Economics, as a branch of the more general theory of human action, deals with all human action, i.e., with mans purposive aiming at the attainment of ends chosen, whatever these ends may be.--Ludwig von Mises

Saturday, August 25, 2012

Monday, March 12, 2012

Government Stimulus

As George Mason University economist Russ Roberts says, government’s stimulus of an economy is equivalent to taking water from the deep end of a pool and pouring it into the shallow end. Thus, all talk of stimulus is nonsense. Both Democrats and Republicans have bought into this Keynesian nonsense, even if they wish to implement it in somewhat different ways...

So, then, how does an economy recover? It doesn’t recover through central-bank policies aimed at keeping interest rates low, discouraging saving, or fiscal policies aimed at boosting consumption, including the government’s own consumption of resources. It doesn’t recover through reinflation of burst bubbles. Recessions (low to negative growth, unemployment, idle resources) follow booms and bubbles, which are caused by central-banking polices that fill the economy with cheap credit and regulatory programs that channel the credit into particular areas, such as the constellation of easy home-purchase policies carried out by several government agencies for years. The booms set off by those policies are characterized by a misshapen capital structure; that is, resources and labor were arranged according to price signals distorted by the central bank and other government agencies. For example, labor and equipment went into the housing and housing-finance industries to a vaster extent than they would have gone absent those price-distorting policies.

When interest rates finally rise to reflect reality, the boom ends, revealing the unsustainable nature of the misshapen capital structure. Businesses close, workers are laid off, and capital is left idle. The effect ripples beyond the immediately affected industries. If government were to retrench at that point, entrepreneurs would set out on the task of re-arranging resources and labor in order to align them with entrepreneurial estimates of future consumer preferences.

This rearrangement is neither costless nor instantaneous. Equipment made for one purpose may be unsuitable for other purposes and may have only scrap value, or it may be in the wrong location. Likewise, people trained to build houses or to work with financial computer models may not be qualified for other jobs and will need retraining. The work of changing the structure of production from its politically distorted shape to one that will better serve consumers requires money. There’s only one place that money can come from if the economy is not to be further distorted: savings. But saving is consumption deferred. Thus all government efforts to stimulate spending and discourage saving accomplish the opposite of what is required for economic recovery.

Free people create economic growth when government backs off — slashes spending and taxes, ends regulations and privileges — and lets them correct the mistakes induced by earlier monetary and regulatory stimuli. Nothing less will work lastingly.

Sunday, September 11, 2011

Ben Powell on The American Jobs Act

After wasting three years and more than a trillion dollars of "stimulus" money, the President has announced he has a new plan for creating jobs.

The problem is: Government doesn't create jobs that add value to the economy; companies and entrepreneurs do. Through taxes, mandates and regulation the government typically discourages hiring and destroys jobs. What Washington should do right now is step aside...

Entrepreneurs create jobs only when they expect the price they will receive for their product or service will exceed the price they pay for labor and other inputs, such as raw materials and equipment. This ensures that the jobs they create make society wealthier.

In contrast, government jobs add little if anything to the economy. They drain resources rather than increase them.

Truth be told, the government easily could solve unemployment tomorrow if our only objective is to say that everyone who wants a job has one. It could do this simply by hiring half of all unemployed workers to dig ditches and the other half to fill them in. Everyone would work. But no net value would be created.

read the entire essay

Peter Schiff on The American Jobs Act

Although it was labeled and hyped as a "jobs plan," the new $447 billion initiative announced last night by President Obama is merely another government stimulus program in disguise. But semantics are of supreme importance in American politics...some could argue that word choice is the only thing that matters. As a result, despite the fact that this plan bears no substantive difference from previous stimulus bills...

In the meantime money to fund the stimulus has to come from somewhere. Either the government will borrow it legitimately, or the Federal Reserve will print. Either way, the adverse consequences will damage economic growth and job creation, and lower the living standards of Americans...

The truth of course is that no real economic growth or job creation is going to occur until the failed policies of both Obama and Bush are reversed. In his speech the President mourned the death of the American dream. Obama should stop killing it. To revive that dream we need to revive the American spirit that produced it in the first place. That means returning to our traditional values of limited government and sound money. Unfortunately we are still headed in the wrong direction.

read the entire essay

Anthony Wile on the American Jobs Act

I've noticed that an old and misleading dominant social theme has taken center stage in America lately. It's the idea that politicians and the political process itself can create jobs.

Of course, government can't create jobs. Government can make things worse, but it can rarely if ever make things better...

