Economics, as a branch of the more general theory of human action, deals with all human action, i.e., with mans purposive aiming at the attainment of ends chosen, whatever these ends may be.--Ludwig von Mises

Tuesday, August 31, 2010

War on the Economy

Butler Schaffer: "Will the economy unconditionally surrender?"

Monday, August 30, 2010

Greenspan, Bernanke, and Central Bank Stupidity

The Mogambo Guru writes:

Well, I am sure you can understand how I could easily make the mistake, and now we are screwed because Alan Greenspan was a lying, slimy little treacherous weasel who could not “afford to be blunt,” but who could afford to keep creating more and more money, gradually destroying the US dollar’s buying power with constant, simmering inflation in prices, so that even the lying US government is forced to admit that $1 in 1987, when Greenspan took over the Fed, had the buying power of $1.77 in 2006 when he retired, which is a compounding inflation rate of 3%! Yikes!

Long-term 3% inflation is, as you can probably tell by the expression on my face, outrageous! And it is especially outrageous because the Federal Reserve was created to prevent inflation! Their mission was to preserve the value of the dollar, and Alan Greenspan gave us a cumulative 77% inflation in the 19 years he was in office! Gaaahhh!...

The reason that I snarl in contempt is that this current recession is actually nothing –nothing! – compared to the many, many other financial crises throughout history, all of them caused when stupid bankers like him, or governments themselves, were allowed to create too much money, which distorts the whole economy and causes inflation in the cost of consumer goods, like food and energy, and nowadays those yummy little chocolate-covered donuts that we all love so much, but which cost almost 50 cents apiece now...What Bernanke said was, “Financial crises will continue to occur, as they have around the world for literally hundreds of years,” although he should have added “that will result from the repeated stupidity of banks and countries continually increasing the money supply, which distorts the economy in weird, unpredictable booms and makes consumer prices go up, which is the Exact Wrong Thing (EWT) to do, which is a point that you would think would be crystal-clear even to a neo-Keynesian econometric halfwit like me, seeing that mere literacy is required to read the actual, written mission of the Federal Reserve, which is to maintain stable prices.

“But thanks to the incompetence of the Federal Reserve, the dollar has tragically lost almost 97% of its purchasing power since the inception of the Federal Reserve in 1913, making a complete mockery of me and the Federal Reserve, proving that I obviously have no idea what in the hell I am doing, except that I know it is wrong, but I keep doing it.”

Personal Savings and Personal Income

The saving rate decreased to 5.9% in July from 6.2% in June (flat at 6.1% using a three month average).

The saving rate decreased to 5.9% in July from 6.2% in June (flat at 6.1% using a three month average).Personal income increased $30.0 billion, or 0.2 percent ... Personal consumption expenditures (PCE) increased $44.1 billion, or 0.4 percent

source

Cartoon: Tax Deductions

Saturday, August 28, 2010

The All But Forgotten Self-Governing Economy

Joel Bowman writes:

The inability of Mr. Bernanke – or anyone else for that matter – to hold back the tide of necessary correction ought to be obvious to all.

The study of economics wasn’t always the bottomless well of embarrassment it has come to be. There was a time when moral philosophers – as those of the trade were once known – spent their days pondering things of actual importance. They listened to the market murmurs of the day, instead of forecasting the unknowable events of tomorrow…they observed rather than tinkered…and asked questions instead of falsifying answers.

How ought members of a society allocate limited supply in an environment of unlimited demand? Is there a fair and equitable way to achieve such a goal? What controls, if any, should be employed to govern the process? Etc., etc., etc…

Although economics is itself an imperfect science, a “soft science,” as some assert, the perfect laws of science nevertheless bind it. Quantitative easing, for instance, is and always will be a bogus theory, a monetary mallet made of liquid, unable to bend anything into shape and forever doomed to flooding the system. Borrowing from one pocket to finance the other is a mug’s game; just as increasing the supply of money in a closed system must necessarily devalue all pre-existing units by a commensurate measure. Put another way, two plus two is never equal to five…never mind what the modern economist has to say on the matter.

