Economics, as a branch of the more general theory of human action, deals with all human action, i.e., with mans purposive aiming at the attainment of ends chosen, whatever these ends may be.--Ludwig von Mises

Sunday, December 30, 2007

Wednesday, December 26, 2007

Tax Law Changes Equals Increasing Paychecks

For a single person earning $50,000 per year (assume all wages/salaries and no adjustments), his federal individual income tax bill under 2007 tax parameters would be calculated as follows:

AGI = $50,000

Income Tax After Credits for 2007 tax law = $6,736.25

Now for a person earning $50,000 under the 2008 tax parameters:

AGI = $50,000

Income Tax After Credits for 2007 tax law = $6,606.25

The person would save $130 on the year assuming no pay change, which would be about a $5.42 pay increase per pay period (assuming two per month).

source: Tax FoundationIt is not much, but declining tax bills are good. Although I'm not holding my breath.

Sunday, December 23, 2007

Life After Peak Oil--Gregory Clark

Oil prices have receded from their recent flirtation with $100 a barrel, but demand soars from China and India, rapidly industrializing countries with a massive energy thirst. The combination of increased demand, high prices and the prospect of an eventual peak in oil production, has caught Americans paralyzed between twin terrors: the fear that rampant consumption of oil and coal is irreversibly warming the Earth and the dread that without cheap oil our affluent lifestyles will evaporate...

Study of the long economic history of the world suggests two things, however. Cheap fossil fuels actually explain little of how we got rich since the Industrial Revolution. And after an initial period of painful adaptation, we can live happily, opulently and indeed more healthily, in a world of permanent $100-a-barrel oil or even $500-a-barrel oil...

Many people think mistakenly that modern prosperity was founded on this fossil energy revolution, and that when the oil and coal is gone, it is back to the Stone Age. If we had no fossil energy, then we would be forced to rely on an essentially unlimited amount of solar power, available at five times current energy costs. With energy five times as expensive as at present we would take a substantial hit to incomes. Our living standard would decline by about 11 percent. But we would still be fantastically rich compared to the pre-industrial world...

At current rates of economic growth we would gain back the income losses from having to convert to solar power in less than six years. And then onward on our march to ever greater prosperity.

Gregory Clark is professor and chair of the Department of Economics at the University of California, Davis.

read the entire essay

Saturday, December 22, 2007

Class Information

Order of Chapters:

1st Semester: 1, 2,16,12, 3, 4, 5, 6, 7, 9

2nd Semester: 10,11, 14, 15, 18, Personal Finance

Etc.

This blog is a work in progress to help the class run more efficiently. Feel free to post comments about improving the blog. Remember, I am a technological illiterate...

Goal:

To provide on-line access to virtually all class information. With the ultimate goal of being "paperless".

Updated: 8/5/09

Personal Finance (Course Work)

Money 101--from CNN Money

23 basic lessons

Financial Literacy

11 areas of finance with articles, tools, and FAQs for each

Feed the Pig

Good info about savings

Kiplinger Money Basics

Wall Street Journal Personal Finance Guide

Sources of Capital (Chapter 9)

Study Guide

Chapter 9 study guide

Notes

Chapter 9 notes

Chapter 9 notes fill in

Activity

Handouts

Articles

Additional Readings

International Trade (Chapter 18)

Chapter 18 Study Guide

Notes

Chapter 18 notes

Chapter 18 notes fill in

Activity

Handouts

Articles

Additional Readings

Other Info

Developing Countries (Chapter 17)

"The problem of rendering the underdeveloped nations more prosperous cannot be solved by material aid. It is a spiritual and intellectual problem. Prosperity is not simply a matter of capital investment. It is an ideological issue. What the underdeveloped countries need first is the ideology of economic freedom and private enterprise." Ludwig von Mises: Money, Method, and the Market Process

Study Guide

Chapter 17 Study Guide

Notes

Chapter 17 notes

Chapter 17 notes fill in

Activity

Handouts

Articles

Additional Readings

Other Info

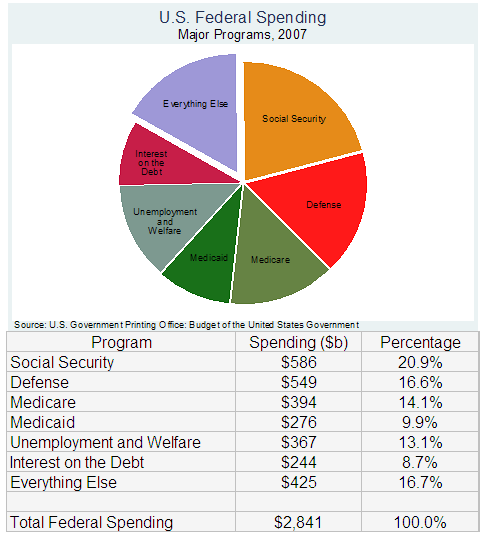

Fiscal Policy (Chapter 15)

