Economics, as a branch of the more general theory of human action, deals with all human action, i.e., with mans purposive aiming at the attainment of ends chosen, whatever these ends may be.--Ludwig von Mises

Tuesday, August 28, 2012

Doug Casey on the Economy

Let me define the word "depression." It's a period of time when most people's standard of living declines significantly. It can also be defined as a time when distortions and misallocations of capital – things usually caused by government intervention – are liquidated.

We have been consuming more than we have been producing and living above our means. This has been made possible by: 1) borrowing against projected future revenues and 2) using the savings of other people. The whole thing is going to fall apart. A new monetary system of some type is going to have to necessarily rise from the ashes.

source

Friday, March 16, 2012

Cartoon: Obama and the Economy

Saturday, October 8, 2011

Gary North on Voting

This world is governed by ethical cause and effect. When people vote for a living, they create an economy that is dependent on more theft. Theft-based economies are Ponzi schemes. It's not just Social Security that is a Ponzi scheme. So is Medicare. So is the FDIC. All governments over-promise. They ask us to become dependent on government promises. The governments issue more promises than taxes and borrowing can fund. Then they inflate.

Government will prove to be the god that fails. That will be a good lesson in theology for hundreds of millions of voters. "Thou shalt not steal, except by majority vote" will prove to have been a destructive principle, although widely believed.

Friday, October 7, 2011

Lew Rockwell on the Fascist Threat

Everyone knows that the term fascist is a pejorative, often used to describe any political position a speaker doesn’t like. There isn’t anyone around who is willing to stand up and say: "I’m a fascist; I think fascism is a great social and economic system."

But I submit that if they were honest, the vast majority of politicians, intellectuals, and political activists would have to say just that.

Fascism is the system of government that cartelizes the private sector, centrally plans the economy to subsidize producers, exalts the police State as the source of order, denies fundamental rights and liberties to individuals, and makes the executive State the unlimited master of society.

This describes mainstream politics in America today. And not just in America. It’s true in Europe, too. It is so much part of the mainstream that it is hardly noticed any more.

It is true that fascism has no overarching theoretical apparatus. There is no grand theorist like Marx. That makes it no less real and distinct as a social, economic, and political system. Fascism also thrives as a distinct style of social and economic management. And it is as much or more of a threat to civilization than full-blown socialism.

This is because its traits are so much a part of life – and have been for so long – that they are nearly invisible to us.

If fascism is invisible to us, it is truly the silent killer. It fastens a huge, violent, lumbering State on the free market that drains its capital and productivity like a deadly parasite on a host. This is why the fascist State has been called The Vampire Economy. It sucks the economic life out of a nation and brings about a slow death of a once thriving economy.

read the entire essay

Tuesday, October 4, 2011

Thursday, September 29, 2011

Tuesday, September 20, 2011

Friday, September 16, 2011

The Economy

When credit creation can no longer be sustained, the markets must began to clear the excesses before the cycle can begin again. It is only then (and must be allowed to happen) that resources can be reallocated back towards more efficient uses. This is why all the efforts of Keynesian policies to stimulate growth in the economy have ultimately failed. Those fiscal and monetary policies, from TARP and QE to tax cuts, only delay the clearing process. Ultimately, that delay only potentially worsens the inevitable clearing process.

The clearing process is going to be very substantial. The economy is currently requiring roughly $4 of total credit market debt to create $1 of economic growth. A reversion to a structurally manageable level of debt would involve a nearly $30 Trillion reduction of total credit market debt. The economic drag from such a reduction will be dramatic while the clearing process occurs.

This is one of the primary reasons why economic growth will continue to run at lower levels going into the future. We will witness an economy plagued by more frequent recessionary spats, lower equity market returns, and a stagflationary environment as wages remain suppressed and the costs of living rise. However, only by clearing the excess can the personal savings return to levels that can promote productive investment, production and ultimately consumption.

The end game of three decades of excess is upon us, and we can't deny the weight of the balance sheet recession that is currently in play. As we have stated in the past — the medicine that the current administration is prescribing to the patient is a treatment for the common cold — in this case a normal business-cycle recession. The problem is that this patient is suffering from a cancer of debt, and, until we begin the proper treatment, the patient will continue to wither.

Thursday, September 15, 2011

Cartoon: The Economy

Saturday, August 13, 2011

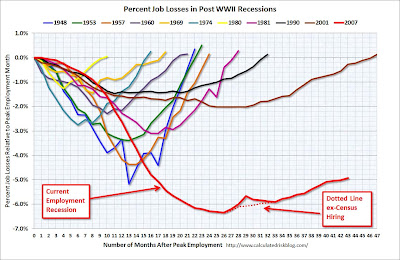

Recession Measures

Marc Faber on the Economy

Faber, who predicted the stock market crash in 1987, turned bearish shortly before the 2007-2009 bear market and called the 2009 lows, believes the markets will now test the July 2010 lows for the S&P 500 at 1,010 and "after that we'll get a QE3 announcement."...

