Economics, as a branch of the more general theory of human action, deals with all human action, i.e., with mans purposive aiming at the attainment of ends chosen, whatever these ends may be.--Ludwig von Mises

Thursday, April 19, 2012

Wednesday, December 14, 2011

Regime Uncertainty and the Non-Recovery

As examples see:

http://mises.org/journals/qjae/pdf/qjae13_3_4.pdf

http://blog.independent.org/2011/11/06/u-s-economic-recovery-remains-anemic-at-best/

http://blog.independent.org/2011/10/08/important-new-evidence-on-regime-uncertainty/

http://blog.independent.org/2011/09/19/global-regime-uncertainty/

http://blog.mises.org/11716/jobs-investment-and-spending/

Today’s Wall Street Journal, “Regulation for Dummies” (p. A20) provides more evidence that regime uncertainty is a major factor in leading forward looking entrepreneurs and managers to be hesitant to expand old or create new enterprises. The evidence is provided in this chart (below) reproduced in the Journal from the Unified Agenda, Regulatory Service Center.

The Journal observes, it is not just existing or newly approved regulations that matter. “(T)he regulatory future matters as much. The Administration’s pipeline is clogged with proposed rules and plans to propose rules, which every business survey says are contributing to the policy uncertainty that is harming growth and hiring.”

Echoing Higgs, the Journal concludes, “The evidence is overwhelming that the Obama regulatory surge is one reason the current economic recovery has been so lackluster by historical standards. Rather than nurture an economy trying to rebuild confidence after a financial heart attack, the Administration pushed through its now-famous blitz of liberal policies on health care, financial services, energy, housing, education and student loans, telecom, labor relations, transportation and probably some other industries we’ve forgotten. Anyone who thinks this has only minimal impact on business has never been in business.” What should be added to the list is the real threat of significantly higher future tax burdens.

source

Thursday, September 29, 2011

Friday, September 16, 2011

The Economy

When credit creation can no longer be sustained, the markets must began to clear the excesses before the cycle can begin again. It is only then (and must be allowed to happen) that resources can be reallocated back towards more efficient uses. This is why all the efforts of Keynesian policies to stimulate growth in the economy have ultimately failed. Those fiscal and monetary policies, from TARP and QE to tax cuts, only delay the clearing process. Ultimately, that delay only potentially worsens the inevitable clearing process.

The clearing process is going to be very substantial. The economy is currently requiring roughly $4 of total credit market debt to create $1 of economic growth. A reversion to a structurally manageable level of debt would involve a nearly $30 Trillion reduction of total credit market debt. The economic drag from such a reduction will be dramatic while the clearing process occurs.

This is one of the primary reasons why economic growth will continue to run at lower levels going into the future. We will witness an economy plagued by more frequent recessionary spats, lower equity market returns, and a stagflationary environment as wages remain suppressed and the costs of living rise. However, only by clearing the excess can the personal savings return to levels that can promote productive investment, production and ultimately consumption.

The end game of three decades of excess is upon us, and we can't deny the weight of the balance sheet recession that is currently in play. As we have stated in the past — the medicine that the current administration is prescribing to the patient is a treatment for the common cold — in this case a normal business-cycle recession. The problem is that this patient is suffering from a cancer of debt, and, until we begin the proper treatment, the patient will continue to wither.

Saturday, August 13, 2011

Recession Measures

Thursday, August 4, 2011

Peter Schiff on the Economy

Schiff thinks the U.S. is headed not just for a recession but rather a full-blown depression. On the upside, he believes the coming economic situation will look familiar.

"The Depression [in the wake of the financial crisis] was temporarily interrupted by a bunch of stimulus which ultimately weakened the economy further," says Schiff. He adds the government's likely knee-jerk response of stimulating is, "probably going to be the fatal dose, the lethal dose" prior to "a complete economic collapse."

