Economics, as a branch of the more general theory of human action, deals with all human action, i.e., with mans purposive aiming at the attainment of ends chosen, whatever these ends may be.--Ludwig von Mises

Thursday, September 30, 2010

The Stand Up Economist

Restaurant Index August 2010

Restaurant operators reported a net decline in same-store sales for the fifth consecutive month in August ... Restaurant operators also continued to report a net decline in customer traffic levels in August..

source

Wednesday, September 29, 2010

End the Drug War: Save $88 Billion

Sate and federal governments in the United States face massive looming fiscal deficits. One policy change that can reduce deficits is ending the drug war. Legalization means reduced expenditure on enforcement and an increase in tax revenue from legalized sales. This report estimates that legalizing drugs would save roughly $41.3 billion per year in government expenditure on enforcement of prohibition. Of these savings, $25.7 billion would accrue to state and local governments, while $15.6 billion would accrue to the federal government.

Approximately $8.7 billion of the savings would result from legalization of marijuana and $32.6 billion from legalization of other drugs.The report also estimates that drug legalization would yield tax revenue of $46.7 billion annually, assuming legal drugs were taxed at rates comparable to those on alcohol and tobacco. Approximately $8.7 billion of this revenue would result from legalization of marijuana and $38.0 billion from legalization of other drugs.

Jeffrey Miron and NYU graduate student Katherine Waldock estimate that ending the war on drugs would save more than $40 billion a year in enforcement costs (about $16 billion federal, $26 billion state and local) while allowing collection of some $47 billion a year in new tax revenue. Although marijuana is by far the most popular illegal drug and accounts for half of all drug arrests, Miron and Waldock calculate that legalizing it would yield just one-fifth of the $88 billion in total savings and revenue...

Miron and Waldock's paper considers only the budgetary impact of repealing drug prohibition. Many other costs of the war on drugs—including the basic loss of control over one's body and brain, the erosion of Fourth Amendment rights and other civil liberties, interference with religious rituals and medical practice, black market violence, official corruption, lives disrupted by arrest and incarceration, terrorism subsidized by drug profits, and deaths and injuries from tainted or unexpectedly strong drugs—are not so easily expressed in dollars.

Tuesday, September 28, 2010

Monday, September 27, 2010

Ambrose Evans-Pritchard on Bernanke

“I apologise to readers around the world for having defended the emergency stimulus policies of the US Federal Reserve, and for arguing like an imbecile naif that the Fed would not succumb to drug addiction, political abuse, and mad intoxicated debauchery, once it began taking its first shots of quantitative easing.

“Ben Bernanke has not only refused to abandon his idee fixe of an “inflation target”, a key cause of the global central banking catastrophe of the last twenty years (because it can and did allow asset booms to run amok, and let credit levels reach dangerous extremes).

“Worse still, he seems determined to print trillions of emergency stimulus without commensurate emergency justification to test his Princeton theories, which by the way are as old as the hills. Keynes ridiculed the “tyranny of the general price level” in the early 1930s, and quite rightly so. Bernanke is reviving a doctrine that was already shown to be bunk eighty years ago.

“So all those hillsmen in Idaho, with their Colt 45s and boxes of Krugerrands, who sent furious emails to the Telegraph accusing me of defending a hyperinflating establishment cabal, were right all along. The Fed is indeed out of control.”

Sunday, September 26, 2010

Reagan's Tax Increases

Tax Cuts | Billions of Dollars |

Economic Recovery Tax Act of 1981 | -264.4 |

Interest and Dividends Tax Compliance Act of 1983 | -1.8 |

Federal Employees’ Retirement System Act of 1986 | -0.2 |

Tax Reform Act of 1986 | -8.9 |

Total cumulative tax cuts | -275.3 |

Tax Increases | Billions of Dollars |

Tax Equity and Fiscal Responsibility Act of 1982 | +57.3 |

Highway Revenue Act of 1982 | +4.9 |

Social Security Amendments of 1983 | +24.6 |

Railroad Retirement Revenue Act of 1983 | +1.2 |

Deficit Reduction Act of 1984 | +25.4 |

Consolidated Omnibus Budget Reconciliation Act of 1985 | +2.9 |

Omnibus Budget Reconciliation Act of 1985 | +2.4 |

Superfund Amendments and Reauthorization Act of 1986 | +0.6 |

Continuing Resolution for 1987 | +2.8 |

Omnibus Budget Reconciliation Act of 1987 | +8.6 |

Continuing Resolution for 1988 | +2.0 |

Total cumulative tax increases | +132.7 |

Mises on Government Job Creation

Ludwig von Mises--Planning for Chaos

Thursday, September 23, 2010

Cartoon: Inflation

Wednesday, September 22, 2010

Cartoon: Obama and the Economy

Tuesday, September 21, 2010

P.R.I.N.T. Money

Recession 12/07 to 06/09

It's official: The 2007-2009 recession, which wiped out 7.3 million jobs, cut 4.1% from economic output and cost Americans 21% of their net worth, marked the longest slump since the Great Depression...

The NBER acknowledged in its announcement that the end of the recession doesn't signify a healthy economy, only that the period of declining economic activity, measured by indicators such as economic output and incomes, has come to an end...

Meanwhile, real gross domestic product has made up only 2.9 percentage points of the 4.1% lost during the recession, while household net worth has recovered only 4 percentage points of the 21% lost...

Monday, September 20, 2010

NBER: Recession Ended June 2009

The National Bureau of Economic Research, the arbiter of the start and end dates of a recession, determined that the recession that began in December 2007 ended in June 2009.