Government doesn't create anything of value. It merely taxes and spends. It is impossible for the government to "create" jobs – and the Keynesian nostrums claiming that government can "stimulate" the economy by creating make-work employment are not feasible – and never really were.

read the entire essay

Adrian Krieg on The American Jobs Act

The president's speech on the evening of September 8 was without question

not a speech about the economy or how to fix it; it was another campaign speech

for Obama's reelection. The plan as announced is called "The American Jobs Act" – very long on vocalization and very short on substance. The same old class warfare of "tax the rich" was repeated often. I lost count on, "You Must Pass This Bill." There

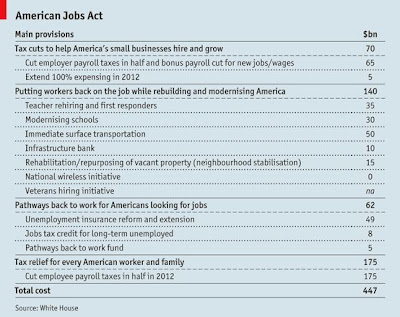

are, according to White House sources, $447 billion required for implementation

of this Act (Stimulus 4, one would suspect), although the president never once

mentioned any dollar amount.

read the entire essay

Friday, September 9, 2011

American Jobs Act

My thoughts: The cost is being reported as $447 billion. This includes $253 billion in tax cuts. Allowing people to keep money that they have earned is NOT a cost. Spending is a cost. The national debt crisis is a result of of overspending, not under taxation.

Sunday, August 28, 2011

Why Americans Hate Economics

Christina Romer, the University of California at Berkeley economics professor and President Obama's first chief economist, once relayed the old joke that "there are two kinds of students: those who hate economics and those who really hate economics."... Why? Because too often economic theories defy common sense. Alas, the policies of this administration haven't boosted the profession's reputation...A few months ago Mr. Obama blamed high unemployment on businesses becoming "more efficient with a lot fewer workers," and he mentioned ATMs and airport kiosks. The Luddites are back raging against the machine. If Mr. Obama really wants to get to full employment, why not ban farm equipment?

Or consider the biggest whopper: Mr. Obama's thoroughly discredited $830 billion stimulus bill. We were promised $1.50 or even up to $3 of economic benefit—the mythical "multiplier"—from every dollar the government spent. There was never any acknowledgment that for the government to spend a dollar, it has to take it from the private economy that is then supposed to create jobs. The multiplier theory only works if you believe there's a fairy passing out free dollars...

The grand pursuit of economics is to overcome scarcity and increase the production of goods and services. Keynesians believe that the economic problem is abundance: too much production and goods on the shelf and too few consumers. Consumers lined up for blocks to buy things in empty stores in communist Russia, but that never sparked production. In macroeconomics today, there is a fatal disregard for the heroes of the economy: the entrepreneur, the risk-taker, the one who innovates and creates the things we want to buy. "All economic problems are about removing impediments to supply, not demand," Arthur Laffer reminds us.

So here we are, three years of mostly impotent stimulus experiments and the economy still hobbled. Keynesians would be expected to be second-guessing the wisdom of their theories. Instead, Prof. Romer recently complained that the political system will not allow Mr. Obama to "go back and ask for more" stimulus.

Cartoon: Stimulus Spending

Wednesday, October 20, 2010

Sunday, September 26, 2010

Mises on Government Job Creation

Ludwig von Mises--Planning for Chaos

Thursday, September 16, 2010

Cartoon: Stimulus

Saturday, September 11, 2010

Cartoon: If I Had a Hammer

Thursday, September 2, 2010

A New Stimulus?

Wolf, Stiglitz, Krugman – we love these guys!They pushed the world’s governments to undertake huge “stimulus” programs. Of course, the stimulus programs didn’t work. They couldn’t work. All they could do was to disguise the facts and delay the necessary adjustments.

But these fellows don’t care about that. They are the technicians, scientists, and engineers of finance. They have measures of financial health – GDP, employment, inflation, etc. They may not be able to make anyone better off…but they can damned sure move those indicators. At least, they believe they can.

Spend enough money and you can move the GDP up. Hire enough people and you can get unemployment down. It’s not that complicated.

So, the engineers went to work two years ago. You know the rest of the story. That is how we got where we are. They turned valves. They connected wires. They adjusted dials and switches. They put at risk nearly an entire year’s worth of US GDP – on the idea that an economy can be controlled and managed, just as if it were a brewery...

The trouble is…managing an economy is not science at all. And these guys are not scientists. They have no controlled experiments. They have no test panels nor test results. They have no peer reviews. They have no proper theories – none that can be disproven or confirmed. They just have crackpot ideas and quack treatments.

And now, Paul Krugman is on television in the US calling for another $800 billion program of boondoggles, bailouts and bumph. “Stimulus,” he calls it. Claptrap is what it is.