Similarly, one can be reasonably certain that there are only two ways in which an economy, and indeed an entire society, is capable of governing itself. The first is by force; the second by means of voluntary cooperation. That both are mutually exclusive should be self-evident. One cannot be partly violated any more than they can be a little bit pregnant. The concept is oxymoronic, as well as ordinarily moronic. The idea is akin to that of a “voluntary tax.” Obviously, no such thing truly exists. It is a donation or it is an act of theft. Plain and simple.

Now wait just a moment, we hear some say. What about the rule of the majority? After all, we can’t very well wait around for everyone to agree on everything all the time. That may be true. But, to paraphrase an old adage, the road to ruin is paved with the whims of political expediency. A system built on a foundation of coercion is sentenced to failure, whether by invasion from without or revolution from within.

For its part, the voting process only serves to muddy the waters. Democracy, as Winston Churchill once observed, is the worst form of government…except for all those others that have previously been tried. Even if 99% of the people vote for some kind of sales tax, for instance, a full and very important 1% are still subject to what essentially becomes legalized theft...

It was perhaps David Hume who expressed it best when, in his monumental First Principles of Government, he wrote, “Nothing appears more surprising to those who consider affairs with a philosophical eye, than the ease with which the many are governed by the few.”

Self government, through individual and collective acts of voluntary cooperation, therefore, seems to be the only philosophically consistent, defensible form of government available to man. The state, with its various forms of coercion, shrouded in the cloak of good intention and peddled by forecast-mongering central bankers, be damned.

GDP 2nd Quarter 2010: 1.6%

The new figure was better than analysts’ expectations for a 1.4 percent rate, lower net exports and a smaller inventory gain being the major factors in the downward revision. The surge in imports subtracted a full 3.4 percentage points from economic growth, the biggest impact by the trade deficit in 63 years.

Consumer spending was revised upward, from a previously reported rate of 1.6 percent to 2 percent to offset other downward revisions, and business spending continued to be the major factor in the overall gain, increasing almost 25 percent from the first quarter.

Corporate Profits: All Time High

1. Nominal corporate profits in the second quarter reached almost $1.2 trillion, which is an all-time record high, and 54.5% above the recent bottom of $774.6 billion in the fourth quarter of 2008.

2. Nominal corporate profits have now doubled in less than ten years, from $600 billion at the end of 2001 to the current level of $1.2 trillion. The S&P 500 Index is actually lower now 1047) than at the end of 2001 (1148).

source

Spreading Hayek, Spurning Keynes

But the 50-year-old professor of economics at George Mason University in Virginia is emerging as the intellectual standard-bearer for the Austrian school of economics that opposes government intervention in markets and decries federal spending to prop up demand during times of crisis. Mr. Boettke, whose latest research explores people's ability to self-regulate, also is minting a new generation of disciples who are spreading the Austrian approach throughout academia, where it had long been left for dead.

To these free-market economists, government intrusion ultimately sows the seeds of the next crisis. It hampers what one famous Austrian, Joseph Schumpeter, called the process of "creative destruction."

Governments that spend money they don't have to cushion downturns, they say, lead nations down the path of large debts and runaway inflation...

"What I'm really worried about is an endless cycle of deficits, debt, and debasement of currency," Mr. Boettke says. "What we've done is engage in a set of policies that's turned a market correction into an economy-wide crisis."...

And the tenures of Paul Volcker and Alan Greenspan at the Federal Reserve seemed to quell doubts about the central bank's ability to manage the U.S. economy.

But all along, the Austrians weren't so sure. Economics, they feared, was increasingly narrow and technical but not necessarily wise. They also remained skeptical of the Fed's approach to targeting stability in consumer prices.

