that shares reached insanely cheap valuations in the period up to March 2009, so we are making up ground now.

Cash was king in 2008, but Cash is trash in 2009, said Schiff, as inflationary fears rise and investors move out of cash into something more tangible.

The current equities run will probably end as the dollar reaches new lows, bond prices fall farther and interest rates spike.

“I think the bear market has been here since 2000 and will be with us for another five to 10 years,” he says.

Basics of Investing from Jim Rogers

2. Buying things that are about to see a dynamic change in their favor.

Put those principles together and you’ll succeed as an investor by buying assets that are out-of-favor -- just before they come back in favor.

read the article

Friday, August 21, 2009

Student: Questions, Comments, and Suggestions

Parents: Questions, Comments, and Suggestions

Thursday, August 20, 2009

Learn to Love the Depression

A W-shaped recovery?

Forget it…there ain’t no letter in the alphabet that describes a “recovery” we’re likely to have.

We say that in the spirit of mischief as well as elucidation. Of course, the world won’t stay in a depression forever. And even depression ain’t so bad, once you get used to it. The world economy will probably drag around a bit on the bottom…with low, or negative, growth rates in most places…until it finds a new model. The old model is dead. The authorities can put on as much rouge and powder as they want. They could even give the corpse jolts of electricity to make it sit up. But they can’t revive it. It’s finished. Over. Kaput...

The problems are real…at the heart of the real economy. They are not problems that can be solved by monkeying with the money supply, interest rates, or even fiscal policy. They are problems that need to be solved by the real economy…in the real economy…by consumers, who need to pay off their debts, and by businessmen, who need to adjust to the realities of the real world – adapting their capacity so as to produce things for people who can actually afford to buy them. It’s a long process…with many bankruptcies and disappointments along the way…

That process has only just begun. It will deepen and get worse, as both consumers and businessmen realize that there will be no quick recovery…and no return to the old model – ever. Look for more layoffs…more foreclosures…more cutbacks and workouts…

Look for more depression, dear reader…

And learn to like it; it will be with us for a long time.

read the entire essay

Wednesday, August 19, 2009

Cartoon: Unemployment

Tuesday, August 18, 2009

Monday, August 17, 2009

Sunday, August 16, 2009

Hickory Smoked Pork Loin

Penn and Teller Explain Obamanomics

"The utopian schemes of leveling, and a community of goods are as visionary and impracticable as those which vest all property in the Crown, are arbitrary, despotic, and, in our government, unconstitutional."

Samuel Adams

"I can find no warrant for such an appropriation in the Constitution; and I do not believe that the power and duty of the General Government ought to be extended to the relief of individual suffering which is in no manner properly related to the public service or benefit. A prevalent tendency to disregard the limited mission of this power and duty should, I think, be steadily resisted, to the end that the lesson should be constantly enforced that, though the people support the Government, the Government should not support the people. ... The friendliness and charity of our fellow countrymen can always be relied on to relieve their fellow citizens in misfortune. This has been repeatedly and quite lately demonstrated. Federal aid in such cases encourages the expectation of paternal care on the part of the Government and weakens the sturdiness of our national character, while it prevents the indulgence among our people of that kindly sentiment and conduct which strengthens the bonds of a common brotherhood."

Grover Cleveland

source

Cartoon: DMV Healthcare

Is the Recession Over?

Is this leg of the Great Recession over? Or has the government duped us yet again?

Is this leg of the Great Recession over? Or has the government duped us yet again?Capacity utilization inched up a few tenths of a percent in July, the Fed proclaimed today. American companies utilized 68.5% of their productive potential, up from June’s record low of 68.1%. We have a particular affinity for this D-list data point…aside from measuring our collective utility, it’s a worthy economic indicator

source

Cartoon: Ponzi Scheme

Saturday, August 15, 2009

Big Banks: TARP and Bonuses

Bill Bonner on the Stimulus

"'Cash-for-clunkers was the icing on the cake,' said David Greenlaw, chief fixed-income economist at Morgan Stanley in New York. 'It's well-timed stimulus syncing with cyclical forces leading to a ramping up of production.'"...