Wednesday, August 25, 2010

Stimulus and the Never Ending Recession

Instead, Mr. Schiff says, “This misses the point that any ‘growth’ created by stimulus is totally dependent on stimulus to continue. The ‘recovery’ will end as soon as the stimulus prop is removed.”...

Well, the analogy seemed apt when he went on, “the Fed will step in with ‘quantitative easing’ as soon as it becomes obvious that the Administration’s stimulus-fueled ‘recovery’ of the past three quarters is fading. The problem is that each round of stimulus, as with each hit of an addictive drug, requires ever larger doses to produce the same result.”...

And just when it seemed that things could not get worse, it gets worse, as he figures that the reality is that “The 2008 recession never ended. It was merely interrupted by trillions of dollars of stimulus that purchased GDP ‘growth’ with borrowed money.”...

Exactly! Let me stop whining about that stupid motorcycle for just a minute so that I can say that, as far as I, too, am concerned, the whole boom of the last 30 years was the result of “trillions of dollars of stimulus,” as the despicable Alan Greenspan had the Federal Reserve keep creating more and more money the whole time, and now the absurd Ben Bernanke, erstwhile head of the obviously-worthless economics department at Princeton, is exponentially worse as the new chairman of the Federal Reserve!...

When a falling dollar forces consumer prices and long-term interest rates to rise, the Fed’s actions will be rendered impotent. The Open Markets Committee will have to make a horrific choice: fight inflation by tightening policy into a weakening economy, or fight recession by allowing inflation to burn out of control. I think it’s obvious that they will choose inflation, all the while pretending that it doesn’t exist.”

Tuesday, August 24, 2010

CBO on the Stimulus

| Change Attributable to ARRA, GDP change (percent) | |||

|---|---|---|---|

| Low Estimate | High Estimate | ||

| 2009 | Q1 | 0.1 | 0.1 |

| 2009 | Q2 | 0.8 | 1.3 |

| 2009 | Q3 | 1.2 | 2.4 |

| 2009 | Q4 | 1.4 | 3.3 |

| 2010 | Q1 | 1.7 | 4.1 |

| 2010 | Q2 | 1.7 | 4.5 |

| 2010 | Q3 | 1.5 | 4.2 |

| 2010 | Q4 | 1.1 | 3.6 |

source

Monday, August 16, 2010

Total Stimulus: $1 Trillion

With the passage of a $26 billion state aid package Tuesday, Congress has approved over $1 trillion in spending and tax measures to stimulate the economy, according to a recent summary of the legislation by two independent economists. This fiscal stimulus has been just a part of the government's response to the recession, which also includes policies such as TARP, homeowner assistance and initiatives by the Federal Reserve.

With the passage of a $26 billion state aid package Tuesday, Congress has approved over $1 trillion in spending and tax measures to stimulate the economy, according to a recent summary of the legislation by two independent economists. This fiscal stimulus has been just a part of the government's response to the recession, which also includes policies such as TARP, homeowner assistance and initiatives by the Federal Reserve.source

Wednesday, August 11, 2010

Did the Stimulus Work?

Friday, August 6, 2010

The Recovery

Bill Bonner writes:

So, we’ll think a bit more about Tim Geithner and the other men who rule us. Geithner wrote an article for The New York Times, “Welcome to the Recovery.”

The gist of the article was that, though the recovery wouldn’t be quick and easy, it was still real and moving forward...

It’s really very simple. The private sector ran up too much debt. It didn’t have the income to support the debt. So, the bad debt has to be destroyed. Companies go broke – their stocks and bonds go to zero. Houses are foreclosed. Consumers declare bankruptcy. Banks close their doors...

They might have admitted their failure and promised to do better next time. Instead, they decided to rescue the debt-laded economy…yes, you guessed it…with more debt!

The project was so loony from the get-go, it made us laugh. But some of the biggest names in economics – Krugman, Stiglitz, et al – are still pushing for more debt-financed “stimulus.”

The trouble with it is obvious, theoretically. Practically, it is even more obvious. In order to get money to give to the private sector, the feds first have to take it from the private sector. Ha ha…

So…

The stimulus campaigns have wrought pretty much what we expected. Instead of stimulating the private sector, the feds have replaced private sector spending with government spending. Government spending and investing is notoriously inefficient – which is to say, the politicians waste money. Much of the spending goes down a rat hole where it neither improves peoples’ lives nor stimulates economic activity.

Since the counter-cyclical spending began, about $2.5 trillion has been put to work. What has it produced? More jobs? Nope. Higher incomes? Definitely not. Higher asset prices? Maybe.

Geithner’s response is that “it would have been worse if we hadn’t done anything.” Here at The Daily Reckoning, we don’t believe it. It would have been better if the feds had let the market clear…

Let it happen. Let it be. Let the chips fall where they may…so that others can pick them up and get to work again.