Economics, as a branch of the more general theory of human action, deals with all human action, i.e., with mans purposive aiming at the attainment of ends chosen, whatever these ends may be.--Ludwig von Mises

Thursday, September 29, 2011

Cartoon: The Shrinking Middle Class

Tuesday, September 27, 2011

Monday, September 26, 2011

Cartoon: The Budget

Cartoon: Unemployment

Bank Failures

Friday, September 23, 2011

Operation Twist

The WSJ writes:

read the entire essay

The Federal Reserve-as-economic-savior school took a beating yesterday, after the Fed's Open Market Committee announced its latest policy gambit to avoid a recession. Stocks promptly sold off on the Fed's comments that it now sees "significant downside risks" to the economy, and perhaps also as reality dawned that the reprise of 1961's Operation Twist is more gesture than salvation.

The Fed announced that through June 2012 it will buy $400 billion in Treasury bonds at the long end of the market—with six- to 30-year maturities—and sell an equal amount of securities of three years' duration or less. The point, said the FOMC statement, is to put further "downward pressure on longer-term interest rates and help make broader financial conditions more accommodative."...

The larger point is that the economy's problems aren't rooted in the supply and price of money. They result from the damage done to business confidence and investment by fiscal and regulatory policy, and that's where the solutions must come. Investors on Wall Street and politicians in Washington want to believe that the Fed can make up for years of policy mistakes. The sooner they realize it can't, the sooner they'll have no choice but to correct the mistakes.

read the entire essay

Thursday, September 22, 2011

New Burger at Hardee's

"Tastes Like It's Made by the God of Hamburgers"

The burger consists of a charbroiled, 100% Black Angus beef patty topped with A.1. steak sauce, crumbled blue cheese, crispy onion strings, Swiss cheese, lettuce, tomatoes, and mayonnaise on a seeded bun.

US-China Trade Relations

Wednesday, September 21, 2011

Balance of Payments

Mark Perry writes:

Mark Perry writes:Even though it's not "newsworthy" and won't be covered by the media, America's international transactions were once again balanced from January-June this year, just like every quarter and every year, and the "balance of payments" was once again ZERO. (What a relief!)

source

Tuesday, September 20, 2011

Was Buffett Wrong?

Mark Perry writes:

We now have a proposal for a tax policy - the "Buffett Rule" - based on Warren Buffett's anecdotal "evidence" of his and his employees' tax burdens. But that "evidence" seems pretty far-fetched and not consistent with: a) average federal income tax rates available from the IRS, nor b) average tax rates for all federal taxes paid, from the CBO. Buffett's anecdote has to be an outlier or exception, because under the current federal tax system, the average "super-rich" taxpayer pays taxes at a rate 2-3 times the average secretary. Instead of raising tax rates, we should probably figure out what kind of loopholes allow Warren Buffet to pay taxes of only 17.4% on his $40 million income last year.

Update: Steve Moore on The Kudlow Report tonight said in reference to myth that secretaries pay taxes at higher rates than the "super-rich," (and citing some of the same tax data that appear above) "It's almost as if Barack Obama and Warren Buffett made those numbers up."

Labels:

quintiles,

tax rates,

Warren Buffett,

wealthiest Americans

Monday, September 19, 2011

Income Share for the Wealthy

Upper-income taxpayers have paid a growing share of the federal tax burden over the last 25 years.

A 2008 study by the Organization for Economic Cooperation and Development, for example, found that the highest-earning 10% of the U.S. population paid the largest share among 24 countries examined, even after adjusting for their relatively higher incomes. "Taxation is most progressively distributed in the United States," the OECD study concluded.

Meanwhile, the percentage of U.S. households paying no federal income tax has been climbing, and reached 51% for 2009, according to a new analysis by the Joint Committee on Taxation. That was the first time since at least 1992 that more than half of households owed no federal income tax, according to JCT estimates.; earlier data were unavailable on Monday.

