Economics, as a branch of the more general theory of human action, deals with all human action, i.e., with mans purposive aiming at the attainment of ends chosen, whatever these ends may be.--Ludwig von Mises

Friday, August 31, 2007

Self-Interest or Altruism?

To remedy the problem we will conduct an experiment.

20 bonus points are up for grabs.

Self-interest or altruism?

Self-interest: The individual and the commenter will get 1 point each.

(Maximum 10 points for the individual; 1 point each for commenter)

or

Altruism: The individual receives 2 points per commenter.

(Maximum 20 points for the individual; o points for the anonymous commenters.)

So will altruism or self-interest win?

I will close the thread to comments Monday afternoon. In the event of more than 10 commenters the first group that gets 10 commenters wins.

Reminder when voting if you choice altruism, just type "altruism". Any attempt to identify yourself is not altruism. Self-interest requires a post that includes your name or I will not know who to award the point to.

Self-Interest defeats altruism 3 to 1. Apathy or marginal analysis dominates.

2nd Quarter GDP Growth 3.95%

Another great chart from the Skeptical Optimist

Another great chart from the Skeptical OptimistStudents: Questions, Comments, Suggestions

Parents: Questions, Comments, Suggestions

Thursday, August 30, 2007

Top 100 Economics Blogs

"Staying abreast of the world’s economy is vital, whether or not you have hefty investments in the stock market. A close study of economics sheds light on political, social, and even environmental trends, all of which affect even the average person’s daily life... Make at least a couple of them daily or weekly reads to help you become an informed, intelligent, and conscientious citizen." --Laura Milligan

Due to the large number of economics related blogs out there, it is impossible to read them all or even be aware of them all. The basic goal of my blog is to find economics related items of interest that may be helpful to my students (in class or life) from a variety of sources.

Those students who do have some interest in economics beyond simply passing the class should try to read at least a few blogs on a weekly if not daily basis. "According to Tyler Cowen...that right now blogs are the best place to learn economics."

Reading blogs probably won't increase test scores as much as it will give a person a breadth of knowledge, information, insights, and commentary in economics and the broader field of human action that can't be obtained from from a textbook, classroom or library.

As with any list there will be debate.

I find this list be much better.

Opinions will vary.

If you have found an economics related blog that you enjoy or think might be useful please share.

Corporate Profits

The Commerce Department reported today that corporate profits strengthened in the second quarter, and hit an all-time high of $1.646 trillion on a before tax basis and $1.154 trillion after taxes (see chart above). Profits after taxes grew by 5.4% in the second quarter, after rising by 1.5% in the first quarter. Year over year, corporate profits increased by 3.5%...

Another way to put

Wednesday, August 29, 2007

Tuesday, August 28, 2007

Robert Frank at Google

Youtube broadcast

Monday, August 27, 2007

Sunday, August 26, 2007

Saturday, August 25, 2007

Incentives Matter

Bonus points for the first 5 students to respond.

I need your name, period/block, and your favorite economics website or blog besides mine.

Ooooops. Times up.

Cost -Benefit Analysis: Michael Vick Edition

"Falcons quarterback Michael Vick's guilty plea on federal dogfighting charges could wind up costing him well over $100 million.

Vick will lose $71 million in salary over the next seven years if the Falcons terminate his contract, which legal experts say the team has the right to do.

He also figures to lose as much as $50 million in endorsement income over the next decade, according to an estimate by the University of Oregon's Warsaw Sports Marketing Center. Then add to Vick's costs the legal fees and other possible fallout from the case."

Friday, August 24, 2007

A Hayekian Hangover

A Hayekian Hangover

A Hayekian HangoverFor the Austrians, things go wrong when a central bank sets short-term interest rates too low and allows credit to artificially expand. Interest rates that are too low-lower than those that would be set in a free market-induce businesses to discount the future at artificially low rates. This pumps up the value of long-lived investments and generates an investment-led boom, one that is characterized by too much investment and investment that is biased towards projects that are too long-lived and too capital intensive.

An investment-led boom sows the seeds of its own destruction and is unsustainable, however. Indeed, on the eve of the downturn investors find that the loanable funds for investments are too expensive to justify commitments they made during the preceding monetary expansion. Some businesses engage in distress borrowing, profit margins collapse under the weight of too much costly debt, and-if that is not bad enough-many businesses are saddled with excess capacity, resulting from what turned out to be wrong-headed investment decisions. With that, the investment-driven boom turns into a bust. In short, artificially-created investment booms always end badly...

If this hangover phase-working off excess capacity and transforming the capital structure to shorten the length of production processes-is not bad enough, the economy is vulnerable during this phase to what Austrians termed a "secondary deflation." If a general feeling of insecurity and pessimism grips individuals and enterprises during a Hayekian hangover, risk aversion and a struggle for liquidity (cash reserves) will ensue. To build liquidity, banks will call in loans and/or not be as willing to extend credit. Not surprisingly, banks are already scrambling for liquidity.

