Economics, as a branch of the more general theory of human action, deals with all human action, i.e., with mans purposive aiming at the attainment of ends chosen, whatever these ends may be.--Ludwig von Mises

Sunday, October 31, 2010

Bernanke, the Fed, and the Dollar

All eyes, meanwhile, are on US Fed Chairman Ben Bernanke, who is widely expected to announce his next round of systematic dollar debasement a few days from now – a strategy otherwise known as “quantitative easing,” or “QE” for short. Trepid investors, unsure of what the value of the world’s reserve currency will be a week from now, sit on the sidelines, awaiting their cue from the man with the magic chopper...

Of course, the battle between central bank-created fiat money and its arch nemesis, gold, is not a new tale. Money meddlers have been tussling with the precious metal since the coin clipping days of the Romans. You’d think the bozos would have learned their lesson by now. But, as Bill likes to say, what one generation learns, the next is quick to forget...

“What’s happened since 1971,” the article wonders aloud, “when President Nixon formally broke the link between the dollar and gold? Higher average unemployment, slower growth, greater instability and a decline in the economy’s resilience.”

And that’s not all.

“For the period 1971 through 2009, unemployment averaged 6.2%, a full 1.5 percentage points above the 1947-67 average, and real growth rates averaged less than 3%. We have since experienced the three worst recessions since the end of World War II, with the unemployment rate averaging 8.5% in 1975, 9.7% in 1982, and above 9.5% for the past 14 months. During these 39 years in which the Fed was free to manipulate the value of the dollar, the consumer-price index rose, on average, 4.4% a year. That means that a dollar today buys only about one-sixth of the consumer goods it purchased in 1971.”...

So, what does a central banker do when one round of money printing doesn’t bring about the desired effect? Does he revisit first principles and reexamine the evidence? Or does he double down on his bets, defending his actions with increasingly zealous evangelism? Bernanke gives the world his answer on Wednesday.

"Gold is Money"

Changes in the “gold price” represent changes in the currency being compared to gold, while gold itself is essentially inert.

This is why gold was used as a monetary foundation for literally thousands of years. You want money to be stable in value. The simplest way to accomplish this was to link it to gold. Today, we summarize this quality by saying that “gold is money.”

From this we can see immediately, that if gold doesn’t change in value – at least not very much – then it can never be in a “bubble.” There may be a time when many people are desperate to trade their paper money for gold, but that is because their paper money is collapsing in value. It has nothing to do with gold.

Let’s take a look at some of the great gold bull markets of the last hundred years:

- From 1920 to 1923, the price of gold in German marks rose from 160/oz. to 48 trillion/oz.

- From 1945 to 1950, the price of gold in Japanese yen rose from 140/oz. to 12,600/oz.

- From 1948 to 1967, the price of gold in Brazilian cruzeiros went from 648/oz. to 94,500/oz.

- From 1970 to 1980, the price of gold in US dollars went from 35/oz. to 850/oz.

- From 1982 to 1990, the price of gold in Mexican pesos went from 8,000/oz. to 1,025,000/oz.

- From 1989 to 2000, the price of gold in Russian rubles went from 1,600/oz. to 8,120,000/oz.

Each of these situations was an episode of paper currency depreciation. Today is no different. The rising dollar/euro/yen gold price is simply a reflection of the Keynesian “easy money” policies popular around the world today...

The “price of gold” may reach five thousand, ten thousand, a hundred thousand, a million, or a billion dollars per ounce. The gold bubble-callers will be frothing at the mouth, until they finally have the realization that there was never a bubble in gold, but only a crash in paper money.

Gold is money. Always has been. Probably always will be. This time it’s different? I don’t think so.

Saturday, October 30, 2010

Midterm Elections

Economic Recovery

Restaurant Performance Index

Growth and Unemployment

| Real GDP Growth | Unemployment Rate in One Year |

|---|---|

| 0.0% | 11.0% |

| 1.0% | 10.5% |

| 2.0% | 10.0% |

| 3.0% | 9.6% |

| 4.0% | 9.1% |

| 5.0% | 8.7% |

I expected a sluggish recovery in 2010, so I thought the unemployment rate would stay elevated throughout 2010 (that was correct)...

