The Federal Reserve slashed two key interest rates by three-quarters of a percentage point Tuesday following an unscheduled meeting, citing continued concerns about a weakening economy and turmoil in the financial markets.

The Fed lowered its federal funds rate, which impacts how much consumers pay on credit card debt, home equity lines of credit and auto loans, from 4.25 percent to 3.5 percent. The Fed also lowered its discount rate, which is what it costs banks to borrow directly from the central bank, by three-quarters of a point, to 4 percent.

This was the biggest rate cut by the Fed since October 1984...

Still, others think the Fed needs to proceed cautiously, especially since it's fair to argue that aggressive rate cuts during 2001 may be the reason why banks are in the subprime mortgage mess they are in now.

To that end, William Poole, president of the Federal Reserve Bank of St. Louis, voted against a rate cut. According to the Fed's statement, Poole did "not believe that current conditions justified policy action before the regularly scheduled meeting next week."

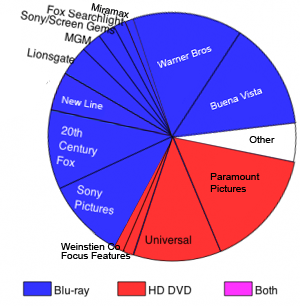

great chart from the WSJ

great chart from the WSJ