That shouldn't be the Fed's goal, says Mr. Boettke, who a friend lured back to George Mason a year after he was denied tenure. The Fed, he says, should be to make money "as neutral as possible, like the rule of law, which never favors one party over the other."...

It wasn't a lack of government oversight that led to the crisis, as some economists argue, but too much of it, Mr. Boettke says. Specifically, low interest rates and policies that subsidized homeownership "gave people the crazy juice," he says.

We Can't Afford This Government

First came word that new jobless claims last week jumped above half a million, a number so large that one economist said "it looks like the economy ran into a wall." Second came a Congressional Budget Office estimate that this year's federal deficit will be well above $1.3 trillion for a second straight year and remain above $1 trillion next year as well - causing as much debt in three years as government built up in the previous 219.

Third came the announcement by Americans for Tax Reform (ATR) that yesterday was the 2010 "Cost of Government Day," which is "the day on which the average American has earned enough gross income to pay off his or her share of the spending and regulatory burdens imposed by government at the federal, state and local levels." Just two years ago, Cost of Government Day fell an astonishing 34 days earlier. This year, the average American worked 231 days just to support government, which consumes 63.41 percent of national income.

If anything, ATR underestimates the problem. Of those 231 days, 74 are taken up by regulatory costs. But that includes only the direct costs of new equipment and labor time required by government red tape. "Not counted are ... hidden costs" (such as discouraging new business investment), according to ATR, that "may be as large as the direct compliance costs of regulation. Economists at Washington University in St. Louis, leaders in the study of regulation, estimated these costs to be over $1.5 trillion per year in 2009."

Taxpayers foot the bill for an increasing number of government workers at outrageously growing wages. ATR reports that federal employment has increased by 230,000, or nearly 5 percent, in just the past year. USA Today reported Aug. 10 that federal pay and benefits per employee now average more than twice that of private workers: $123,049 compared to $61,051. Federal salaries outpaced inflation in the past decade by 33 percent.

Such government extravagance is unsustainable, and all this doesn't even take into account the $115.8 trillion of unfunded liabilities in Social Security and Medicare, as calculated by Michael D. Tanner of the Cato Institute.

The United States is headed toward financial collapse unless these trends are reversed. The radical change needed is not a government takeover, but a significant downsizing of government's intrusion into our economy and daily lives.

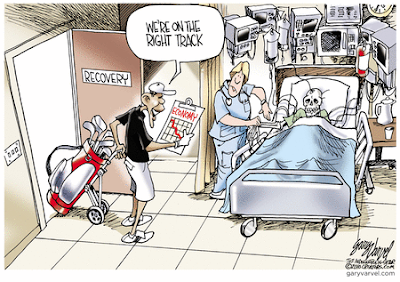

Cartoon: Good News, Bad News

The Great Deleveraging Lie

Total credit market debt peaked at $52.9 trillion in the 1st quarter of 2009. It is currently at $52.1 trillion. The GREAT DE-LEVERAGING of the United States has chopped our total debt by 1.5%. Move along. No more to see here. Time to go to the mall. Can anyone in their right mind look at this chart and think this financial crisis is over?...

Now we get to the Big Lie about frugal consumers paying off debts, cutting up those credit cards, and eating Raman noodles 5 nights per week. Household and non-profit debt, which includes mortgages, credit card debt, auto loans, home equity loans, and student loans peaked at $13.8 trillion in 2008. After two years of supposed deleveraging, frugality and mass austerity, the balance is $13.5 trillion. Consumers have buckled down and have paid off 2.2% of their debts, it seems. Not exactly going cold turkey, but it is a start...

The truth is that the debt has simply been shifted from criminal Wall Street Banks to the American taxpayer. These consumer debts were created in a private transaction between individuals and these banks. When the loans went bad, the consumers should have lost their home, car, etc., and their credit rating should have been ruined, keeping them out of the credit market for a number of years. If the banks that made these bad loans made too many, they should have failed and had their assets liquidated in bankruptcy. Instead, the Federal Government has inserted the American taxpayer into the equation by using our tax dollars to prop up insolvent Wall Street banks and allowing screw-ups who took on too much debt to live in houses for over two years without making a mortgage payment.

