Economics, as a branch of the more general theory of human action, deals with all human action, i.e., with mans purposive aiming at the attainment of ends chosen, whatever these ends may be.--Ludwig von Mises

Thursday, September 11, 2008

Monday, May 5, 2008

Greg Mankiw on Bailouts

The bottom line: The Bear Stearns bailout may have saved the economy from an episode of financial contagion in the short run, but in the long run it will likely leave us with a more regulated and less vibrant financial system.

source

My Comments: Bear Stearns should have been allowed to fail.

Saturday, April 12, 2008

Essay: Our Financial Bailout Culture

Our Financial Bailout Culture

Ethan PennerLast week's congressional hearings on the Bear Stearns "non-bailout" were fascinating, and frightening. Our leading financial regulators said the Federal Reserve's unprecedented action was necessary to ensure the stability of financial markets, which would have melted down had nature taken its course.

When asked by the committee if opening the Fed borrowing window for investment banks (which was done later) could have saved Bear, New York Fed President Timothy Geithner responded that "We only allow sound institutions to borrow against collateral," thus implying that Bear was not sound. That raises the question of when Bear became unsound, especially in light of the public statements about the company's strength by their CEO only days earlier. If Bear was undercapitalized and overleveraged, shouldn't red flags have gone up long before?...

The unstated premise is that, with better government oversight, we would not be suffering today's bear market and financial chaos. Of course, during the previous outsized boom, no one was calling up his congressman to complain that home values were appreciating too quickly. Meanwhile, they drained that appreciation regularly through refinancings to pay for vacations, new cars and other pleasantries, all of which created the prosperity for which politicians were pleased to take credit...

Had Bear gone bankrupt, these funds would have been compelled to seize and immediately liquidate the collateral into an already highly distressed market, ensuring that its investors (you and me again) would have likely lost much of their stake. Painful? Surely. Eye-opening? Definitely.

Instead of losses spreading through the system, however, the government stepped in. As J.P. Morgan CEO James Dimon said in the hearings, "This would have been far more, in my opinion, expensive to taxpayers had Bear Stearns gone bankrupt and added to the financial crisis we have today. It wouldn't have even been close."

This is clearly true on this deal and in the short run. But as Mr. Bunning implied, isn't it the regulators' job to ensure that we don't end up here ever again? That is the dilemma of "moral hazard." Consequences not suffered from bad decisions lead to lessons not learned, which leads to bigger failings down the road.

And so we have the insidious modern trend to shirk responsibility and blame others for our missteps. This trend, this "victim mentality," is a path toward personal disaster.

Perhaps if the Fed had raised short-term rates more aggressively, the excesses of the bubble could have been avoided. Maybe regulators could have noticed that the criteria for achieving an AAA rating had weakened markedly and inserted themselves early on. Yes, we can hope that the government takes the appropriate steps to ensure that the regulatory system improves as a result of this crisis. However, we citizens also need to accept our share of the responsibility.

Homeowners must learn that there are risks to using a home as an ATM. Investors who borrowed to flip condos must learn the downside of such risk. Individuals who steered money from insured bank deposits into uninsured money market accounts to pick up 1% more yield – like the institutional investors who purchased complex securities with little due diligence – need to know that in an efficient market, extra yield means extra risk. Those who played the derivatives market, focusing more on computer-driven pricing models and less on managing counterparty risk, must pay for that oversight. And, much as it is impolitic to say, people who took money from lenders and signed without considering how they'd repay those loans must also be held accountable.

In one of this year's primary debates, Ron Paul said it is not the president's job to run the economy. I'd add that it is not the government's job either. It is each and every citizen's job to manage our own affairs, make our own decisions, bear the fruits or painful consequences and learn our lessons...

Sunday, April 6, 2008

Saturday, April 5, 2008

Tuesday, March 25, 2008

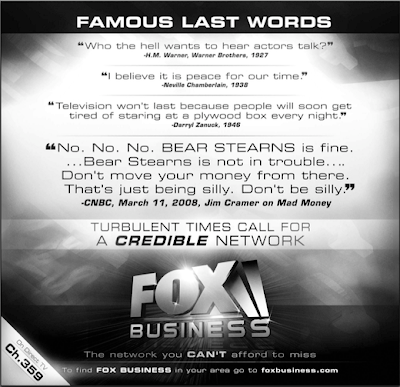

Famous Predictions

Friday, March 21, 2008

Great Analysis on Bear Stearns

There is a meme going around about the death of Bear Stearns (BSC). According to some people (mostly current and ex-employees) the collapse of the fifth largest investment bank in the US is the fault of many people, none of whom happen to be the management of Bear Stearns itself...