Which is precisely why Schiff wasn't among those expecting a debt deal relief rally last Monday morning. The attention paid to the deal was a "massive victory for propaganda that would have done Goebbels proud" (yes, this Goebbels). Schiff believes the real crisis wasn't the debt ceiling but spending and debt, both of which were effectively worsened by the deal.

"The reckless thing to do was to raise the debt ceiling" he says. Exacerbating matters Schiff thinks the ceiling is going to have to be raised yet again before President Obama leaves office. Not that the chance for DC to spend more freely will help the economy. "The reason we can't grow the economy is because the government is in the way... There's no jobs because there's no recovery."

By way of a cheery goodbye Schiff concludes, "We're on a collision course for disaster. All we can do, all your viewers can do is brace for impact...Buy gold. Buy silver... Get as far away as you can from U.S. currency and the U.S. economy."

Monday, July 11, 2011

Economic Recovery??

The fight for recovery is over. The feds have waved the white flag. Maybe…The Labor Department came out with the latest employment numbers last week. They were atrocious. Only about a fifth as many new jobs as economists expected. Which shows you three things.

First, economists can’t really predict levels of employment, growth, prices, or anything else. And they are especially bad at it when they have the wrong idea of how things work.

Second, the feds have failed. They have been completely unable to make any progress against the downturn.

Third, this is not a recovery. Widely reported in the media was the opinion that the employment numbers were ‘disappointing for the second year of a recovery.’ Well…yes. Because it’s not a recovery. It’s a Great Correction. And this is just what you’d expect.

For the last 4 years – since the beginning of the financial crisis in ’07 to today – economists, analysts, investors and policymakers have had the wrong idea. They thought they were dealing with an ordinary (though perhaps severe) recession, which they thought would be followed by an ordinary (though perhaps weak) recovery.

Not at all! It was not an ordinary post-war recession. So, the ordinary counter-cyclical policy measure – more credit! – didn’t work. This time, the economy already had too much credit. Which is to say, too much debt. It didn’t do any good to add more debt. Households were already drenched in it.

They couldn’t absorb any more. They couldn’t increase their spending by borrowing more money. So, spending couldn’t go up…

Instead, households are struggling to maintain their standards of living in the face of rising consumer prices and flat…or falling…incomes.

And now, the mainstream financial press is finally catching on. Heck, even the US Secretary of the Treasury, Tim Geithner, may be opening his eyes.

Saturday, June 11, 2011

The Next Crisis or the Continuation of the Current Crisis

The mainstream financial media are running stories on the next financial crisis. This is unheard of two years into a so-called economic recovery. So weak is this recovery that the old pre-2008 confidence has not returned...

We are being warned in advance by the financial media: expect another major crisis. The bailouts were not enough. The expansion of the monetary base was not enough. The new Dodd-Frank regulatory structure is not enough...There is no formula to deal with this. There is no organized government response that is waiting in the wings. There will be another crisis. And when it comes, the response will be the same: to preserve the solvency of the biggest banks, at taxpayer expense and at central bank expense. When it comes to bailouts and central bank inflation, it's all "doable." It will therefore be done.

source

Monday, May 9, 2011

Economic Recovery

Sunday, February 27, 2011

Higgs on the Economic Recovery

What is to blame is the collapse of private business investment. Until this critical component of the economy — technically, "private domestic business net investment" — fully recovers, the economy will continue to sputter.

Don't confuse net investment with gross investment.

Gross investment includes expenditures aimed merely at maintaining or replacing existing structures, tools and equipment, software and other capital goods as they become obsolete or wear out.

But unless firms do more than make up for depreciation, they do not expand their productive capacity, except to the extent that they replace worn-out or obsolete capital goods with models that employ improved technology. If all we do is replace a worn-out machine tool with a new one, we have not increased the number of machine tools.

Economic growth requires net investment — investment above and beyond the replacement level — and more rapid economic growth requires a greater rate of increase in such investment.

With that in mind, consider what has happened to net private investment.

Net private investment reached its recent cyclical peak in the third quarter of 2007, when firms were investing at a net annual rate of $463 billion per year. (In that same quarter, gross business investment was running at a $1.66 trillion annual rate.)