The Big Lie will eventually lose out to the grim truth. America's economy is built on a debt-based foundation of sand and the tide of reality is relentlessly eating away at that foundation of debt. Collapse is just a matter of time. The charts below from the Federal Reserve paint a grim picture of reality.

source

We Don’t Need No Stinkin’ Gold Standard

France, Germany, the European Central Bank, Russia, India, and China are all much more favorable toward gold as a reserve asset than is the United States. They have shown this through their actions in holding or adding to their gold reserves. China has promoted gold as an investment. Although they have not spoken openly of gold, they are moving toward the increased importance of gold in the international monetary arrangements.

In other words, they are aiming at some version of a gold standard. The idea seems to be to go back to a pre-1971 system while bolstering the roles of the IMF and the BIS and reducing the dollar standard to a standard of a basket of currencies linked to gold.

The idea is to prolong the life of national central banks and fiat currencies by a gold linkage.

This, I say, is something we don’t need. We don’t need no stinkin’ gold standard that is another version of government-controlled currencies, accompanied by government suppression of monetary freedom and privately or market-produced money.

What we need is market-produced money. This may take a number of possible forms, such as e-money backed by metals such as silver and gold, or silver coin, or gold coin and bullion for larger transactions.

Market-produced money differs radically from government-controlled and government-produced money. With market-produced money, there cannot be a systematically injurious deflation or harmful shortage of money. If the demand for money exceeds the supply to the point where the costs of a money shortage to demanders are exceeding the costs of producing more money, the market will produce more money and eliminate the shortage.

By the same token, with market-produced money, there cannot be a systematically injurious inflation or excess of money. If the supply of a money exceeds its demand at a given price, the market will reduce the supply and demanders will seek alternative money, thereby eliminating the excess demand.

With market-produced money, variations in the demand and supply of money will be of no greater consequence than the analogous variations of any other of the thousands of goods and services that the government does not control and whose prices are market-determined.

With market-produced money, there cannot be a money-caused business cycle of any substantial consequence, because prolonged alterations in money supply and interest rates caused by government control of money will be absent.

This means that with market-produced money, we can say goodbye to unemployment caused by business cycles induced by government mismanagement of currencies.

The Great Depression occurred at a time when the gold backing of government money was extensive. The current hardships are occurring at a time when gold is far, far less important in America’s monetary system. The common feature of these large depressions is not the presence or absence of gold backing. It is the presence of government-controlled money, with or without gold backing.

The most common meaning of "gold standard" associates this term with government-controlled money, not privately-produced money. This is why we don’t need no stinkin’ gold standard.

Bernanke's Jackon Hole Speech

It should be noted that the three basics were never seen in a "benefits and drawbacks" manner. This is really all about the new "tools", which really brings to the forefront and, the question: Why are all these new tools being developed and implemented, to varying degrees, in the middle of a financial crisis? Mad.

In conclusion, one has to ask: Is implementing all these new 'tools' in the middle of a financial and economic crises the work of a sane man, when former Fed chairmen managed control of the money supply with proven tools for decades? Is Bernanke a mad scientist using the United States economy as his laboratory to experiment with new "tools"?

While Bernanke stargazes and watches a horse whisperer perform, it is probably time for the rest of America to focus on the speech he just gave in Jackson Hole and realize that this is not the work of a man that can be classified as anything other than a mad scientist.

It's really time for Ben to take his helicopter and new tools and go.

read the entire essay

Thomas Sowell on Moral Hazard

One of the things that makes it tough to figure out how much has to be charged for insurance is that people behave differently when they are insured from the way they behave when they are not insured.