In general, the U.S. economy needs to grow faster than a 3% real rate to reduce the unemployment - and there is no evidence yet of a pickup in growth.

source

Real GDP Still Below Pre-Recession Levels

Real GDP is 0.8% below the pre-recession peak, so real GDP would have to grow at a 3.1% annualized pace in Q4 for the economy to be back at the pre-recession peak.

Real GDP is 0.8% below the pre-recession peak, so real GDP would have to grow at a 3.1% annualized pace in Q4 for the economy to be back at the pre-recession peak.That is unlikely since growth in personal consumption expenditures (PCE) will probably slow in Q4, and the contribution from the change in private inventories will likely be much smaller or negative in Q4.

Probably the earliest the economy will be back to pre-recession levels for GDP would be in Q1 2011 and that requires a 1.6% annualized growth rate over the next two quarters. It might even take until Q2 2011 (my current forecast).

Real personal income less transfer payments is still 5.5% below the pre-recession peak. Much of the growth in PCE over the last year has come from transfer payments - this includes people taking Social Security early, extended unemployment benefits, and other assistance programs - and it will be some time before this indicator returns to pre-recession levels.

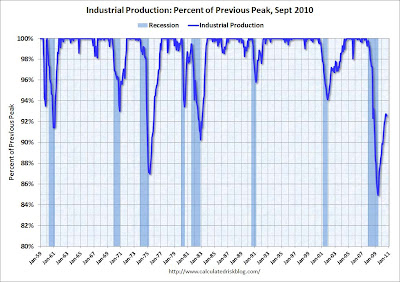

Industrial production has been one of the stronger performing sectors because of inventory restocking and some growth in exports. However industrial production is still 7.5% below the pre-recession peak, and it appears export growth has slowed, and the inventory cycle is almost over.

Payroll employment is still 5.6% below the pre-recession peak. And with below trend GDP growth, payroll employment growth will likely remain sluggish.

source

GDP 3rd Quarter 2010: 2.0%

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the median growth rate of 3.05%. The current recovery is very weak - the 2nd half slowdown continues.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the median growth rate of 3.05%. The current recovery is very weak - the 2nd half slowdown continues.source

Friday, October 29, 2010

Cartoon: Cost of Living Adjustment

Thursday, October 28, 2010

For the year 2007, we had a current account deficit or "trade deficit" of about $700 billion, and a capital account surplus, or capital inflow of approximately the same amount, of about $700 billion (statistical discrepancies account each year for any differences). Americans in 2007 purchased $2.35 trillion of goods and services from foreigners, which was more than the $1.65 trillion foreigners spent on U.S. goods and services in that year. On the other hand, foreigners invested more than $2 trillion in U.S. assets in 2007 (stocks, bonds, real estate, Treasuries, direct investment), which was more than the approximately $1.4 trillion invested by Americans overseas in foreign assets, resulting in a net capital inflow of about $700 billion into the U.S. that year.

For the year 2007, we had a current account deficit or "trade deficit" of about $700 billion, and a capital account surplus, or capital inflow of approximately the same amount, of about $700 billion (statistical discrepancies account each year for any differences). Americans in 2007 purchased $2.35 trillion of goods and services from foreigners, which was more than the $1.65 trillion foreigners spent on U.S. goods and services in that year. On the other hand, foreigners invested more than $2 trillion in U.S. assets in 2007 (stocks, bonds, real estate, Treasuries, direct investment), which was more than the approximately $1.4 trillion invested by Americans overseas in foreign assets, resulting in a net capital inflow of about $700 billion into the U.S. that year. In other words, the $700 billion "trade deficit" in 2007 was exactly offset by a $700 billion capital account surplus, or capital inflow, and the overall BOP = -$700 billion + $700 billion = 0. What are the lessons from this?