The bottom line is that Bear went under because of the poor judgment of their management: their aggressive risk taking, their positions in the mortgage back market, their apparent lack of risk controls, their leverage, lack of liquidity and reserves, and the enemies they made over the years. Sorry to be so blunt, but get real: It was nobody's fault but their own.

from The Big Picture

Wednesday, March 19, 2008

Tuesday, March 18, 2008

Jim Rogers on Bear Stearns

He is next going to be in his helicopter going around the world collecting rent payments from people. Who gave him the authority to do that? To destroy the dollar, to destroy our currency, to essentially destroy the American economy? And, no one ever voted for the man. It is just mind boggling to me.

And then he gives more money to Bears Stearns so these guys can continue to drive around in their Maserati's."

Monday, March 17, 2008

Is Bear Stearns Net Worth Negative?

from Crooked Timber

Sunday, March 16, 2008

Bear Stearns and a Market Meltdown

Treasuries rose after the Federal Reserve cut its discount rate by a quarter-point and traders added to bets the central bank will reduce its target for overnight lending at a meeting tomorrow.from BloombergFutures contracts on the Chicago Board of Trade show a 52 percent chance the Fed will lower its 3 percent target to 2 percent. The odds of a reduction that large were zero last week. The rest of the bets are on a cut to 2.25 percent. Fed Chairman Ben S. Bernanke is increasing efforts to keep losses in credit markets from pushing the U.S. economy into a recession.

The Nikkei Index is down 514.61 @ 11:00 AM Japanese Time

Bear Stearns and the Fed

Teetering on the brink of collapse from a lack of cash, New York-based Bear Stearns got emergency funding yesterday from the Federal Reserve and JPMorgan in the largest government bailout of a U.S. securities firm. The move failed to avert a crisis of confidence among Bear Stearns's customers and shareholders, who drove the stock down a record 47 percent.

After denying earlier this week that access to capital was at risk, Bear Stearns Chief Executive Officer Alan Schwartz said yesterday the company's cash position had ``significantly deteriorated'' in the past 24 hours. The Fed agreed to provide financing through JPMorgan for up to 28 days, the bank said in a statement yesterday...

The Fed is taking on the credit risk from collateral supplied by Bear Stearns, which approached the central bank for emergency funds, Fed staff officials said yesterday.

The Fed, under Chairman Ben S. Bernanke, voted unanimously to lend the funds through JPMorgan because it would be operationally simpler than a direct loan to Bear Stearns, the staff said on condition of anonymity. The regulator invoked a little-used law that allows it to make loans to corporations and private partnerships, which required a Board vote, according to the staffers.

The Fed said it was "monitoring market developments closely and will continue to provide liquidity as necessary to promote the orderly functioning of the financial system.''

from the WSJIn an extraordinary move, the Federal Reserve and J.P. Morgan Chase & Co. stepped in to keep Bear afloat following a severe cash crunch.

The maneuver signaled that the Fed was trying to move aggressively to prevent Bear's crisis from spreading to the broader economy. But it seemed to do little to soothe fears. Bear's shares fell 47% to a nine-year low of $30 in New York Stock Exchange composite trading at 4 p.m. The Bear crisis, coming on the heels of this week's implosion of a publicly held affiliate of Carlyle Group, further rattled Wall Street. The Dow Jones Industrial Average fell nearly 195 points.

The lifeline gives Bear access to cash for an initial period of 28 days. J.P. Morgan will borrow the money from the Fed and relend it to Bear. Exact terms weren't disclosed, but the amount is limited only by how much collateral Bear can provide, Fed officials said.

The Fed, not J.P. Morgan, is bearing the risk of the loan. It is the first time since the Great Depression that the Fed has lent in this fashion to any entity other than a bank...

After initial relief, credit markets have taken a turn for the worse in recent weeks, breeding an every-man-for-himself attitude among Wall Street firms. With each firm intricately intertwined with others in a maze of loans, credit lines, derivatives and swaps, the Fed and Treasury agreed that letting Bear Stearns collapse quickly was a risk not worth taking, because the consequences were simply unknowable.

This could signal a major collapse. Consumer confidence will drop, the dollar will fall, oil will increase, Bernanke and the boys will be exposed as incompetent. This is likely the trigger event for a major recession.

Or I could be wrong.

JP Morgan to buy Bear Stearns

J.P. Morgan Chase agreed to buy Bear Stearns for $2 a share in a stock-swap transaction, people familiar with the matter say. J.P. Morgan will exchange 0.05473 shares of its common stock per one share of Bear Stearns stock. Both boards have approved the transaction.

Indeed, the Fed is taking the extraordinary step of providing special financing in connection with this transaction. The Fed has agreed to fund up to $30 billion of Bear Stearns' less liquid assets.

The deal values Bear Stearns at just $236 million, based on the number of Bear shares outstanding as of Feb. 16. At the end of Friday, Bear's stock-market value was about $3.54 billion.