In other words, if one person out of 10,000 has his car set on fire, and it costs an average of $10,000 to restore the car to its previous condition, then it might seem as if charging one dollar to all 10,000 people would be enough to cover the cost of paying $10,000 to the one person whose car that will need to be repaired. But the joker in this deal is that people whose cars are insured may not be as cautious as other people are about what kinds of neighborhoods they park their car in...

Although "moral hazard" is an insurance term, it applies to other government policies besides insurance. International studies show that people in countries with more generous and long-lasting unemployment compensation spend less time looking for jobs. In the United States, where unemployment compensation is less generous than in Western Europe, unemployed Americans spend more hours looking for work than do unemployed Europeans in countries with more generous unemployment compensation.

People change their behavior in other ways when the government pays with the taxpayers' money. After welfare became more readily available in the 1960s, unwed motherhood skyrocketed. The country is still paying the price for that – of which the money is the least of it. Children raised by single mothers on welfare have far higher rates of crime, welfare and other social pathology.

San Francisco has been one of the most generous cities in the country when it comes to subsidizing the homeless. Should we be surprised that homelessness is a big problem in San Francisco?...

We all need safety nets. That is why we "save for a rainy day," instead of living it up to the limit of our income and beyond.

We also hear a lot of talk about "the uninsured," for whose benefit we are to drastically change the whole medical-care system. But income data show that many of those uninsured people have incomes from which they could easily afford insurance. But they can live it up instead, because the government has mandated that hospital emergency rooms treat everyone.

All of this is a large hazard to taxpayers. And it is not very moral.

Bernanke's Jackon Hole Speech and Gary North's Translation Part I

This list of concerns makes clear that a return to strong and stable economic growth will require appropriate and effective responses from economic policymakers across a wide spectrum, as well as from leaders in the private sector.Translation: There is going to be central planning like we have not seen since the end of World War II. Corporate leaders are going to fall in line, or else they will face some really daunting problems.

...

Fiscal policy – including stimulus packages, expansions of the social safety net, and the countercyclical spending and tax policies known collectively as automatic stabilizers – also helped to arrest the global decline.

Translation: Also required were budget deficits larger than anything seen since World War II.

...The prospects for household spending depend to a significant extent on how the jobs situation evolves. But the pace of spending will also depend on the progress that households make in repairing their financial positions.

Translation: We don't know what the pace of spending will be. We don't not know when the job market will recover.

...

Friday, August 27, 2010

Cartoon: Recovery

Thursday, August 26, 2010

Unemployment Claims: Highest Since 11/09

In the week ending Aug. 21, the advance figure for seasonally adjusted initial claims was 473,000, a decrease of 31,000 from the previous week's revised figure of 504,000. The 4-week moving average was 486,750, an increase of 3,250 from the previous week's revised average of 483,500...

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week by 3,250 to 486,750. This is the highest level since November 2009.

source

Delinquency and Foreclosures

The MBA reports that 14.42 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q2 2010 (seasonally adjusted). This is down slightly from the record 14.69 percent in Q1 2010.

source

Fighting the Correction

When stocks go down, they will drag inflationary expectations. It will probably bring down stock markets in the emerging economies…possibly causing the Chinese economy to blow up…and bring falling commodities prices and deflation too. The idea of a “bond bubble” will disappear. People will see the “depression/Great Recession” as real…and permanent. They will try to protect themselves by buying US Treasury bonds. This will permit the feds to go further and further into debt.

Thus begins the world’s long day’s journey into night.

The US economy will become a Zombie Economy, with more and more activity dependent on government spending and government support. Banks are already Zombie Investors. Rather than lend to viable businesses that expand the world’s wealth, they borrow from the feds and lend the money back to them. We’ll see private investors become Zombie Investors too – putting nearly all their savings into US Treasury paper, just as the Japanese did.