Net investment then fell steadily for the next four quarters, reaching $336 billion in the third quarter of 2008 and plummeting to $159 billion in the fourth quarter of 2008, a 53% drop in a single three-month period.

Although the financial-market panic that flared up in September 2008 began to subside early in 2009, net investment continued to fall, going into negative territory (minus $53 billion annually) in the first quarter of 2009 and falling further to minus $119 billion in the second quarter of 2009.

Some improvement began in the next quarter, but for the entire year 2009, net business investment amounted to minus $69 billion. Hardly by coincidence, U.S. gross domestic product also fell substantially in 2009...

Unless private investment recovers more rapidly, the economy's recovery is sure to remain slow, too slow to significantly lower unemployment...

Sunday, January 30, 2011

Economic Recovery

In the fourth quarter, economic output reached a $13.38 trillion seasonally adjusted annual rate, measured in 2005 dollars, inching 0.14% above the final quarter of 2007, when the recession began.

In the summer of 2009, the recession's official end, output plunged 4.14% below pre-crisis levels to a $12.81 trillion seasonally adjusted annual rate.

It took 12 quarters to recoup the losses and, on a per-capita basis, the economy is still not as large as it was before the recession took hold. Such a prolonged recovery is unusual: It took eight quarters to bounce back from the deep recession of the early 1970s.

sourceThursday, January 20, 2011

Cartoon: Economic Recovery

Wednesday, November 17, 2010

Cartoon: Economic Recovery

Saturday, October 30, 2010

Economic Recovery

Real GDP Still Below Pre-Recession Levels

Real GDP is 0.8% below the pre-recession peak, so real GDP would have to grow at a 3.1% annualized pace in Q4 for the economy to be back at the pre-recession peak.

Real GDP is 0.8% below the pre-recession peak, so real GDP would have to grow at a 3.1% annualized pace in Q4 for the economy to be back at the pre-recession peak.That is unlikely since growth in personal consumption expenditures (PCE) will probably slow in Q4, and the contribution from the change in private inventories will likely be much smaller or negative in Q4.

Probably the earliest the economy will be back to pre-recession levels for GDP would be in Q1 2011 and that requires a 1.6% annualized growth rate over the next two quarters. It might even take until Q2 2011 (my current forecast).

Real personal income less transfer payments is still 5.5% below the pre-recession peak. Much of the growth in PCE over the last year has come from transfer payments - this includes people taking Social Security early, extended unemployment benefits, and other assistance programs - and it will be some time before this indicator returns to pre-recession levels.

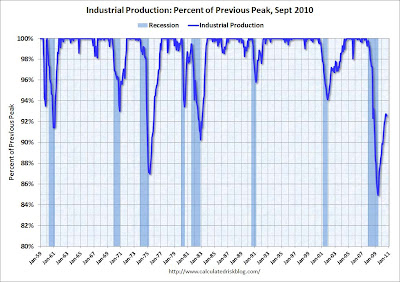

Industrial production has been one of the stronger performing sectors because of inventory restocking and some growth in exports. However industrial production is still 7.5% below the pre-recession peak, and it appears export growth has slowed, and the inventory cycle is almost over.

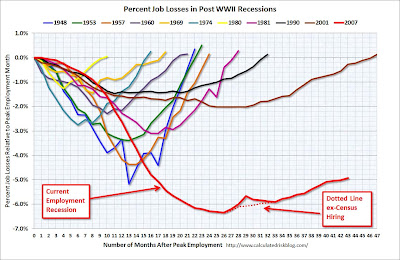

Payroll employment is still 5.6% below the pre-recession peak. And with below trend GDP growth, payroll employment growth will likely remain sluggish.

source

Saturday, October 9, 2010

Why 'Stimulus' Doesn't Stimulate

President Obama has asked Congress for an additional $50 billion in "stimulus" money to finance infrastructure projects. The theory is that the additional spending will cause businesses to boost production to meet this demand. Producers will add jobs, triggering increases in consumer spending that will ripple through the economy and fuel a stronger overall recovery.