Federal Taxes as Percent of GDP

Friday, September 16, 2011

The Economy

When credit creation can no longer be sustained, the markets must began to clear the excesses before the cycle can begin again. It is only then (and must be allowed to happen) that resources can be reallocated back towards more efficient uses. This is why all the efforts of Keynesian policies to stimulate growth in the economy have ultimately failed. Those fiscal and monetary policies, from TARP and QE to tax cuts, only delay the clearing process. Ultimately, that delay only potentially worsens the inevitable clearing process.

The clearing process is going to be very substantial. The economy is currently requiring roughly $4 of total credit market debt to create $1 of economic growth. A reversion to a structurally manageable level of debt would involve a nearly $30 Trillion reduction of total credit market debt. The economic drag from such a reduction will be dramatic while the clearing process occurs.

This is one of the primary reasons why economic growth will continue to run at lower levels going into the future. We will witness an economy plagued by more frequent recessionary spats, lower equity market returns, and a stagflationary environment as wages remain suppressed and the costs of living rise. However, only by clearing the excess can the personal savings return to levels that can promote productive investment, production and ultimately consumption.

The end game of three decades of excess is upon us, and we can't deny the weight of the balance sheet recession that is currently in play. As we have stated in the past — the medicine that the current administration is prescribing to the patient is a treatment for the common cold — in this case a normal business-cycle recession. The problem is that this patient is suffering from a cancer of debt, and, until we begin the proper treatment, the patient will continue to wither.

Thursday, September 15, 2011

Cartoon: The Economy

Wednesday, September 14, 2011

World's Largest Employers

America's defence department had 3.2m people on its payroll last year, equivalent to 1% of the country's population. China, the world's most populous nation and a big military spender, employs 2.3m people in its armed forces. And the number of people working for the National Health Service in England is equivalent to over 2.5% of the country's population. The three private companies are Walmart, McDonald's and Taiwan's Hon Hai Precision Industry Company, a subsidiary of which is Foxconn, a secretive electronics manufacturer.

Tuesday, September 13, 2011

Borders Bookstore Closes

The "failure of Borders is a glorious event," and today's closing of Borders Store No. 1 gives us reason to celebrate - it demonstrates that the market forces of: a) creative destruction, b) consumer sovereignty, and c) the profit-and-loss system, are all working perfectly. To quote Anthony Gregory, "If voluntary competition should one day bring Amazon.com down, in the midst of a competing commercial success today unimaginable but even more friendly to consumers than that wonderful online store, we will again have reason to celebrate."

Monday, September 12, 2011

Robert Higgs makes an important point that "Consumption Spending HAS Already Recovered," and it's private investment spending that is lagging and holding the economy back:

Commentators and pundits, some of whom ought to know better, continue to harp on the idea that the recession persists because consumers are not spending. Every Keynesian seems to believe that because consumers are in a dreadful funk, only government stimulus spending can rescue the moribund economy, given (to them, at least) that investors will not spend more because the Fed, having already driven interest rates to extraordinarily low levels, cannot use conventional policies to drive them any lower and thereby elicit more investment spending.

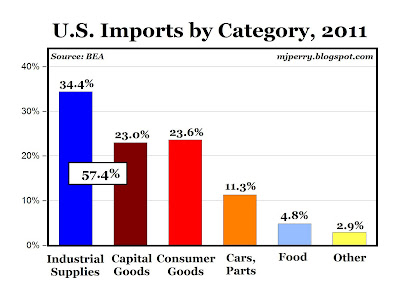

Imports

As important as access to foreign markets is, however, some of the most significant obstacles to U.S. export success aren't foreign-made but homegrown. If the president is genuinely committed to spurring economic growth and job creation, he will take the lead on reducing or eliminating duties that U.S. producers pay on imported raw materials and components they need for manufacturing. This would instantly boost the competitiveness of U.S. products at home and abroad.

