The Bush-era deficits were bad. I know. I spent eight years complaining about the president’s lack of fiscal responsibly (here and here for instance).

First, while President Obama is fond of promoting what he calls a "new ethic of responsibility"—in fact he named his first budget, for fiscal 2010, "A New Era of Responsibility"—that is a misrepresentation of his actual budget plan. For each of Obama’s years in office, the deficit is projected to be larger than any year during Bush’s terms.

Second, Obama is right to note that he inherited a large deficit in fiscal 2009. But as we can see here, he is responsible for growing the deficit beyond expectations in fiscal 2009 and thereafter...

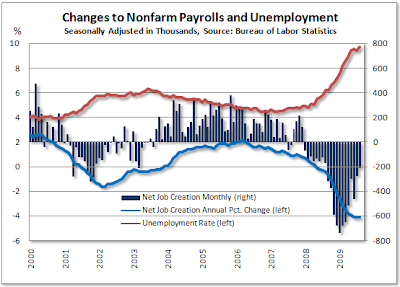

Third, Obama’s deficits are frightening but they promise to get worse. Each month that goes by the president adds spending to the deficit. The August 2009 projections for instance, do not include any of the president’s healthcare reform spending and they assume that the “temporary” stimulus spending will not be prolonged past fiscal 2011. Finally, they also assume that the economy will recover soon and that it will grow enough to generate increasing tax revenue, in spite of the president’s plan to impose new taxes and regulations on the private sector.