Unfortunately, however, such government pump-priming hasn't worked in the past, and there's no reason to believe it will work now...

So the conventional wisdom—that a sharp decline in consumer spending caused the economy's downturn—is wrong.

What did cause the downturn? The answer is: a sharp decline in private investment.

In fact, the ups and downs of the business cycle are always driven by investment spending, not by consumption spending...

The media's focus on consumption unfortunately tempts politicians to approve "stimulus" measures aimed at pumping up this part of total spending—measures such as long extensions of unemployment insurance, aid to state and local governments to help them avoid personnel reductions, and increases in federal employee salaries.

Some economists in fact single out such measures for special praise on the grounds that such payments, because they are most likely to stimulate near-term consumption spending, have the greatest "multiplier effect."

Such arguments fail to grasp the true nature of boom-bust cycles, however, especially the central role of investment spending in driving them—and, more important, in driving long-term economic growth.

If politicians truly wish to promote genuine, sustainable recovery and long-term economic growth, they should focus on actions that will contribute to a revival of private investment, not on pumping up consumption. In the most recent quarter, gross private domestic investment was still running at an annual rate more than 20 percent below its previous peak. Net private investment was fully two-thirds below the previous peak.

To bring about this essential revival of investment, the government needs to put an end to actions that threaten investors' returns or create uncertainty that paralyzes the undertaking of new long-term projects...

What entrepreneurs, investors and executives await is policy stability and predictability, not more government spending, borrowing, sweeping new regulations, and heightened uncertainty.

Our crying need at present is for a robust revival of private long-term investment. Consumption-oriented government "stimulus" programs, threats of tax increases for entrepreneurs and business owners, and costly regulatory onslaughts breed fear and uncertainty and thus ensure a protracted period of economic stagnation.

read the entire essay

Friday, September 17, 2010

Principles for Economic Revival

The most fundamental starting point is that people respond to incentives and disincentives. Tax rates are a great example because the data are so clear and the results so powerful. A wealth of evidence shows that high tax rates reduce work effort, retard investment and lower productivity growth. Raise taxes, and living standards stagnate...

Saturday, September 11, 2010

Housing and Economic Recovery

Our study of all the postwar recessions and the Great Depression leads to the following empirical proposition: If there is no recovery in housing expenditures, confirmed by a recovery in consumer durable goods expenditures, then there is no economic recovery.

In the Great Depression and in every recession since, recovery of residential construction has preceded recovery in every other sector, and its recovery has been far larger in percentage terms than the recovery in any other major sector.

Applied to the Great Recession, it appears that those who see signs of a recovery may be grasping at straws. What one should hope is that this time it is different from every one of the past 14 U.S. downturns, but those who believe this have the weight of past experience against them.

We looked at all the major expenditure components of Gross Domestic Product in percentage deviations from their levels in the fourth quarter of 2007, officially declared as the start of the Great Recession by the National Bureau of Economic Research.

The onset of and decline during this recession were like previous recessions, though its course has been deeper and longer. By quarter four of 2007, sales of new homes had fallen without interruption for nine straight quarters and expenditures on new residential construction had fallen for seven quarters—strong lead time signals of the looming distress. New home sales recovered briefly in 2009 but have now declined for three quarters. Residential construction expenditures have essentially been flat for five quarters. Consumer durables spending at best has stabilized, up slightly from its low in the fourth quarter of 2008.

The average increase in new residential construction in the first year following the previous 10 postwar recessions has been 26.3%. The largest increase in residential construction followed the 1981-82 recession, when it increased 75.5% as monetary policy was relaxed. In the past year, residential construction has increased 6.3%. This is the slowest rebound in residential construction in any sustained recovery from a postwar recession.

No currently debated policy will likely change this situation, as the market is saturated with foreclosed houses and homeowners suffer from $771 billion in negative equity. This fact needs to be confronted: We are almost surely in for a long slog.

source

source