Cartoon: Stock Market Losses

Cartoon: The Dow and Credit Markets

Who Owns the National Debt: June 2007

Students: Questions, Comments, and Suggestions

Parents: Questions, Comments, and Suggestions

Thursday, August 23, 2007

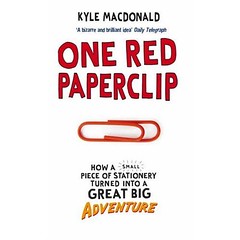

A Barter Success Story: One Red Paperclip

Kyle MacDonald traded one red paperclip for a house. He started with one red paperclip on July 12 2005 and 14 trades later, on July 12, 2006 he traded with the Town of Kipling Saskatchewan for a house.

http://oneredpaperclip.blogspot.com/

Essay: Laissez Faire is Best Medicine

"The ever-present demand to "do something" is unfortunately immune to the wisdom counseling that there are some problems best left to sort themselves out. Government efforts to "solve" market adjustments and dislocations typically -- and at best -- supply only short-run relief while making the longer-run situation more dire....

On the eve of entering World War II in 1941, America's economy was still quite depressed -- as it had been for more than a decade. And as economic historian Robert Higgs shows in his 2006 book, "Depression, War, and Cold War," New Deal policies and the prevailing climate of ideas from which they sprang suppressed investment.

The New Deal and the genuine risk of outright socialization of industry in the 1930s kept the American economy in deep doldrums for a much longer time than would have been the case if Uncle Sam just said "laissez faire" and had conspicuously ignored all the Very Smart People who clamored for socialism. No investor, after all, wants to put his assets at stake in a country whose government might tax away or outright confiscate these assets...

History is clear that freer trade means more opportunity and greater and more widespread prosperity. That Uncle Sam might be losing his taste for freer trade is very frightening. "

Read the entire essay here.

Wednesday, August 22, 2007

Famous Economist: Frederic Bastiat

– Frédéric Bastiat, "To the Youth of France," Economic Harmonies

A new article about Bastiat.

Who was Bastiat?

Tuesday, August 21, 2007

Monday, August 20, 2007

Big Five Automakers?

23.9% General Motors

17.1% Toyota

13.7% Ford

10.8% Honda

10.5% Chrysler

How long until General Motors falls from the top spot?

Saturday, August 18, 2007

And You Thought Mailing a Letter was Expensive

Pentagon Paid $999,798 to Ship Two 19-Cent Washers to Texas

"A small South Carolina parts supplier collected about $20.5 million over six years from the Pentagon for fraudulent shipping costs, including $998,798 for sending two 19-cent washers to a Texas base, U.S. officials said...

A review of paid shipping invoices showed that fraudulent billing is ``is not a widespread problem,'' she said."

The people who it took 6 years to discover the billing fraud say the problem is not widespread. Is anyone else having doubts?

Free Market Critiques of Social Security

Social Security Reform: A Free-Market Alternative

By George Reisman

The Revolution of 1935

By Gregory Bresiger

by John Attarian

Attarian's conclusion

A MODEST PROPOSAL

Social Security’s history casts grave doubt on the wisdom of having any government retirement program at all. Any such program is subject to pernicious dynamics. There is an inherent asymmetry whereby expansion is politically rewarded, but retrenchment is penalized. There is too an inherent symbiosis whereby the program serves the constituency, and the constituency protects the program. An entitlement mentality disastrously compounds these tendencies. It creates enormous political pressure to make benefit outlays fixed charges on the future, and thereby sharply constrains policymakers’ options. In any such program a conflict between a political demand for rigid benefit guarantees and an economic need for flexibility is inescapable. Sound public finance, sound money, small government, individual liberty and personal responsibility are all but predestined to lose out.

The truly wise course, then, is to reverse direction, to abandon government paternalism and put the responsibility for old-age provision on individuals themselves, where it belongs. Individual responsibility is the hallmark of a free society. Coerced transfers are by definition a denial of individual rights and liberty. As the trend in Social Security itself—from the initial paternalism of the New Deal to the far vaster loss of freedom under Social Security “reform” proposals—teaches, freedom, power and responsibility march shoulder to shoulder. The more responsibility for our welfare we shunt onto the government, the more power over us we give it, and the more freedom we necessarily forfeit thereby.

