Real GDP is 0.8% below the pre-recession peak, so real GDP would have to grow at a 3.1% annualized pace in Q4 for the economy to be back at the pre-recession peak.

That is unlikely since growth in personal consumption expenditures (PCE) will probably slow in Q4, and the contribution from the change in private inventories will likely be much smaller or negative in Q4.

Probably the earliest the economy will be back to pre-recession levels for GDP would be in Q1 2011 and that requires a 1.6% annualized growth rate over the next two quarters. It might even take until Q2 2011 (my current forecast).

Real personal income less transfer payments is still 5.5% below the pre-recession peak. Much of the growth in PCE over the last year has come from transfer payments - this includes people taking Social Security early, extended unemployment benefits, and other assistance programs - and it will be some time before this indicator returns to pre-recession levels.

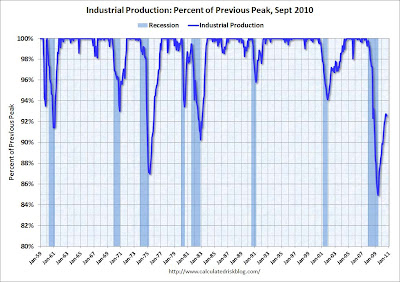

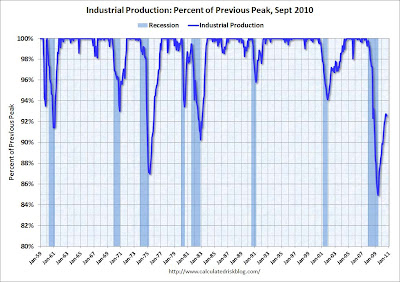

Industrial production has been one of the stronger performing sectors because of inventory restocking and some growth in exports. However industrial production is still 7.5% below the pre-recession peak, and it appears export growth has slowed, and the inventory cycle is almost over.

Payroll employment is still 5.6% below the pre-recession peak. And with below trend GDP growth, payroll employment growth will likely remain sluggish.

source

real personal income less transfer payments is still 3.4% below the previous peak.

real personal income less transfer payments is still 3.4% below the previous peak. It appears that GDP bottomed in Q2 2009 and GDI in Q3 2009. Real GDP finally reached the pre-recession peak in Q4 2010, but real GDI is still slightly below the previous peak.

It appears that GDP bottomed in Q2 2009 and GDI in Q3 2009. Real GDP finally reached the pre-recession peak in Q4 2010, but real GDI is still slightly below the previous peak.