read the entire essayPeople often ask me, "What do you think the government should do instead of QE inflation?" My stock answer is that the government should not try to fight the depression with government spending and cheap credit. Trying to stop the market from correcting the errors of the past only delays the consequences and makes them much worse.

Government should balance its budget. There should be no new credit expansion by the Federal Reserve. Most importantly, government should not meddle in markets to try to soften the consequences of the correction. Specifically, that means no bailouts, stimulus packages, or new public-works projects. Do not prop up wages. Allow competition to lower the prices of land, labor, and capital. The only positive steps for government to take are implementing tax cuts and spending cuts, eliminating regulations, and allowing free trade.

Now, I have a name for this policy. It's called the "Lehman Bros. plan," after Lehman Brothers, the large financial firm on Wall Street that was allowed to go bankrupt in September 2008. This plan relies on allowing big firms to fail. Had this policy been followed from the beginning, I have little doubt that the crisis would already be over and we would not have added to the debt problem.

Economics, as a branch of the more general theory of human action, deals with all human action, i.e., with mans purposive aiming at the attainment of ends chosen, whatever these ends may be.--Ludwig von Mises

Thursday, May 26, 2011

Free Market Solutions

Tuesday, May 11, 2010

The Bailout Era

The Bailout Age?

The printing press already has its own prominent place in history, so we’re not sure what else to call the first couple decades of the new millennium. But after this morning’s news, there’s little debate: time to fire it up!

The European Union (EU) and International Monetary Fund (IMF) announced a plan that comes straight out of the United States’ playbook: smother debt flare-ups with truckloads of “free money” while the central bank manipulates rates.

European leaders unveiled a $957 billion plan to save themselves and their currency. Here’s the quick and dirty:

The EU will pony up $560 billion in new loans and $76 billion in existing deals for the GIIPS nations (as we’ve taken to calling them…no reason to give pigs such a bad rap)

The IMF says its ready with $321 billion

The European Central Bank (ECB) has abandoned its old stance (and credibility) by launching a program to purchase government and corporate debt.

“This is like pouring Chanel No. 5 on a French ‘lady of the evening,’” Rob Parenteau wrote us early this morning, “after a night of wanton debauchery.”

source

Saturday, April 24, 2010

Cartoon: Wall Street Bailouts

Saturday, October 24, 2009

Saturday, August 8, 2009

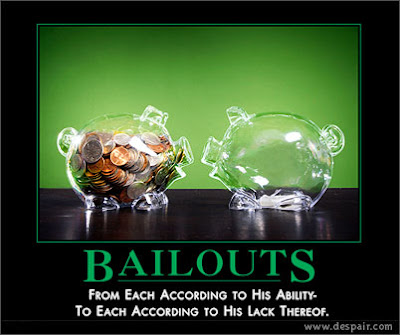

Bailouts

Wednesday, July 22, 2009

Bailout Totals: $23.7 Trillion or $3 Trillion

The independent overseer of the $700 billion bailout has caused a ruckus over an important question: How much do taxpayers have on the line?Neil Barofsky, the special inspector general overseeing the Troubled Asset Relief Program, said the total amount committed for federal programs supporting companies, industries and consumers affected by the economic meltdown was $23.7 trillion...

In an interview with CNNMoney on Wednesday, Barofsky said the actual amount of money outstanding is closer to $3 trillion.

Barofsky's math wasn't wrong. It's just that the $23.7 trillion figure assumes that all government rescue programs are used to their full extent and suffered total losses.

My thoughts: When you make bad bets you expect to lose the entire amount. The total will ultimately be closer to 23 than 3.

Sunday, June 28, 2009

Cartoon: Government Bailouts

Friday, June 26, 2009

Bailout Costs: $835 Billion This Year

The federal government is likely to spend $835 billion this year fighting the crises in the financial system and the economy, according to a new report by the Congressional Budget Office.

That spending represents about 6% of the nation's gross domestic product.

Of that amount, $340 billion is going toward the Troubled Asset Relief Program, which is being used primarily to bail out banks, insurers and the auto industry. Another $290 billion in 2009 outlays is being used to prop up mortgage giants Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500).

In addition, $187 billion is being used for economic stimulus and relief efforts such as extended unemployment insurance....

But over the long-term, CBO said, much greater pressure will bear down on the federal budget -- raising "fundamental questions about economic sustainability." That's because, barring any changes, federal debt is on track to greatly outpace economic growth over time.

The main culprits are the growth in federal spending on Medicare and Medicaid and, to a much lesser degree, Social Security. The growth rate in spending on those entitlement programs is due to two factors: the growth rate in health care spending and an increasing number of Americans growing old.

Today roughly 5% of GDP is spent on Medicare and Medicaid. By 2035, the CBO estimates, that number will double. The jump in Social Security spending is projected to rise from under 5% of GDP today to 6% by 2035.

read the CNN articleSaturday, May 23, 2009

Monday, May 4, 2009

Cartoon: Chrysler

Thursday, April 9, 2009

Bailout Bonds

During World War I, Americans were exhorted to buy Liberty Bonds to help their soldiers on the front.Now, it seems, they will be asked to come to the aid of their banks — with the added inducement of possibly making some money for themselves.