As important as access to foreign markets is, however, some of the most significant obstacles to U.S. export success aren't foreign-made but homegrown. If the president is genuinely committed to spurring economic growth and job creation, he will take the lead on reducing or eliminating duties that U.S. producers pay on imported raw materials and components they need for manufacturing. This would instantly boost the competitiveness of U.S. products at home and abroad.source

Sunday, September 11, 2011

S and P 500: The Lost Decade

We're now over eleven years beyond the S&P 500 2000 high. This little charting exercise gives credence to the frequent reference to a "lost decade" for investors. In nominal terms, the index is about 6.8 percent below where it was at the 2000 peak, but in real terms, it's a disappointing 29.5 percent off the original investment. The chart also offers support for the wisdom of diversification across asset classes ... and perhaps the value of active management during secular bear markets.

Ben Powell on The American Jobs Act

Powell writes:

read the entire essay

After wasting three years and more than a trillion dollars of "stimulus" money, the President has announced he has a new plan for creating jobs.

The problem is: Government doesn't create jobs that add value to the economy; companies and entrepreneurs do. Through taxes, mandates and regulation the government typically discourages hiring and destroys jobs. What Washington should do right now is step aside...

Entrepreneurs create jobs only when they expect the price they will receive for their product or service will exceed the price they pay for labor and other inputs, such as raw materials and equipment. This ensures that the jobs they create make society wealthier.

In contrast, government jobs add little if anything to the economy. They drain resources rather than increase them.

Truth be told, the government easily could solve unemployment tomorrow if our only objective is to say that everyone who wants a job has one. It could do this simply by hiring half of all unemployed workers to dig ditches and the other half to fill them in. Everyone would work. But no net value would be created.

read the entire essay

Peter Schiff on The American Jobs Act

Schiff writes:

read the entire essay

Although it was labeled and hyped as a "jobs plan," the new $447 billion initiative announced last night by President Obama is merely another government stimulus program in disguise. But semantics are of supreme importance in American politics...some could argue that word choice is the only thing that matters. As a result, despite the fact that this plan bears no substantive difference from previous stimulus bills...

In the meantime money to fund the stimulus has to come from somewhere. Either the government will borrow it legitimately, or the Federal Reserve will print. Either way, the adverse consequences will damage economic growth and job creation, and lower the living standards of Americans...

The truth of course is that no real economic growth or job creation is going to occur until the failed policies of both Obama and Bush are reversed. In his speech the President mourned the death of the American dream. Obama should stop killing it. To revive that dream we need to revive the American spirit that produced it in the first place. That means returning to our traditional values of limited government and sound money. Unfortunately we are still headed in the wrong direction.

read the entire essay

Labels:

American Jobs Act,

economic stimulus,

Peter Schiff

Anthony Wile on the American Jobs Act

Wile writes:

read the entire essay

I've noticed that an old and misleading dominant social theme has taken center stage in America lately. It's the idea that politicians and the political process itself can create jobs.

Of course, government can't create jobs. Government can make things worse, but it can rarely if ever make things better...

Government doesn't create anything of value. It merely taxes and spends. It is impossible for the government to "create" jobs – and the Keynesian nostrums claiming that government can "stimulate" the economy by creating make-work employment are not feasible – and never really were.

read the entire essay

Labels:

American Jobs Act,

Anthony Wile,

economic stimulus

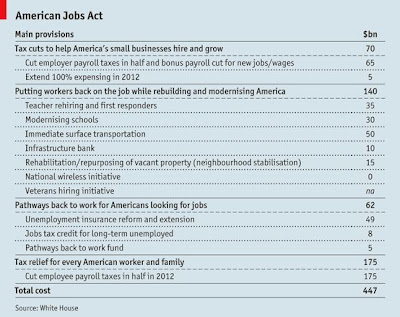

Adrian Krieg on The American Jobs Act

Krieg writes:

read the entire essay

The president's speech on the evening of September 8 was without question

not a speech about the economy or how to fix it; it was another campaign speech

for Obama's reelection. The plan as announced is called "The American Jobs Act" – very long on vocalization and very short on substance. The same old class warfare of "tax the rich" was repeated often. I lost count on, "You Must Pass This Bill." There

are, according to White House sources, $447 billion required for implementation

of this Act (Stimulus 4, one would suspect), although the president never once

mentioned any dollar amount.

read the entire essay

Friday, September 9, 2011

Tibor Machan on the American Job Creation Act

Machan writes:

read the entire essay

Jobs are created when people who have earned an honest buck go to the market and purchase goods and services that other people need to produce. If a good many go to the market to do this, there will be many jobs; if only a few, there will be few jobs. Moreover, only if the people get to choose what purchases they make in the market will the resulting jobs be more than make-believe or artificial jobs, like digging holes and filling them up again...