Chapter 15 Study Guide

Notes

Chapter 15 notes

Chapter 15 notes fill in

Activity

Handouts

Articles

Additional Readings

Other INfo

The Federal Reserve and Monetary Policy (Chapter 14)

Chapter 14 Study Guide

Notes

Chapter 14 notes

Chapter 14 notes fill in

Activity

Handouts

Articles:

A Classic Hayekian Hangover Roger Garrison and Gene Callahan

Thinking Like a Center Banker by William Poole

Additional Readings

Other Info

Money and the Banking System (Chapter 13)

Chapter 13 Study Guide

Notes

Chapter 13 notes

Chapter 13 notes fill in

Activity

Handouts

Articles

Is the Gold Standard Still the Gold Standard among Monetary Systems? by Lawrence H. White

Additional Readings

Other Info

Role of Government (Chapter 12)

Study Guide

Chapter 12 Study Guide

Notes

Chapter 12 notes

Chapter 12 notes fill in

Activity

Handouts

Articles

Additional Readings

A World Without the FDA

Websites

FDA Review

Economic Challenges (Chapter 11)

Chapter 11 Study Guide

Notes

Chapter 11 notes

Chapter 11 notes fill in

Activity

Handouts

Articles

Additional Readings

Other Info

Economic Performance (Chapter 10)

Chapter 10 Study Guide

Notes

Chapter 10 notes

Chapter 10 notes fill in

Activity

Handouts

Articles

Additional Readings

Other

Business Organizations (Chapter 7)

Study Guide

Chapter 7 study guide

Notes

Chapter 7 notes

Chapter 7 notes fill in

Activity

Handouts

Articles

Additional Reading

Market Structures (Chapter 6)

Study Guide

Chapter 6 study guide

Notes

Chapter 6 notes

Chapter 6 notes fill in

Activity

Handouts

Articles

Additional Readings

Prices (Chapter 5)

Study Guide

Chapter 5 study guide

Notes

Chapter 5 notes

Chapter 5 notes fill in

Activity

Handouts

Articles

Additional Readings

Supply (Chapter 4)

Study Guide

Chapter 4 study guide

Notes

Chapter 4 notes

Chapter 4 notes fill in

Activity

Handouts

Articles

Additional Readings

Demand (Chapter 3)

Study Guide

Chapter 3 study guide

Notes

Chapter 3 notes

Chapter 3 notes fill in

Activity

Handouts

Articles

Additional Readings

Comparing Economic Systems (Chapter 16)

Chapter 16 Study Guide

Notes

Chapter 16 notes

Chapter 16 notes fill in

Activity

Handouts

Articles

Additional Readings

Other Info

Economic Systems (Chapter 2)

Study Guide

Chapter 2 Study Guide

Notes

Chapter 2 notes

Chapter 2 notes fill in

Activity

Handouts

Articles

Additional Readings

Tragedy of the Commons by Garrett Hardin

The Commons: Tragedy or Triumph?

Games

Tragedy of the Bunnies a game that illustrates the "tragedy of the commons"

What is Economics? (Chapter 1)

Study Guide

Chapter 1 Study Guide

Notes

Chapter 1 Notes

Chapter 1 Notes Fill In

Activity

Why Are We a Nation of Couch Potatoes?

Handouts

Economics in One Page

Articles

Opportunities and Costs

Opportunities and Costs questions

Additional Readings

I, Pencil

Largest Wall Street Bonus Ever

Blankfein was awarded $26.8 million in cash and $41.1 million in restricted stock and stock options, according to a company filing with the Securities and Exchange Commission issued Friday.

With this year's bonus, Blankfein shatters the record he set a year ago, when he was awarded $54 million.

Friday, December 21, 2007

Thursday, December 20, 2007

New Corvette

"High-performance cars like this may be legislated out of existence," Corvette chief engineer Tadge Juechter said...

GM will likely build about 2,000 ZR1s annually in an effort to maintain exclusivity. Besides the ZR1, which goes on sale later in 2008, Chevrolet sells other versions of the car for base prices between $46,000 and $71,000.

Wednesday, December 19, 2007

Google Challenges Wikipedia

Google, Inc. announced Thursday that it is working on a collaborative online encyclopedia that could compete with Wikipedia, the popular user-edited encyclopedia.

The "knol" project – named for Google's shorthand for a unit of knowledge – will allow a user to create an entry on virtually any topic. Like Wikipedia, it will allow anyone to add an entry, but unlike the largely anonymous Wikipedia, it will post an author's byline and profile with each entry.

read the articlePersonal FInance: Investing Advice

The new book Jim Cramer's Stay Mad for Life is a primer for saving and investing. It advises readers to pay off credit cards, make the most of 401(k) plans and individual retirement accounts (IRAs), and get the right kinds of insurance. The subtitle of the book, written with Cliff Mason: Get Rich, Stay Rich (Make Your Kids Even Richer).

Most people actually won't get rich by buying individual stocks, Cramer says. Unless you do your homework, namely spending an hour a week researching for each stock you own, "You won't beat the market, and you'll probably lose money," he writes.

