The Fed's New Tricks Are Creating Disaster Frank ShostakThe Federal Reserve is trying a range of new tricks to push new forms of lending as a means of preventing what they fear may otherwise be a major collapse in financial markets. What all these strategies have in common is an unwillingness to come to terms with the reality that the crisis is based on real factors and can't be merely papered over without grave consequence to economic health...

Bernanke is of the view that by means of aggressive monetary policy the credit markets can be normalized. Once credit markets are brought back to normalcy, this will play an important role in preventing serious economic crisis. Remember Bernanke's financial accelerator model: a minor shock in the financial sector could result in large damage to the real economy.

In short, Bernanke, by means of his so-called "innovative" policy of fixing the symptoms of the disease, believes he can cure the disease.

What is the source of the disease and why are investment banks so heavily infected by it?

The root of the problem is the Fed's very loose interest rate policy and strong monetary pumping from January 2001 to June 2004. The federal funds rate target was lowered from 6.5% to 1%. It is this that has given rise to various malinvestments, which we label here as bubble activities...Obviously, then, if the pool of real saving is still healthy, Bernanke's policies might "work." In short, after a time lag, financial markets might start zooming ahead and the real economy will follow suit. We suggest that if this were to happen, the recovery shouldn't be attributed to Bernanke's policies but, rather, understood to have happened despite his policies.

In the alternative scenario, to which we assign a fairly high likelihood, the pool of real savings is actually falling or stagnating. In the framework of the alternative scenario,

Bernanke's policies will only do further damage to the stock of savings and sound capital investment, and plunge the economy into a severe and prolonged crisis.read the entire essayThe markets responded favorable to more rate cuts yesterday. However, the fundamentals are largely unsound. The solution to the problem is not rate cuts, which caused the current crisis.

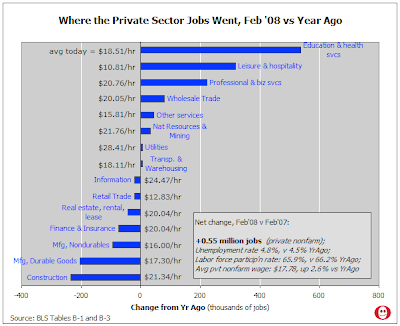

great charts from the Skeptical Optimist

great charts from the Skeptical Optimist