1. There are no BOP deficits once we account for all international transactions, both for: a) goods and services, and b) financial transactions. For all of the one-sided coverage in the press about the "trade deficit," you would almost never even know that there is an offsetting "capital surplus" or "capital inflow." It's important for the general public to understand that trade deficits are offset by capital inflows on almost a 1:1 basis, resulting in a "balance of payments" for international transactions. When the public constantly hears about "trade deficits" without any understanding of the offsetting surplus, that economic ignorance allows politicians and special interest groups to exploit the general public, by advancing and promoting protectionist trade policies aimed to reduce the "trade deficit," or by refusing to approve trade agreements between Colombia, Panama and Korea, etc.

2. The "trade deficit" generates so much negative coverage, that the significant advantages of capital inflows from abroad get frequently overlooked. Since 1980, the U.S. has attracted almost $8 trillion of foreign investment, which has provided much-needed equity capital that has allowed U.S. companies to start or expand, has provided much-needed debt capital that has also funded the expansion of American companies, along with providing debt capital for U.S. consumers in the form of mortgages, student loans, and car loans. Some of the $8 trillion of investment includes billions of dollars of Foreign Direct Investment, which has funded thousands of new projects in the U.S. (Toyota factories for example) and created hundreds of thousands of jobs.

source

Wednesday, October 27, 2010

Monday, October 25, 2010

Cartoon: Universal Protest Sign

Cartoon: Slow Economy

Sunday, October 24, 2010

College Degree Does Not Necessarily Lead to a Good Job

Over 317,000 waiters and waitresses have college degrees (over 8,000 of them have doctoral or professional degrees), along with over 80,000 bartenders, and over 18,000 parking lot attendants. All told, some 17,000,000 Americans with college degrees are doing jobs that the BLS says require less than the skill levels associated with a bachelor’s degree.

Putting issues of student abilities aside, the growing disconnect between labor market realities and the propaganda of higher-education apologists is causing more and more people to graduate and take menial jobs or no job at all. This is even true at the doctoral and professional level—there are 5,057 janitors in the U.S. with Ph.D.’s, other doctorates, or professional degrees.

For hundreds of thousands of Americans, spending four years and untold amounts of money (and debt?) gets you a job as a waiter, parking lot attendant, or janitor. Yet everyone from Barack Obama to Bill Gates keep pushing a college education as the way to secure one's economic future. That is a view that should be heavily qualified.

source

FOMC and QE2

| Person, Position | FOMC Membership | QE2 Position |

|---|---|---|

| Ben S. Bernanke, Board of Governors, Chairman | FOMC | Yes |

| Janet L. Yellen, Fed Vice Chairman, Board of Governors | FOMC | Yes |

| William C. Dudley, New York, FOMC Vice Chairman | FOMC | Yes |

| James Bullard, St. Louis | FOMC | Yes |

| Elizabeth A. Duke, Board of Governors | FOMC | Yes (probably) |

| Thomas M. Hoenig, Kansas City | FOMC | No |

| Sandra Pianalto, Cleveland | FOMC | Yes |

| Sarah Bloom Raskin, Board of Governors | FOMC | Yes (probably) |

| Eric S. Rosengren, Boston | FOMC | Yes |

| Daniel K. Tarullo, Board of Governors | FOMC | Yes (probably) |

| Kevin M. Warsh, Board of Governors | FOMC | Undecided |

| Charles L. Evans, Chicago | Alternate | Yes |

| Richard W. Fisher, Dallas | Alternate | Undecided |

| Narayana Kocherlakota, Minneapolis | Alternate | Undecided |

| Charles I. Plosser, Philadelphia | Alternate | No |

| Christine M. Cumming, First Vice President, New York | Alternate | Unknown |

source

My thoughts: For those keeping score, Thomas M. Hoenig, Kansas City and Charles I. Plosser, Philadelphia are the only ones who have a clue. They believe inflation is a bad thing and that the Fed should not actively promote inflation.

Thursday, October 21, 2010

Cartoon: Inflation

According to Bloomberg, Philadelphia president Charles Plosser said unemployment is a “terrible problem,” but he flat out prefers it “to monetary-policy solutions at this point,” that increase inflation. Even more plainly, he said, “I am less inclined to want to follow a policy that is highly concentrated on raising inflation and raising inflation expectations.”