The Dow will sink down towards 5,000. The feds will announce program after program to boost up the economy. Household savings rates will head to 10%. Unemployment will go to 12%…maybe 15%. Bond yields will collapse to new record lows. Ben Bernanke will threaten to drop money from helicopters…but as long as the US remains in an orderly decline, he will not dare to do it.

Eventually, the whole system will blow up in a spectacular fireball. But not until America’s investors are fully committed to US paper. Then, after having suffered huge losses in stocks and real estate, they can be finally ruined in what they thought were the safest investments in the world – dollar-based US Treasury bonds.

Buy Gold?

“Should I buy gold now, or wait for a pullback?”...Today we face the prospect of prolonged economic stagnation, and most governments are administering grossly abusive monetary policy as a remedy. While some of the consequences are already being felt, the full ramifications have not hit your wallet yet. But they will.

If you don’t have at least 10% of your investable assets in physical gold, or at least two months of living expenses, you have your answer: Buy. Don’t use leverage, don’t borrow money, and don’t buy with reckless abandon, but yes, get your asset insurance policy and tuck it away. And then start working toward 20% (we recommend a third of assets be in various forms of gold in Casey’s Gold & Resource Report).

Back to the original question: should we buy now, or wait for a pullback?...

Heck, even if gold peaks at $2,400, you still get a double from current levels. (But unless government monetary policies immediately reverse course, gold isn’t stopping at $2,400.)

So there’s my answer. Yes, you have to accept my projection of gold’s ultimate price plateau. And you have to sell at some point to realize the profit. But if the final chapter of this bull market looks anything like the chart above, I don’t think you’ll be too upset having bought at $1,200.

Mogambo Guru: Buy Gold

Anyway, the whole point is not that Santa Claus is a dangerous lunatic, or that Ben Bernanke of the Federal Reserve is a dangerous lunatic who actually believes his stupid neo-Keynesian econometric theories despite their utter, utter failure. I mean, look around! Does this seem to be the result of a good economic theory in the hands of competent people to you? Hahaha! Me neither!

No, the point is that these are indeed very weird times, and a lot of strange, terrifying, unbelievable, nonsensical, suicidal, desperation-fueled fiscal and monetary idiocies are going on, and new ones appear with each passing day.

Social Security: An Analysis

That’s right, the feds just use the money to finance whatever fool scheme they’ve got going at the moment…and give the Social Security Administration a bond in return. In theory, the SSA has assets. In practice, all they’ve got is the hope that the feds can squeeze enough money out of taxpayers to meet their obligations...

In other words, there is no question about whether the US government will default or not. It will default. The only question is how. Will it manage to slip out of its obligations by raising the inflation rate enough to slough them off? Or will it have to officially renounce them? Will it refuse to pay retirees? Or bondholders?

Any way you look at it, the situation is interesting. Retirees, employees, loafers and chiselers – all are stakeholders in the US government. They have something to lose and will fight to hold onto what they’ve been promised. Bondholders have something to lose too.

So far, the bondholders have been largely protected – even enriched. Stakeholders in Greece, Ireland and other countries have begun to feel the pain. In America, the class of stakeholders is actually increasing, as the public sector spends more and the private sector spends less.

Best guess: stakeholders, bondholders, placeholders, cupholders, napkin holders – they’ll all take a loss.

Cartoon: Labor Statistics

Wednesday, August 25, 2010

Housing Market: The Distressing Gap

Initially the gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The two spikes in existing home sales were due primarily to the first time homebuyer tax credit (the initial credit last year, followed by the extension to April 30th / close by June 30th). There were also two smaller bumps for new home sales related to the tax credit.

Since new home sales are reported when contracts are signed, the 2nd spike for new home sales was in April and then sales collapsed in May. The 2nd spike for existing home sales was in May and June, and then existing home sales collapsed in July.

I expect that eventually this gap will be closed. However that will only happen after the huge overhang of existing inventory (especially distressed inventory) is significantly reduced.

source

No Recovery

None of the key components of recovery – housing, jobs, or consumer spending – suggest that the economy is returning to its pre-recession habits...