What can the Fed do to support the economy?

"The best they could do for markets would be to collectively resign," Faber suggested.

"Everybody in the world has become a Keynesian, everybody thinks the government should do this and that, the Fed should do this, the Treasury should do that.....I think sometimes the best is to do...nothing!

Reiterating his views on the prospects for another asset purchase program, Faber asked: "What has QE1 and QE2 done for the labor market? Nothing at all, and nothing for the housing market."

"It [QE] has lifted stocks and it created wider wealth inequality in the sense that people who own assets have done well and people who are in the lower income recipient groups are getting hurt from rising energy and food prices," he added.

Thursday, August 11, 2011

Cartoon: Unemployment

Cartoon: The Economy and Obama

Cartoon: The Economy

Wednesday, August 10, 2011

Bob Murphy Destroys Krugman (and Keynes)

according to Krugman, the economy is stuck in a rut because (a) the federal government has been unwilling to run large enough budget deficits, while (b) the Federal Reserve has been unwilling to create enough new money...

Look again at the two charts above. Anyone with common sense will admit that the last two years have seen unprecedented budget deficits and monetary expansion. Krugman is correct; that hasn't been working at all. It's time to let the free market end this agony and bring us genuine recovery.

read the essay

Lew Rockwell on the Economic Crisis

Of course, the whole theory that the government can stimulate through control and robbery is wrong and counterproductive. It only ends up rewarding government and its friends while the rest of us suffer. If we ever get out of this depression, it will be because government is forced to stop this nonsense, and the economy really stimulated by taking a meat axe to the planning-spending-inflating apparatus.read the entire essay

Tuesday, August 9, 2011

Bill Bonner on the Economy and Gold

Bonner writes:

Still, we’ll stick with gold. Gold has gone up too. But for completely different reasons. You buy US Treasuries when you have faith in the system and the people running it. You buy gold when you don’t.

T-notes have gone up because the lumpeninvestoriat seeks to protect itself from natural market forces. It looks for safety in the world’s ersatz reserve currency – the dollar. As Alan Greenspan said, the US won’t default. It can always print more dollars!

Gold has gone up because smart people know that there is only one money they can really trust. There is only one currency that won’t disappear. And there is only one financial reserve that will hold up to a real crisis.

That is gold. Gold is back on its throne – as the world’s One True Money. Wise governments, wise investors, and wise families are buying it to protect themselves from the jackasses who run the world’s money system.

A few days ago, Ben Bernanke was asked about gold. Ron Paul asked him if he considered it money. ‘No,’ he said. Gold was just a commodity. Like bauxite or guano.

But now commodities are tumbling. If gold were just a commodity, it should be going down with copper and lead. Instead it is soaring.

Why is that, Ben?

Ha, ha, ha…so you see…the financial world is fun again. Yes, England is smoking from riots. Europe is on the edge of a complete financial meltdown. And America is sinking into depression. But we can still laugh at the morons who rule us. We can guffaw and snicker at the people who are supposed to know what they are doing. We can curl up in spasms of mirth at the knuckleheads who run the world’s financial institutions…

Wealth Effect

You might expect Fed chief Ben Bernanke to laud QE2 because of its effect on stock prices: Easy money fuels the “wealth effect”… people feel flush as their brokerage accounts grow… and then go out and spend money.

Of course, it’s a dopey notion — based on the idea that consumption grows the economy, not savings and production. But it is what it is.

At yesterday’s close, the S&P 500 is only 70 points away from where the whole QE2 process started nearly a year ago — when Bernanke winked and said it was all but a done deal during his annual speech in Jackson Hole, Wyo.

When Bernanke indicated during his first news conference on April 27, 2011 that QE2 would wind down as scheduled at the end of June, the market topped two days later. The market then entered a holding pattern until the circus over the debt ceiling concluded… then, well, the last week of July through this morning tells the rest of the story.

Fear Gauge

n the wake of “Great S&P Downgrade” volatility in the stock market as measured by the VIX — the volume of S&P 500 index options — jumped 50% yesterday.

n the wake of “Great S&P Downgrade” volatility in the stock market as measured by the VIX — the volume of S&P 500 index options — jumped 50% yesterday. The market’s “fear gauge” closed out the day at 48...

Going back to its inception in 1993, there are only five other episodes in which the VIX topped 45:

• September 1998: Russian default

• October 1998: Long-Term Capital Management (LTCM) implosion

• August 2002: WorldCom collapse

• September 2008: Lehman Bros. bankruptcy and ensuing Panic of ’08

• May 2010: The incestuous “flash crash.”

In four of five of these spooky episodes, you could have done very nicely for yourself buying the Dow 30 as soon as the VIX topped 45… and holding those shares for a year. The blue chips picked up between 1,500-2,500 points each time.

source

source