Nonetheless, QE2 will likely proceed as planned, and many already hard hit by recession will find their remaining dollars even less valuable.

Wednesday, October 20, 2010

Mogambo Guru on Alan Greenspan

The guy responsible for all of this suffering and misery is, of course, Alan Greenspan, the lunatic former chairman of the Federal Reserve who personally created all the excess money for all the years that produced the bubbles in stocks, in bonds, in houses, in derivatives and in the cancerous size of a gargantuan deficit-spending government.

And since Greenspan is an old man now, if we are going to wreak vengeance upon him for the inflationary bust that is unfolding all around us, so that all future chairmen of the Federal Reserve will remember with a shudder the fate of those who foster crazy monetary booms and allow the money supply to rise to produce inflation in prices, we had better do it soon.

If not, we will be whacking on a dead guy which loses something in the “lesson” department when video footage could show Greenspan begging for his life and saying how he is sorry for having created so much money, that created so much consumption, that created so much new debt, that created so much new deficit-spending government, which produced so much more government, which created so many new people now dependent upon government, which created the “need” for more taxes and more deficit-spending, which was accommodated by the creation of more money by the Federal Reserve and the demonic Alan Greenspan, turning government deficit-spending and Federal Reserve over-creation of money into a hellish, poisonous brew that will combine, like a tornado inside a hurricane inside a tsunami during an earthquake caused by getting smashed with a huge killer-asteroid, to produce horrific inflation in prices.

Marc Faber on Inflation

He suggested that, like the king in a fairytale, Mr. Obama should dress up at night like a pauper and go out and talk to business people. According to Marcus, King Obama would then realize how unpopular he is and how destructive his economic policies have been for small businesses. He also suggested that the academics at the Fed and in the administration should, for once in their lives, go out and work, instead of sitting in big glass office towers and having no clue about what is ailing the economy.

Marcus then emphasized that none of the small businessmen he talked to had any plans to hire staff, because they felt there was far too much uncertainty about what kinds of regulations and laws Congress and the administration would come up with next. All his business friends and customers had told him that Obamacare would be a complete disaster for them. (It imposes on small businesses enormous non-medical tax compliance. It will require them to mail IRS 1099 tax forms to every vendor from whom they make purchases of more than US$600 in a year, with duplicate forms going to the IRS. Obamacare will also fund 16,000 new IRS agents…) Asked what he would suggest as a solution, Marcus, who looks much younger than his age and is still very alert, responded that the US would be greatly helped if Congress went on a holiday for two years, as this would prevent the government from doing even more economic damage.

read the entire essayMogambo Guru on Inflation

The Eternal Ugly Truth (EUT) is that 4,500 years of history has conclusively shown that any inflation in prices is Bad News (BN), especially a sustained, years-long inflation, and anything over 3% annual inflation is always Bad, Bad News (BBN). So, 5.9% inflation in prices would be considered, continuing in this vein, Really Bad, Bad News (RBBN).

If you are NOT likewise screaming in horror and surreptitiously checking to see if you have, likewise, peed in your pants as you suspect, then I assume you are either drunk, stoned, distracted, stupid, or have remarkable bladder control, or else you know very little about the Austrian school of economics – the only true theory of economics, and which can be found, free, at mises.org – and thusly I know that you have no interest in using Mogambo’s Iron Laws Of Economics (MILOE) to intelligently invest your money in gold, silver and oil when the foul Federal Reserve is creating trillions and trillions of new dollars – Every Freaking Year (EFY)! – so that the corrupt, bankrupted federal government can borrow it and spend it, also EFY! EFY!!!!