But, take away the stimulus spending...and the stimulating low interest rates...and what have you got? You've got is an economy entering a depression.

Oh, there's the rub, isn't it? If the feds hand out money so people can buy automobiles, people buy automobiles. If they don't give out the money, people don't buy automobiles. If they buy automobiles, of course, it looks like the economy is recovering. But take away the giveaways, and the recovery disappears.

Solution: keep giving away money!..

...if giving people money so they could buy things actually made people prosperous, welfare recipients would be the richest people on the planet. Obviously, it doesn't work that way. What makes people rich is the ability to earn money...not their ability to get handouts. And remember, too, the feds don't really have any money to hand out. They can only get money by taking it from its rightful owners – either in taxation or loans. Or, they can print it up themselves. In any case, the money adds nothing real or extra to the economy. It merely distorts the economy...twists it...misleads it...and makes it a bigger mess than it was already.

Peter Schiff on the Economy

To return our economy to health, we must first allow market forces to ring out the excesses of the bubble years. Even government economists acknowledge that this decade’s spending boom resulted from a combination of asset bubbles and the dangerous overextension of consumer credit. Yet the same economists balk at the logical need for spending to drop now that the stimuli are no longer in effect. They argue for the resumption of spending by any means, regardless of its ultimate cost. This is a recipe for momentary gain and lasting pain.

America’s economic vitality will never be restored until we rebuild our savings and pay down our debts. To build back up, we must change the pattern of capital flows from the phony economy. It is a painful process, but one that will leave our economy on a stronger foundation. Unfortunately, Americans cannot accomplish these goals unless they stop shopping, live within their means, and replenish their savings. Though this may be problematic for retailers, it is beneficial to the overall economy...

We must once again become the leader in economic freedom. This entails dismantling a significant portion of our federal and state governments, repealing countless unnecessary regulations, significantly lowering and simplifying taxes, and reinstituting sound money. If we accomplish these tasks, conditions will be ripe for a lasting recovery that solidifies our place at the top of the global economic totem pole...

There are two ways to rebalance the American economy. The right way is to restore competitiveness through diminished government spending, deregulation, lower taxes, and higher savings. Higher savings will facilitate capital formation, and lower taxes and fewer regulations will allow that capital to improve the competitiveness of American labor. Improved productivity and capital investment will translate into higher real wages and pave the way to higher future living standards...

Though president Obama claims that his policies will not raise taxes on average Americans, the unfortunate truth is that the effect of his policies will be to lower wages. The choice is simple: either we shrink government and enjoy higher wages, or grow government and accept lower wages.

Cartoon: Obama and Health Care

How can a private company compete against the government? My answer is that if the private insurance companies are providing a good bargain, and if the public option has to be self-sustaining, meaning that taxpayers aren't subsidizing it, but it has to run on charging premiums and providing good services, and a good network of doctors, just like private insurers do, then I think private insurers should be able to compete.

They do it all the time. If you think about it, UPS and Fed-Ex are doing just fine. It's the post office that's always having problems … there is nothing inevitable about this somehow destroying the private marketplace. As long as it is not set up where the government is being subsidized by the taxpayers so that even if they are providing a good deal, we keep having to pony up more and more money.

Cartoon: Socialized Medicine

My thoughts: This is the problem of the slippery slope. There is no logical stopping point once you accept government intervention in an industry or the economy. Proponents of the health care plan like to claim opposition is to the plan is hypocrisy. In some cases it is. However many who oppose government health care also oppose Medicare, Social Security, and all other government intervention in the economy. Then there is the practical reality of the federal budget. It is Medicare and Medicaid that are currently projected to be the programs that bankrupt the government. An additional government health care program will likely accelerate the process. This issue should be aaddressed by the proponents of the health care plan.

