Marc Faber the Swiss fund manager and Gloom Boom & Doom editor spoke Tuesday about the Fed's decision to keep interest rates low for a prolonged period of time and the prospects of QE3. He says the Treasury market is a gigantic bubble and long-dated T-bonds are the short of the century. Faber suggests that sometimes the best the Fed can do for markets is to do nothing!...

Faber, who predicted the stock market crash in 1987, turned bearish shortly before the 2007-2009 bear market and called the 2009 lows, believes the markets will now test the July 2010 lows for the S&P 500 at 1,010 and "after that we'll get a QE3 announcement."...

What can the Fed do to support the economy?

"The best they could do for markets would be to collectively resign," Faber suggested.

"Everybody in the world has become a Keynesian, everybody thinks the government should do this and that, the Fed should do this, the Treasury should do that.....I think sometimes the best is to do...nothing!

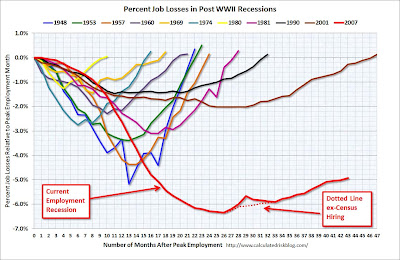

Reiterating his views on the prospects for another asset purchase program, Faber asked: "What has QE1 and QE2 done for the labor market? Nothing at all, and nothing for the housing market."

"It [QE] has lifted stocks and it created wider wealth inequality in the sense that people who own assets have done well and people who are in the lower income recipient groups are getting hurt from rising energy and food prices," he added.

read the entire article