As part of its sweeping plan to purge banks of troublesome assets, the Obama administration is encouraging several large investment companies to create the financial-crisis equivalent of war bonds: bailout funds.

The idea is that these investments, akin to mutual funds that buy stocks and bonds, would give ordinary Americans a chance to profit from the bailouts that are being financed by their tax dollars. But there is another, deeply political motivation as well: to quiet accusations that all of these giant bailouts will benefit only Wall Street plutocrats.

The potential risks — politically for the administration, and financially for would-be investors — are considerable.

The funds, the thinking goes, would buy troubled mortgage securities from banks, enabling the lenders to make the loans that are needed to rekindle the economy. Many of the loans that back these securities were made during the subprime era. If all goes well, the funds will eventually sell the investments at a profit.

read the NYT article

My thoughts: There was a reason that these assets were originally called "toxic" assets. They are a dangerous and virtually worthless investment that nearly caused the collapse of many Wall Street firms.

Monday, March 30, 2009

Sunday, March 29, 2009

Cartoon: Bailouts

Monday, March 23, 2009

Geithner Plan

The Treasury Department unveiled its long-awaited plan to remove many of the troubled assets from banks' books Monday, representing one of the biggest efforts by the U.S. government so far aimed at tackling the ongoing financial crisis.

The Treasury Department unveiled its long-awaited plan to remove many of the troubled assets from banks' books Monday, representing one of the biggest efforts by the U.S. government so far aimed at tackling the ongoing financial crisis.Under the new so-called "Public-Private Investment Program," taxpayer funds will be used to seed partnerships with private investors that will buy up toxic assets backed by mortgages and other loans.

The goal is to buy up at least $500 billion of existing assets and loans, such as subprime mortgages that are now in danger of default.

Treasury said the program could potentially expand to $1 trillion over time, but that the hope is that it would not only help cleanse the balance sheets of many of the nation's largest banks, which continue to suffer billions of dollars in losses, but help get credit flowing again.

Today, we are announcing another critical piece of our plan to increase the flow of credit and expand liquidity. Our new Public-Private Investment Program will set up funds to provide a market for the legacy loans and securities that currently burden the financial system.

The Public-Private Investment Program will purchase real-estate related loans from banks and securities from the broader markets. Banks will have the ability to sell pools of loans to dedicated funds, and investors will compete to have the ability to participate in those funds and take advantage of the financing provided by the government.

The funds established under this program will have three essential design features. First, they will use government resources in the form of capital from the Treasury, and financing from the FDIC and Federal Reserve, to mobilize capital from private investors. Second, the Public-Private Investment Program will ensure that private-sector participants share the risks alongside the taxpayer, and that the taxpayer shares in the profits from these investments. These funds will be open to investors of all types, such as pension funds, so that a broad range of Americans can participate.

Third, private-sector purchasers will establish the value of the loans and securities purchased under the program, which will protect the government from overpaying for these assets.

The new Public-Private Investment Program will initially provide financing for $500 billion with the potential to expand up to $1 trillion over time, which is a substantial share of real-estate related assets originated before the recession that are now clogging our financial system. Over time, by providing a market for these assets that does not now exist, this program will help improve asset values, increase lending capacity by banks, and reduce uncertainty about the scale of losses on bank balance sheets. The ability to sell assets to this fund will make it easier for banks to raise private capital, which will accelerate their ability to replace the capital investments provided by the Treasury.

Cartoon: AIG and Campaign Contributions

While some bailed-out banks, such as Wells Fargo and JP Morgan Chase, have reduced their campaign donations, others have discreetly made donations this year, Newsweek reported. Bank of America's political action committee (PAC) gave $24,500 in January and February, "including $1,500 to House Majority Leader Steny Hoyer and another $15,000 to members of the House and Senate banking panels," the weekly news magazine said...

Citigroup, which has received a total of $45 billion in federal aid, donated $29,620 to members of Congress, including $2,500 to House GOP Whip Eric Cantor. In February, the U.S. government boosted its stake in the troubled financial firm to 36 percent – a move that aimed to avoid nationalization of Citi, once the world's biggest financial firm. Analysts said the conversion gave the government effective control as the bank's largest shareholder...

read the article

Saturday, March 14, 2009

Wednesday, March 4, 2009

The AIG Bailout Continues

U.S. Federal Reserve Chairman Ben Bernanke Tuesday defended the government's latest bailout of insurer AIG, telling irate lawmakers that he, too, was angry, but that failure to act could have triggered an economic disaster...

Pressed by the Senate committee to justify the latest in an expanding series of bailouts for American International Group, Bernanke said there was no alternative, even though the company had been irresponsible.

"We know that failure of major financial firms in a financial crisis can be disastrous for the economy. We really had no choice," he told the panel.

The U.S. government threw a fresh $30 billion lifeline to AIG (AIG, Fortune 500) on Monday, as part of a restructured bailout that had earlier swelled to about $150 billion. AIG, which reported a record $61.7 billion quarterly loss on Monday, has been slammed by losses on its credit default swaps that guarantee mortgage-linked securities.

read the CNN story

source

source