US Employment Figures

After the Dow’s dazzling 77% rally from the lows of March 2009 to the recent high of 11,258 in March 2010, a little “give-back” was to be expected. But a lot of give-back was not expected…at least not by the legions of investors who believed that the Fed had vanquished the credit crisis for good, and had conjured a recovery out of thin air.

So now that this give-back has lasted an uncomfortably long period of time – and now that most economic data are coming in “weaker than expected,” the Dow’s nifty rally off the March 2009 lows begins to feel more like a deception than a validation...

“We may not have said it first,” we declared in the June 30 edition of The Daily Reckoning, “but we have said it repeatedly: The US economic recovery is a myth…a fairy tale.”...

Back in early March, however, most professional economic observer-prophets were still crowing about the end of the credit crisis and the resumption of economic growth. Today, the observe-prophets are trying to shake the fog out of their crystal balls. There is no recovery. Merely less catastrophe.

Stimulus and the Never Ending Recession

Instead, Mr. Schiff says, “This misses the point that any ‘growth’ created by stimulus is totally dependent on stimulus to continue. The ‘recovery’ will end as soon as the stimulus prop is removed.”...

Well, the analogy seemed apt when he went on, “the Fed will step in with ‘quantitative easing’ as soon as it becomes obvious that the Administration’s stimulus-fueled ‘recovery’ of the past three quarters is fading. The problem is that each round of stimulus, as with each hit of an addictive drug, requires ever larger doses to produce the same result.”...

And just when it seemed that things could not get worse, it gets worse, as he figures that the reality is that “The 2008 recession never ended. It was merely interrupted by trillions of dollars of stimulus that purchased GDP ‘growth’ with borrowed money.”...

Exactly! Let me stop whining about that stupid motorcycle for just a minute so that I can say that, as far as I, too, am concerned, the whole boom of the last 30 years was the result of “trillions of dollars of stimulus,” as the despicable Alan Greenspan had the Federal Reserve keep creating more and more money the whole time, and now the absurd Ben Bernanke, erstwhile head of the obviously-worthless economics department at Princeton, is exponentially worse as the new chairman of the Federal Reserve!...

When a falling dollar forces consumer prices and long-term interest rates to rise, the Fed’s actions will be rendered impotent. The Open Markets Committee will have to make a horrific choice: fight inflation by tightening policy into a weakening economy, or fight recession by allowing inflation to burn out of control. I think it’s obvious that they will choose inflation, all the while pretending that it doesn’t exist.”

Cartoon: Choose Wisely

Tuesday, August 24, 2010

Home Sales and Inventories

source

source he National Association of Realtors (NAR) reported today that existing homes sales in July of 3,830,000 units at a seasonally-adjusted annual rate was 27.2% below the sales level in June of 5,260,000 units, and 25.5% below last July, when 5,140,000 homes were sold.

he National Association of Realtors (NAR) reported today that existing homes sales in July of 3,830,000 units at a seasonally-adjusted annual rate was 27.2% below the sales level in June of 5,260,000 units, and 25.5% below last July, when 5,140,000 homes were sold. source

CBO on the Stimulus

| Change Attributable to ARRA, GDP change (percent) | |||

|---|---|---|---|

| Low Estimate | High Estimate | ||

| 2009 | Q1 | 0.1 | 0.1 |

| 2009 | Q2 | 0.8 | 1.3 |

| 2009 | Q3 | 1.2 | 2.4 |

| 2009 | Q4 | 1.4 | 3.3 |

| 2010 | Q1 | 1.7 | 4.1 |

| 2010 | Q2 | 1.7 | 4.5 |

| 2010 | Q3 | 1.5 | 4.2 |

| 2010 | Q4 | 1.1 | 3.6 |

source

The Fed is a Failure

The Federal Reserve was created in 1913 to help stabilize the economy and prevent recessions, particularly like those which occurred in 1873, 1893 and 1907.