The entire plan of the jobs bill amounts to nothing more than artificially manufacturing jobs, from phony money, creating phony demand. And this doesn't even address the issue of Mr. Obama's favorite superstition, namely, his idea that he can somehow turn America into a showcase of green life without incurring massive expenses for this, expenses the country cannot afford.

read the entire essay

Cost of Regulation

"Call it Dodd-Frank Inc. A year after Congress passed the broadest financial overhaul since the Great Depression, the law has spawned a host of new businesses to help Wall Street comply — and capitalize — on the hundreds of new regulations. Besides the lawyers, there are legions of corporate accountants, financial consultants, risk management advisers, turnaround artists and technology vendors all vying for their cut."

American Jobs Act

Bailing out state governments, extending jobless benefits, etc. all seem to presume that, somehow, the U.S. economy is going to return to its pre-2008 growth track and that all we need to do is give it a little help along the way. With each passing month, that seems more unlikely and it might be a good idea to begin adjusting to a more sustainable economy (i.e., one less dependent on credit, finance, and rising asset prices) sooner rather than later.

source

My thoughts: The cost is being reported as $447 billion. This includes $253 billion in tax cuts. Allowing people to keep money that they have earned is NOT a cost. Spending is a cost. The national debt crisis is a result of of overspending, not under taxation.

My thoughts: The cost is being reported as $447 billion. This includes $253 billion in tax cuts. Allowing people to keep money that they have earned is NOT a cost. Spending is a cost. The national debt crisis is a result of of overspending, not under taxation.

Thursday, September 8, 2011

Trade Deficit July 2011 $44.8 Billion

July exports of $178.0 billion and imports of $222.8 billion resulted in a goods and services deficit of $44.8 billion, down from $51.6 billion in June, revised. July exports were $6.2 billion more than June exports of $171.8 billion. July imports were $0.5 billion less than June imports of $223.4 billion.

Cartoon: Rhetoric or Reality

Where does someone who supports economic liberty belong?

or read a recent essay by Walter Williams

After reading Hornberger’s “Economic Liberty and the Constitution,” one

cannot avoid the conclusion that the liberties envisioned by the nation’s

founders have been under siege, trivialized and nullified. Philosopher Johann

Wolfgang von Goethe explained that “no one is as hopelessly enslaved as the

person who thinks he's free.” That’s becoming an apt description for Americans

who are oblivious to -- or ignorant of -- the liberties we’ve lost.

Wednesday, September 7, 2011

Unemployment by Education

Tuesday, September 6, 2011

S and P 500: Bulls and Bears

Cartoon: Labor Day

Monday, September 5, 2011

Is Social Security a Ponzi Scheme?

Friday, September 2, 2011

August Unemployment: 9.1%

The jobless rate held steady at 9.1 percent and the official tally of unemployed workers was virtually unchanged at 14 million. The broad U6 measure of underemployment – including those who have given up looking for work and who are working part-time for economic reasons – rose from 16.1 percent to 16.2 percent.

The number of long-term unemployed – those going without work for 27 weeks or more – was unchanged at 6.0 million and they accounted for a stunning 42.9 percent of the unemployed while the civilian labor force participation rate was steady at 64.0 percent.

Unemployment August: 9.1%

The current employment recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

The current employment recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

The unemployment rate was unchanged at 9.1% (red line). The Labor Force Participation Rate increased to 64.0% in August (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

Bernstein-Romer Chart

The White House budget office forecast Thursday that the unemployment rate won't fall below 6% until 2017 -- two years later than it predicted in February, when President Obama delivered his 2012 budget proposal to Congress.

My thoughts: Only 5 years after the initial promise.

Thursday, September 1, 2011

Cartoon: The First Economist

Subscribe to:

Posts (Atom)

source

source