Moreover, Social Security has had a very corrosive and degrading effect on our national character. Instead of fostering fortitude and self-reliance, it has encouraged whiny dependence. It has made Americans first servile and then petulant in their relations with their government: tamely submitting to crushing tax burdens in their productive years under the deliberately-cultivated delusion that they were buying something for themselves, and in their retirement years, railing at any attempt, however innocuous, to trim benefits. Its zero-sum finance, whereby the beneficiary’s gain is inescapably the taxpayer’s loss, has made the old callous toward the program’s burdens on the young, and the young resentful of the old. It is telling that the sour epithet “greedy geezer” was unknown in

We must jettison Social Security’s pernicious entitlement mentality. Benefits are paid because people apply for them, out of a belief that they are “entitled” to them. It is an inflation of rights beyond all reason and a flouting of justice to say that one is “entitled” to retirement, or anything else, at the expense of coercion of others, and a prior lien on their income. What should be done about Social Security is fairly clear.

(1) Repeal the Social Security Act and replace Social Security with a rigorously means-tested benefit, for current and imminent retirees only. Abolish the Social Security tax and finance benefits with general revenues. This one step would begin the process of treating this program for what it is, not insurance but coercive redistribution. Total benefit termination for current and imminent retirees is politically impossible. However, as should by now be clear, Social Security benefits are not sacrosanct or an earned right. There is neither a legal nor a moral barrier for applying a means test. The payroll tax’s true purpose was to create a mentality of entitlement and make the insurance analogy plausible. Abolition of this tax is essential for exploding the false consciousness. Those born after 1945 would lose their Social Security benefits and would have to recognize the OASDI taxes they have already paid for what they are—redistributive transfers. On the other hand, they would be free to make their own arrangements for old age with the money they now pay in Social Security taxes. A less severe option would be to permit people after 1945 to make a free choice between receiving their benefits or receiving tax lifetime exemptions equal to or greater than accumulated benefits.

(2) For those born after 1945, provide a means-tested old-age benefit similar to Supplemental Security Income. Political realities being what they are, some such federal benefit would probably continue to exist for the near future. We should, however, ultimately devolve an old-age safety net provision onto churches and families, which is where it properly belongs, and fund it through private resources voluntarily contributed. And to make the need for this backup benefit minimal, and facilitate its ultimate replacement with private measures, we should:

(3) Facilitate saving for old age. The $2,000 ceiling on contributions to Individual Retirement Accounts is far too low given both the inflation which has occurred since that ceiling was created and our need to save more. It should be increased to $5,000, and indexed thereafter for inflation. To maximize the incentive to save and invest for old age, and to let the money accumulate undisturbed, taxes on IRAs should be abolished, except for a penalty for early withdrawal. Moreover, there needs to be more flexibility for withdrawing the money before retirement and fewer penalities for doing so. Ultimately, the goal should be to institute a system whereby the tax code is not used to pressure any particular tradeoff between saving and consumption.

(4) Reform employee pensions. The question of how businesses and employees should handle pensions should be taken out of the realm of regulation and be governed exclusively by the law of contract. Workers urgently need the freedom to make contracts with their employers whereby they can put together the most mutually advantageous terms. With company consent, it should be possible for pensions to be made portable and vested in the worker.

This approach makes no promises of either taxpayer- funded security or affluent retirement through forced investment in stocks, as do the “reform” plans being advanced. But in dismantling Social Security it would avert a probable fiscal and economic disaster and political crisis as the baby boomers retire; relieve Americans of a huge tax burden; avoid a dangerous government presence in the stock market; reverse the trend toward totalitarian paternalism in

Friday, August 17, 2007

Students: Questions, Comments, and Suggestions

Parents: Questions, Comments, and Suggestions

Social Security Cartoon

Thursday, August 16, 2007

Open House Bonus

Please leave a comment for your student to receive a few bonus points.

Tell me the student's name and what period/block I have them.

Hopefully you will find my site useful and informative.

Mayfield

Wednesday, August 15, 2007

The Dow Hits a 4 Month Low: 12,861.47

Recommended Reading: Roads, Bridges, and Socialist Capital

Thus, we then see the sets of incentives of which both Edmonds and Sowell spoke now making more sense. The owners of a privately owned bridge would have the incentive to keep it in repair because the bridge is bringing them income; loss of that piece of capital is the loss of the income that flows from it. Therefore, we see the economic calculation for privately owned capital at work.

Governments, on the other hand, operate according to a very different economic calculus. Since the bridge does not bring an income to the state, at least directly, it is much easier for politicians to want to spend on those things that provide fame, glory, and votes. In fact, in a perverse way, the bridge collapse in Minnesota provides a benefit to politicians, since they now have an excuse to confiscate even more taxes from individuals, thus expanding the power of the state."

read the entire article

Tuesday, August 14, 2007

Pay Gap between Men and Women

"Women have been graduating from college in larger numbers than men, and that many of those women seem to be gravitating toward major urban areas. In 2005, 53% of women in their 20s working in New York were college graduates, compared with only 38% of men of that age. And many of those women are not marrying right after college, leaving them freer to focus on building careers."