The Fed was to stimulate in down periods and de-stimulate when growth became too frothy.

The Fed started its duties in 1914. Has it done its job?

Here’s its record: America has had recessions in 1918-19, 1920-21, 1923-24, 1926-27, 1945, 1948-49, 1953-54, 1957-58, 1960-61, 1969-70, 1973-75, 1980-82, 1990-91, 2001 and 2008-09, plus a horrendous depression lasting from 1929 to 1941.

The 2008-09 recession is now entering into what is termed a double-dip recession, and has all the earmarks of becoming another depression.

As to de-stimulating an overheated economy, the Fed has also failed. It failed to act during the gigantic stock market bubbles of the 1920s and 1990s. It failed to apply the brakes to the housing bubble of the early 2000s that ended tragically for millions of homeowners.

The Fed actually encouraged these bubbles and then later claimed no one could have foreseen the fallout.

Monday, August 23, 2010

Energy Consumption and Efficiency

International Trade

Cargo volume on the Far East-U.S. trades grew 25.7 percent during the first three months of the new trans-Pacific contract season from May to July based on preliminary customs figures. Weekly capacity deployed on Far East-U.S. trades is already back to 2008 levels and is 12 percent above 2009 levels.

source

Chicago Fed Index: July 2010

Led by improvements in production-related indicators, the Chicago Fed National Activity Index returned to its historical average of zero in July, up from –0.70 in June. Three of the four broad categories of indicators that make up the index improved from June, but only the production and income category made a positive contribution to the index in July.

Led by improvements in production-related indicators, the Chicago Fed National Activity Index returned to its historical average of zero in July, up from –0.70 in June. Three of the four broad categories of indicators that make up the index improved from June, but only the production and income category made a positive contribution to the index in July.The index’s three-month moving average, CFNAI-MA3, edged lower to –0.17 in July from –0.12 in June. July’s CFNAI-MA3 suggests that growth in national economic activity was somewhat below its historical trend. With regard to inflation, the amount of economic slack reflected in the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

source

Miles Driven June 2010

The Department of Transportation (DOT) reported that vehicle miles driven in June were up 1.3% compared to June 2009...

On a rolling 12 month basis, vehicle miles driven are mostly moving sideways. Miles driven are still 1.9% below the peak - and only 0.7% above the recent low.

source

Sunday, August 22, 2010

Soft Drinks: Market Share

source

- 42.8%: Coca-Cola’s 25 brands and 139 varieties;

- 31.1%: Pepsi’s 18 brands and 163 varieties;

- 15%: Dr. Pepper Snapple Group’s 20 brands and 109 varieties;

source

Cartoon: Nagging

Friday, August 20, 2010

Thursday, August 19, 2010

$8 Billion Resort in Singapore

That's what Las Vegas Sands spent constructing Marina Bay Sands, the world's most expensive standalone resort that looks more like a cruise boat perched atop a 55-floor skyscraper than any fully earthbound structure...

And, not to mention, this massive hospitality project is set to bump Singapore's already slap happy GDP growth rate up another 0.8% as the venture is expected to generate $1 billion in profits per year from the time it opens.

Philly Fed Index

This index turned down sharply in June and July and was negative in August for the first time since July 2009.

source

Cartoon: The Great Rope of China

Job Growth?

Economists are getting more pessimistic about the strength of the U.S. recovery, but they don't think policy makers should do anything more to support it, according to the latest Wall Street Journal forecasting survey...

The economists, though, generally didn't support the idea of ending Bush-era tax cuts, which will expire at the end of this year unless Congress acts. Just three respondents said that the tax cuts on individual income should be allowed to expire for everyone. Thirty-two economists said they should all be extended, while 11 said they should be extended for people making less than $250,000 a year—the policy option backed by the Obama administration.

source