Economics, as a branch of the more general theory of human action, deals with all human action, i.e., with mans purposive aiming at the attainment of ends chosen, whatever these ends may be.--Ludwig von Mises

Tuesday, January 31, 2012

Who Pays Better?

Wednesday, September 14, 2011

World's Largest Employers

Wednesday, September 7, 2011

Saturday, August 13, 2011

July Employment Numbers

The unemployment rate decreased to 9.1% (red line).

The Labor Force Participation Rate declined to 63.9% in July (blue line). This is the percentage of the working age population in the labor force. This is a new cycle low - and the lowest participation rate since the early '80s.

The Employment-Population ratio declined to 58.1% in July (black line). This is also at a new cycle low and the lowest since the early '80s.

source

Wednesday, April 6, 2011

Monday, March 7, 2011

Job Loss by Recession

Monday, February 7, 2011

According to the Bureau of Economic Analysis (BEA), real GDP is now slightly above the pre-recession peak. Real GDP (in 2005 dollars) was at $13,382.6 billion in Q4, just 0.14% above the $13,363.5 billion in Q4 2007.

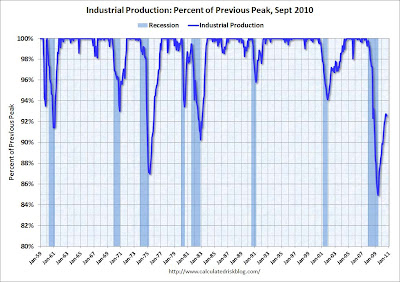

According to the Bureau of Economic Analysis (BEA), real GDP is now slightly above the pre-recession peak. Real GDP (in 2005 dollars) was at $13,382.6 billion in Q4, just 0.14% above the $13,363.5 billion in Q4 2007. However industrial production is still 5.8% below the pre-recession peak, and it will probably be some time before industrial production returns to pre-recession levels.

However industrial production is still 5.8% below the pre-recession peak, and it will probably be some time before industrial production returns to pre-recession levels. Payroll employment is still 5.6% below the pre-recession peak. And even with slightly above trend GDP growth in 2011, payroll employment growth will probably only recover slowly. Payroll employment is still 7.7 million below the pre-recession peak, and if the the U.S. adds 2.5 million payroll jobs per year over the next 3 years (my current forecast is 2.4 million private sector jobs this year), it would take 3+ years to return to the pre-recession peak. And that doesn't include population growth!

Payroll employment is still 5.6% below the pre-recession peak. And even with slightly above trend GDP growth in 2011, payroll employment growth will probably only recover slowly. Payroll employment is still 7.7 million below the pre-recession peak, and if the the U.S. adds 2.5 million payroll jobs per year over the next 3 years (my current forecast is 2.4 million private sector jobs this year), it would take 3+ years to return to the pre-recession peak. And that doesn't include population growth!Saturday, October 30, 2010

Real GDP Still Below Pre-Recession Levels

Real GDP is 0.8% below the pre-recession peak, so real GDP would have to grow at a 3.1% annualized pace in Q4 for the economy to be back at the pre-recession peak.

Real GDP is 0.8% below the pre-recession peak, so real GDP would have to grow at a 3.1% annualized pace in Q4 for the economy to be back at the pre-recession peak.That is unlikely since growth in personal consumption expenditures (PCE) will probably slow in Q4, and the contribution from the change in private inventories will likely be much smaller or negative in Q4.

Probably the earliest the economy will be back to pre-recession levels for GDP would be in Q1 2011 and that requires a 1.6% annualized growth rate over the next two quarters. It might even take until Q2 2011 (my current forecast).

Real personal income less transfer payments is still 5.5% below the pre-recession peak. Much of the growth in PCE over the last year has come from transfer payments - this includes people taking Social Security early, extended unemployment benefits, and other assistance programs - and it will be some time before this indicator returns to pre-recession levels.

Industrial production has been one of the stronger performing sectors because of inventory restocking and some growth in exports. However industrial production is still 7.5% below the pre-recession peak, and it appears export growth has slowed, and the inventory cycle is almost over.

Payroll employment is still 5.6% below the pre-recession peak. And with below trend GDP growth, payroll employment growth will likely remain sluggish.

source

Wednesday, August 25, 2010

US Employment Figures

After the Dow’s dazzling 77% rally from the lows of March 2009 to the recent high of 11,258 in March 2010, a little “give-back” was to be expected. But a lot of give-back was not expected…at least not by the legions of investors who believed that the Fed had vanquished the credit crisis for good, and had conjured a recovery out of thin air.

So now that this give-back has lasted an uncomfortably long period of time – and now that most economic data are coming in “weaker than expected,” the Dow’s nifty rally off the March 2009 lows begins to feel more like a deception than a validation...

“We may not have said it first,” we declared in the June 30 edition of The Daily Reckoning, “but we have said it repeatedly: The US economic recovery is a myth…a fairy tale.”...

Back in early March, however, most professional economic observer-prophets were still crowing about the end of the credit crisis and the resumption of economic growth. Today, the observe-prophets are trying to shake the fog out of their crystal balls. There is no recovery. Merely less catastrophe.

Saturday, August 7, 2010

July 2010:

For the current employment recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

source

Monday, July 19, 2010

US Manufacturing

Tuesday, June 22, 2010

Jobs Adjustment by Industry

source

In the Great Recession on 35 percent of employment was in industries that faced cyclical employment trends in the recession. The majority of industries lost or gained jobs permanently (or at least have lost or gained jobs on a continued basis for the past 11 months).

The one outlier in the top right corner, if you can't make it out, is the "federal government" industry. It gained jobs during the recession and has gained jobs far faster than any other industry during the recovery.

Friday, April 16, 2010

Budget Cuts

Friday, April 2, 2010

Tuesday, February 9, 2010

Employment: Hirings, Layoffs, Openings

Wednesday, February 3, 2010

Government Employment

The Obama administration says the government will grow to 2.15 million employees this year, topping 2 million for the first time since President Clinton declared that "the era of big government is over" and joined forces with a Republican-led Congress in the 1990s to pare back the federal work force...

Including both the civilian and defense sectors, the federal government will employ 2.15 million people in 2010 and 2.11 million in 2011, excluding Postal Service workers.

source

source

source