Tuesday, October 19, 2010

Monday, October 18, 2010

Trade Deficit: August 2010

Cartoon: Mortgage Industry

Sunday, October 17, 2010

Tailgating: Auburn v. Arkansas

Peter Schiff on Gold and the Dow

Schiff: I like to quote it in terms of the Dow, because you just don’t know how much inflation there’s going to be. So my target is for a relationship that’s close to 1-to-1 between gold and the Dow. I’ve had that target since the Dow was worth more than 40 ounces of gold. Right now it’s worth 8 or 8-1/2 ounces, so I think it’ll get down to 1-to-1. But you don’t know where that’s going to be. It could be Dow 5,000-gold $5,000, it could be Dow 10,000-gold $10,000; it could be Dow 20,000-gold $20,000; it could be Dow 2,000-gold $2,000. I don’t know where it’s going to be, but I think it’s going to happen.

Ludwig: Why 1-to-1?

Schiff: That was the low of the bear market of the 1930 and that was the low of the bear market of the 1970s. The Dow was worth one ounce of gold in 1932 and the Dow was worth one ounce of gold in 1980.

read the interview

The Free Market: A Litmus Test

Very few people believe in the free market. This is true of virtually all academic economists. The proof that they do not believe in the free market is that they oppose the creation of a full gold coin standard. They say they believe in the free market in many areas of life, but they do not believe in the free market with respect to the monetary system. Yet, above all other areas of the economy that ought to be governed by the free market, the money system should be. Why is this? Because money is the central institution in a market economy. Control over money is the central form of economic control.

We have seen this with a vengeance with the passing of the banking reform bill of 2010. The great winner in the reform is the Federal Reserve System. It receives the authority over the banking system. It is not limited merely to control over the money supply; it now possesses the authority of direct regulation and intervention.

The central banks of the world have now become allocators of capital. They are making the decisions as to who gets what and on what terms. Central planning over money increasingly has become central planning over the entire economy. This is not a mistake. This is consistent with the original logic of central banking. It means government control over the money supply.

When you hear a self-designated free market economist defend the idea of central banking, meaning a government-licensed monopoly over the monetary base, you can be sure that this person does not believe in the free market. He does not believe in the logic of decentralized private property. He believes in central planning, and he sees the central bank as the agency of such planning.

The few academic economists who are willing to accept even a pseudo-gold standard do not believe the government should be out of the money business. They do not believe in the widespread use of gold coins by the general population. They believe in central banks, and they believe in government control over the banking system.

What I recommend is simple: the removal of all government authority possessed by the Federal Reserve System. There would be no further legal connection between the Federal Reserve System and the United States government.

What would the result be? Within a few years, the Federal Reserve System would go bankrupt. This has been the fate of the two previous central banks of the United States. They could not operate in a competitive environment. They could operate only by means of a grant of monopolistic power by the United States government. So, I am not at all worried about the operation of the Federal Reserve System without government supervision. Besides, there is no government supervision of the Federal Reserve System. There is supervision of the government by the Federal Reserve System. Congress does not control the FED: the FED controls Congress. This has been true since 1914, and it is not likely to change...

If we were to abolish the Federal Reserve System, and if the government would then transfer to American voters all of the gold presently said to be in the vaults of the Federal Reserve Bank of New York and Fort Knox, we would see the restoration of liberty. I can think of no other pair of laws that would transfer more authority to the voters the abolition of the Federal Reserve system and transfer of the gold in the form of tenth-ounce coins back to the voters. This is why this essay is hypothetical.

Who are the opponents of such a procedure? First, the Congress of the United States. Second, all the bureaucrats who work for the Federal government. Third, all of the decision-makers of the Federal Reserve System. Fourth, the vast majority of all commercial bankers. Fifth, the entire academic economics profession. This is why we are unlikely to see this pair of laws passed in our generation.

Cartoon: Intellectual Property

Cartoon: The Economy

Friday, October 15, 2010

Gold, Currency Crash, and Debt Collaspe

I believe the life cycle for the central banking fiat currency Ponzi scheme is about over. After the coming dollar and debt collapse, government and hopefully competing private alternatives will eventually require some form of precious metal or commodity backing guarantee in order to restore faith and trust in currencies. As always, private alternatives will buy gold etc. on the open market while governments will likely confiscate and steal what they need to create a new dollar after hyperinflation and currency collapse.