My thoughts: This is the problem of the slippery slope. There is no logical stopping point once you accept government intervention in an industry or the economy. Proponents of the health care plan like to claim opposition is to the plan is hypocrisy. In some cases it is. However many who oppose government health care also oppose Medicare, Social Security, and all other government intervention in the economy. Then there is the practical reality of the federal budget. It is Medicare and Medicaid that are currently projected to be the programs that bankrupt the government. An additional government health care program will likely accelerate the process. This issue should be aaddressed by the proponents of the health care plan. Friday, August 14, 2009

Students: Questions, Comments and Suggestions

Cartoon: National Debt

Thursday, August 13, 2009

Cartoon: The Economy

Rate Cut Strategy

Is the Recession Over?

Wednesday, August 12, 2009

Cartoon: Jobless Recovery

Four Arguments Against Socialism

A second argument against any socialist program is that it just doesn’t work. Let me repeat that for emphasis: Socialism doesn’t work, not even when American politicians and bureaucrats are running it. It inevitably produces crises, which are then used as the excuse for more government intervention. Moreover, it is inordinately expensive, as Americans have discovered with Medicare, much to their dismay.

A third argument against any socialist program is that it destroys the independence, fortitude, strength, and moral fiber of the people. How can a people be strong and independent when they have become frightened, dependent wards of the government?...

A fourth argument against socialism is that it turns into a war in which everyone is doing his best to get into everyone else’s pocketbook, while doing everything he can to protect his own pocketbook from being plundered. As Frédéric Bastiat put it so well, under socialism the government becomes a great fiction by which everyone is trying to live at the expense of everyone else. How can a society survive when everyone is warring against everyone else?

read the essay

Mises and Mellon on Crisis

Ludwig von Mises

Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate.… It will purge the rottenness of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up from less competent people.

Andrew Mellon

Socialism is Not Free

In effect, there are two segments of society — the private sector and the public (or government) sector.

In order to accumulate wealth, people in the private sector must produce a good or service that other people are willing to pay for...

However, unlike the private sector the government doesn’t depend on the voluntary decisions of consumers for its money. It forces the private sector to pay for its goods and services by simply confiscating (taxing) the income or wealth of people in the private sector.

read the essay

The Right to Medical Care

Let’s start with something basic: for a right to be genuine, it has to be capable of being exercised without anyone’s affirmative cooperation. The full exercise of my right of self-ownership requires you to do nothing except refrain from killing or assaulting me. The full exercise of my property rights requires you to do nothing except refrain from taking what is mine. You have no positive, enforceable obligations to me, apart from any you accept through contract...

Here is the crux of the issue. The right to medical care must mean—no exceptions—the power of government, in principle, to determine who gets what. It may not exercise that power immediately. But given the economics of the matter, it will, sooner or later. I submit that this has nothing to do with rights and everything to do with control, literally, of people’s lives...

read the entire essay

The Worst is Ahead of Us

First, we have to realize that the trends of mass layoffs had to end, albeit temporarily...

Second, the effects of the environmental policies such as “cap and trade” and other new regulations have not yet been fully felt by U.S. employers...

Third, increases in the minimum wage will take their toll on lower-wage workers, while other new labor and “workplace safety” policies are going to make it more costly to run a business...

Last, whether or not Obama’s health plan will pass Congress intact is irrelevant. The government is going to make medical care more costly, less available, and a greater financial burden on employers and employees. That is a given, and it also translates into higher rates of unemployment.

At best, the “stimulus” has created a lull in the downturn, an eye in the economic hurricane...

From its expensive wars abroad to its multitrillion-dollar borrowing to the continued criminalization of routine business practices, the government has sent a message to private enterprise that it is the enemy. The rest of us will feel the blunt edge of government policy as we watch the economy implode.

read the entire essay

source

source source

source from Carpe Diem

from Carpe Diem

source

source