"Women have been graduating from college in larger numbers than men, and that many of those women seem to be gravitating toward major urban areas. In 2005, 53% of women in their 20s working in New York were college graduates, compared with only 38% of men of that age. And many of those women are not marrying right after college, leaving them freer to focus on building careers."from Mark Perry

It appears that college pays

Monday, August 13, 2007

Incentives Matter

In the comments include the following info:

Name

Block/Period

What is the opportunity cost of reading my blog?

Deficit Watch

If trends continue the budget will be balanced in March 2009. I'm guessing not.

from the Skeptical Optimist

Sunday, August 12, 2007

Parents: Questions, Comments, and Suggestions

Please take note of the Class Announcements at the top of the page. I will post test dates and other important class info there.

Students: Questions, Comments, and Suggestions

Please keep the comments appropriate. The comments are moderated, so don't repost 17 times.

How is the Economy Doing? Cartoon Edition

Saturday, August 11, 2007

Friday, August 10, 2007

Active Day for the Federal Reserve

"The Federal Reserve is providing liquidity to facilitate the orderly functioning of financial markets," the Fed said in a statement.

full storyOPEN MARKET OPERATIONS:

The buying and selling of U.S. Treasury securities by the Federal Reserve System (the Fed) as a means of a controlling the money supply. An increase in the money supply is achieved when the Fed buys securities. A decrease in the money supply is achieved when the Fed sells securities. The Federal Open Market Committee is the specific component of the Federal Reserve System that is charged with open market operations. Open market operations are the most important of the three monetary policy tools that the Fed can use, in principle, to control the money supply. The other two are the discount rate and reserve requirements.LIQUIDITY:

read more about open market operations here

The ease with which an asset can be converted to money with little or no loss of value. Money, currency and checkable deposits, is the benchmark for liquidity. Money is what other assets are converted to. Different assets have differing degrees of liquidity. Financial assets have differing degrees of liquidity but tend to be more liquid that physical assets. Liquidity is important to components of the three monetary aggregates tracked and reported by the Federal Reserve System--M1, M2, and M3.

read more about liquidity here

Thursday, August 9, 2007

Dow Jones Drops 387 Points

Wednesday, August 8, 2007

Recommended Reading: I, Pencil

It is worth reading if you get a chance. Many of the principles from the "Economics In One Page" handout are illustrated in the short essay.

from the Skeptical Optimist

from the Skeptical OptimistTuesday, August 7, 2007

Parents: Questions, Comments, and Suggestions

I plan to use this site to make you aware of upcoming tests.

Feel free to make comments.

Students: Questions, Comments, and Suggestions

Please keep the comments appropriate. The comments are moderated, so don't repost 17 times.

Federal Funds Rate Remains 5.25%

Monday, August 6, 2007

Saturday, August 4, 2007

Thursday, August 2, 2007

Recommended Reading: Walter Williams' Column

Economic Thinking

"Historical costs, sometimes called sunk costs, are irrelevant to decision-making because they are costs that have already been incurred....

The only costs relevant to decision-making are what economists call marginal or incremental cost; that's the change in costs as a result of doing something. That cost should be compared to the expected benefit..."

read the entire column

Wednesday, August 1, 2007

1,028 Economists Oppose Protectionist Policies

PETITION

Concerning Protectionist Policies Against ChinaWe, the undersigned, have serious concerns about the recent protectionist sentiments coming from Congress, especially with regards to China.

By the end of this year, China will most likely be the United States' second largest trading partner. Over the past six years, total trade between the two countries has soared, growing from $116 billion in 2000 to almost $343 billion in 2006. That's an average growth rate of almost 20% a year.

This marvelous growth has led to more affordable goods, higher productivity, strong job growth, and a higher standard of living for both countries. These economic benefits were made possible in large part because both China and the United States embraced freer trade.

As economists, we understand the vital and beneficial role that free trade plays in the world economy. Conversely, we believe that barriers to free trade destroy wealth and benefit no one in the long run. Because of these fundamental economic principles, we sign this letter to advise Congress against imposing retaliatory trade measures against China.

There is no foundation in economics that supports punitive tariffs. China currently supplies American consumers with inexpensive goods and low-interest rate loans. Retaliatory tariffs on China are tantamount to taxing ourselves as a punishment. Worse, such a move will likely encourage China to impose its own tariffs, increasing the possibility of a futile and harmful trade war. American consumers and businesses would pay the price for this senseless war through higher prices, worse jobs, and reduced economic growth.

We urge Congress to discard any plans for increased protectionism, and instead urge lawmakers to work towards fostering stronger global economic ties through free trade.

List of economists