If you trust the gold reserves are in Fort Knox then just buy more gold from time to time on price dips. But, if you believe "it’s not just the beer talkin," then take actions while you still can to secure your gold now before we have a crisis and a repeat of Roosevelt’s confiscation program.

Gerald Celente on the Economy

“People are going to wait for the elections in November. They think they’re going to have some other change that they can believe in. It won’t happen. When the economic winter sets in, then you’re going to start seeing people protesting more and more. This is just the beginning.”

“This country’s gone from the greatest entrepreneurial empire to one that Mussolini would have called fascism, the merger of state and corporate powers.”

Cartoon: Wall Street Graffiti

Thursday, October 14, 2010

Cartoon: Schmoozing

Wednesday, October 13, 2010

Nobel Prize in Economics

Diamond, 70, is an economist at the Massachusetts Institute of Technology, and a specialist in Social Security. Bernie Madoff would have loved to have Diamond on his team, since Diamond completely ignores the Ponzi like aspects of Social Security and tinkers with "fixing" the scam. Going beyond Madoff, Diamond then ignores the coercion involved in SS. He focuses with tunnel-like narrow vision beyond the coercive aspects, and Ponzi like aspects, to pontificate in numerous journal articles and books about how to "save" SS, including recommendations to cut "benefits" and aggressively increase SS taxes...

Mortensen, 71, is an economics professor at Northwestern University in Evanston, Illinois. He studies frictional unemployment. This is like studying half time in a basketball game. Yeah, it exists, but it is a pretty simple concept that doesn't tell you much about the game. Frictional unemployment simply means that if someone loses a job, it takes them time to find another job...

Outside of this obvious point, these guys have no real insights that can help anyone understand the economy and one of them. Diamond, is near the controls of the greatest Ponzi scheme the earth has ever experienced. I would be objecting less if the award was given directly to Madoff.

In summary, the Nobel Committee could have only done a worse job by giving the award jointly to Alan Greenspan and Ben Bernanke.

read the entire article

Tuesday, October 12, 2010

Cartoon: Jobs

The Collaspe of the Dollar?

Much of the content of the latest Fed statement, released on September 21, echoes the central bank's previous post-credit crunch pronouncements: there is still too much slack in the economy, interest rates are still going to be near-zero for an "extended period," and the Fed will continue to use payments from its Treasury purchases to buy yet more Treasuries.

But this recent statement uses a new turn of phrase that should have Americans very upset.

The Fed says that "measures of underlying inflation are currently at levels somewhat below those the Committee judges most consistent, over the longer run, with its mandate." Though the wording treads lightly, it should not be taken lightly. It may signal the final push toward dollar collapse.

The Fed's dual mandate, since an amendment in 1977, has been to promote "price stability" and "maximum employment." While often discussed as if both goals are complementary facets of one mandate, they tend to have been at odds during every recession since the Great Depression.

The problem is that central banks tend to keep interest rates too low for too long (usually to create a feeling of prosperity credited to the government), which then causes major asset bubbles. When the bubbles pop, there is a period of high unemployment during which prices are supposed to fall. Then, the central bank must choose between boosting short-term employment through inflation or defending price stability by allowing assets to return to a reasonable market value. Aside from the early 1980s chairmanship of Paul Volcker, the Fed has always chosen more inflation...

The truth has always been that whatever the question you ask the Fed, the answer is inflation. With prices drifting steadily upward since its establishment in 1913, I dare to ask: has the Fed ever achieved its dual mandate?...

All the salient indicators tell me that the global dollar crisis has entered a new phase. The Fed is getting more aggressive about money printing because it really doesn't have any other politically viable options. I've always said the Fed uses inflation to give appearance of prosperity, but I never expected them to come out and say it! You don't give warning when you're about to rob somebody, because then the victim might take precautions – in this case, buying gold and foreign equities.

read the entire essay

My thoughts: Bernanke will destroy the economy will his printing press. Expect significant inflation, war, and $4,000/oz gold before we have return of true prosperity.

Monday, October 11, 2010

International Trade

source and article

source and article