The business-cycle dating committee met by phone on Sunday and came to the determination. “In determining that a trough occurred in June 2009, the committee did not conclude that economic conditions since that month have been favorable or that the economy has returned to operating at normal capacity. Rather, the committee determined only that the recession ended and a recovery began in that month,” the committee said in a statement. The 2007-2009 recession is the longest in the post-WWII period. (Read related article.)

The decision by the NBER means that any future downturn in the economy would be considered a new recession and not a continuation of the recession that began in 2007.

Sunday, September 19, 2010

Cartoon: Investment Banking

Cartoon: Too Many Choices?

Cartoon: IRS and the Pentagon

Friday, September 17, 2010

Great Leap Forward: 45 Million Dead

Mr Dikötter, who has been studying Chinese rural history from 1958 to 1962, when the nation was facing a famine, compared the systematic torture, brutality, starvation and killing of Chinese peasants to the Second World War in its magnitude. At least 45 million people were worked, starved or beaten to death in China over these four years; the worldwide death toll of the Second World War was 55 million.

Mr Dikötter is the only author to have delved into the Chinese archives since they were reopened four years ago. He argued that this devastating period of history – which has until now remained hidden – has international resonance. "It ranks alongside the gulags and the Holocaust as one of the three greatest events of the 20th century.... It was like [the Cambodian communist dictator] Pol Pot's genocide multiplied 20 times over," he said.

Between 1958 and 1962, a war raged between the peasants and the state; it was a period when a third of all homes in China were destroyed to produce fertiliser and when the nation descended into famine and starvation, Mr Dikötter said.

His book, Mao's Great Famine; The Story of China's Most Devastating Catastrophe, reveals that while this is a part of history that has been "quite forgotten" in the official memory of the People's Republic of China, there was a "staggering degree of violence" that was, remarkably, carefully catalogued in Public Security Bureau reports, which featured among the provincial archives he studied. In them, he found that the members of the rural farming communities were seen by the Party merely as "digits", or a faceless workforce. For those who committed any acts of disobedience, however minor, the punishments were huge.

State retribution for tiny thefts, such as stealing a potato, even by a child, would include being tied up and thrown into a pond; parents were forced to bury their children alive or were doused in excrement and urine, others were set alight, or had a nose or ear cut off. One record shows how a man was branded with hot metal. People were forced to work naked in the middle of winter; 80 per cent of all the villagers in one region of a quarter of a million Chinese were banned from the official canteen because they were too old or ill to be effective workers, so were deliberately starved to death.

Cost of Living August 2010

The COLA adjustment is based on the increase from Q3 of one year from the highest previous Q3 average. So a 2.3% increase was announced in 2007 for 2008, and a 5.8% increase was announced in 2008 for 2009.

In Q3 2009, CPI-W was lower than in Q3 2008, so there was no change in benefits for 2010.

For 2011, the calculation is not based on Q3 2010 over Q3 2009, but based on the average CPI-W for Q3 2010 over the highest preceding Q3 average - the 215.495 in Q3 2008. This means CPI-W in Q3 2010 has to average above 215.495 for there to be an increase in Social Security benefits in 2011.

source

Inflation August 2010

This graph shows three measure of inflation, Core CPI, Median CPI (from the Cleveland Fed), and 16% trimmed CPI (also from Cleveland Fed).

They all show that inflation has been falling, and that measured inflation is up less than 1% year-over-year. Core CPI was flat, and median CPI and the 16% trimmed mean CPI were up 0.1% in August.

source

Principles for Economic Revival

The most fundamental starting point is that people respond to incentives and disincentives. Tax rates are a great example because the data are so clear and the results so powerful. A wealth of evidence shows that high tax rates reduce work effort, retard investment and lower productivity growth. Raise taxes, and living standards stagnate...

Thursday, September 16, 2010

Philly Fed Index

This index turned down sharply in June and July and was negative in August and September (indicating contraction).

source

Cartoon: Castro, Obama, and Socialism

Cartoon: Retirement

Cartoon: Stimulus

Cartoon: The Economy

Wednesday, September 15, 2010

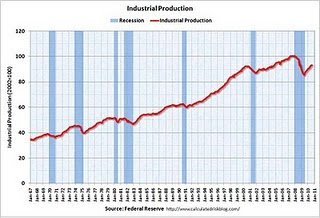

Industrial Production and Capacity Utilization

This graph shows Capacity Utilization. This series is up 9.6% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 74.7% is still far below normal - and well below the the pre-recession levels of 81.2% in November 2007.

source

Tuesday, September 14, 2010

Retail Sales August 2010

Retail sales rose 0.4 percent in August after a gain of 0.3 percent in July, the latest figure topping expectations for a 0.3 percent increase. Excluding automobile sales, the main factor in July’s overall gain, sales were up 0.6 percent in August, also better than expected.

Gasoline station sales rose 1.9 percent, the biggest increase for any sector, and excluding both autos and gasoline, sales rose 0.5 percent in August after a decline of 0.1 percent in July. Food and beverage sales rose 1.3 percent, clothing sales rose 1.2 percent, and sporting goods were up 0.9 percent while auto sales and electronics store sales fell 1.1 percent.

Retail Sales August 2010

On a monthly basis, retail sales increased 0.4% from July to August (seasonally adjusted, after revisions), and sales were up 3.6% from August 2009. Retail sales increased 0.6% ex-autos.

On a monthly basis, retail sales increased 0.4% from July to August (seasonally adjusted, after revisions), and sales were up 3.6% from August 2009. Retail sales increased 0.6% ex-autos.source