For Cramerites willing to do the research, the book helps construct a long-term, diversified portfolio. For most people, however, he advises low-fee stock index funds.

All the personal finance advice you ever need in 3 paragraphs. A couple of other points, spend less than you make. Don't get an adjustable rate mortgage.

Wealhiest Americans

Standard of Living for wealthy Americans.

New book:

All the Money in the World: How the Forbes 400 Make--and Spend--Their Fortunes

more charts here

Tuesday, December 18, 2007

Austrian-style Business Cycle

Though deficient in the powers of foresight and observation, economists do believe they know how to treat an economy on the brink of recession, as this one seems to be. They administer what non-economists know as the “hair of the dog that bit you.”

But booms not only precede busts, they also cause them. Bargain-basement interest rates are a potent stimulant. Borrowing more than they might at higher rates, people stretch. Businesses stock up on labor, machinery and buildings. Consumers buy cars and houses — houses, especially, these past five years. The G.D.P. takes flight.

Then unwelcome facts intrude. Easy money, it seems, was an illusion. Society was not so rich as it seemed. The prosperous future for which people had collectively prepared is slow to arrive. The inflation rate picks up. Supposedly creditworthy consumers and businesses turn out to be risky. They were creditworthy only so long as lenders were willing to advance them more and more funds at those ever-so-affordable low rates.

Now what to do? Why, slash interest rates to coax forth still more lending and borrowing. It’s the customary curative, seemingly as humane as it is politic.

And if recessions served no useful purpose, it might be. But recessions do. On Wall Street, they speak of “corrections.” What corrections correct are errors in judgment. So do recessions.

They allow the sorting out of boomtime error. They permit — indeed, force — the repricing of inflated assets. In a downturn, previously overpriced businesses, houses and buildings are made affordable again.

Naturally, people hate these painful, salutary interludes. Nobody likes insecurity, bankruptcy and joblessness. So the Fed keeps slashing interest rates. And this balm does mitigate the suffering. Homeowners and businesses refinance their debts. Fewer houses are thrown on an overstocked market.

Observe, however, that the great preceding illusion is undispelled. Prices have not come down as they should have. Neither has indebtedness. The architecture of the economy remains as it was. Land, labor and capital are still structured for an imagined glittering future.

Presently, a new upcycle does begin, but it’s slow off the mark. The world’s top economy seems curiously sluggish. And the economists and politicians ask, “What happened to America’s dynamic economy?” The answer: It’s wrapped in the coils of debt.

— James Grant, the editor of Grant’s Interest Rate Observer.

HT: Mises Blog

Monday, December 17, 2007

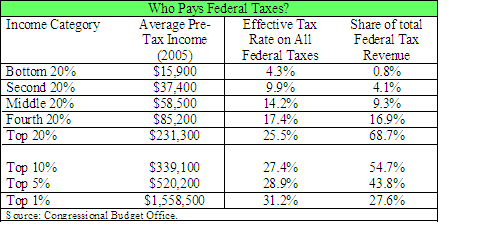

The Rich Are Paying Taxes

Recession in 2008?

In the latest WSJ.com survey of economists, forecasters on average put the chance of a recession -- often defined as two straight quarterly declines in gross domestic product -- at 38%. That's the highest in more than three years, but the forecasters' best bet right now is that the U.S. will skirt a recession...

In the latest WSJ.com survey of economists, forecasters on average put the chance of a recession -- often defined as two straight quarterly declines in gross domestic product -- at 38%. That's the highest in more than three years, but the forecasters' best bet right now is that the U.S. will skirt a recession...read the WSJ article

Saturday, December 15, 2007

Friday, December 14, 2007

Parents: Questions, Comments, and Suggestions

Students: Questions, Comments, and Suggestions

The end is near.

Thursday, December 13, 2007

Producer Price Index up 3.2%

Wednesday, December 12, 2007

Saturday, December 8, 2007

Friday, December 7, 2007

Students: Questions, Comments, and Suggestions

Parents: Questions, Comments, and Suggestions

Thursday, December 6, 2007

Where Would You Prefer to Live?

House B

One house has hot and cold running water, central air conditioning, electricity and flush toilets. The other does not. One owner has a a computer, a high speed connection to the Internet, a DVD player with a movie collection, and several television sets. The other has none of these things. One owner has a refrigerator, a vacuum cleaner, a toaster oven, an iPod, an alarm clock that plays music in the morning, a coffee maker, and a decent car. The other has none of these. One owner has ice cubes for his lemonade, while the other has to drink his warm in the summer time. One owner can pick up the telephone and do business with anyone in the world, while the other had to travel by train and ship for days (or weeks) to conduct business in real time.

from Coyote Blog

Wednesday, December 5, 2007

Tuesday, December 4, 2007

National Debt: $9.13 trillion

That's $10,000,000,000,000.00, or one digit more than an odometer-style "national debt clock" near New York's Times Square can handle. When the privately owned automated clock was activated in 1989, the national debt was $2.7 trillion.

read the article