Economics, as a branch of the more general theory of human action, deals with all human action, i.e., with mans purposive aiming at the attainment of ends chosen, whatever these ends may be.--Ludwig von Mises

Showing posts with label subprime mortgages. Show all posts

Showing posts with label subprime mortgages. Show all posts

Saturday, February 27, 2010

Cartoon: Subprime

Saturday, August 22, 2009

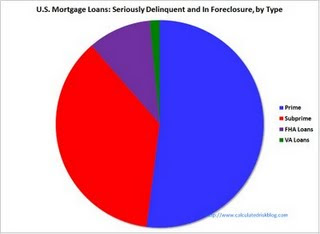

1 in 8 Mortgages are Behind

Prime loans, however, accounted for 58% of foreclosure starts, up from 44% last year. Meanwhile, subprime mortgages accounted for 33% of foreclosure starts, down from 49%. Prime fixed-rate mortgages, usually considered among the safest of all loan types, accounted for one in three foreclosure starts, up from one in five.

Prime loans, however, accounted for 58% of foreclosure starts, up from 44% last year. Meanwhile, subprime mortgages accounted for 33% of foreclosure starts, down from 49%. Prime fixed-rate mortgages, usually considered among the safest of all loan types, accounted for one in three foreclosure starts, up from one in five.read the WSJ article

US Mortgage Market

Thursday, March 19, 2009

Cartoon: Subprime Mortgages

Saturday, February 21, 2009

Karl Denninger Calls Out Press Secretary Gibbs

Rick Santelli is perhaps starting a grassroots revolt.

http://chicagoteaparty.com/

My thoughts: Gibbs might need to stay around. If is really the job of the press secretary to spin, distort and lie to the American people. He appears to be off to a great start.

Wednesday, December 31, 2008

Crisis of 2008: A Summary

In summary, the essence of the subprime crisis is that money was lent (often through the agency of questionable mortgage brokers) at very low interest rates (courtesy of the Fed) to hundreds of thousands of people (all they needed was a credit score and a pulse) who could not afford to pay it back; and it was backed by collateral (a house) that was not properly valued. Such assets, accurately described as "liar loans," were then packaged into opaque securities, known as structured-investment vehicles (sponsored but not guaranteed by a respected and well-known name), which very few people understood. They were sold on to pension funds, banks, and others whose gullible investment managers also did not understand them and failed to carry out the rigorous analysis that their clients had a right to expect.

read the entire essay

My thoughts: One of the best explanations of the crisis that I have seen.

Sunday, September 28, 2008

WSJ on the Mortgage Crisis and Financial Crisis

But Washington is as deeply implicated in this meltdown as anyone on Wall Street or at Countrywide Financial. Going back decades, but especially in the past 15 or so years, our politicians have promoted housing and easy credit with a variety of subsidies and policies that helped to create and feed the mania.

read the article

read the article

Labels:

financial crisis,

housing crisis,

subprime mortgages

Saturday, September 27, 2008

Financial Crisis and Subprime Loans

Real good summary of the origins of the current economic "crisis". The last minute is a pure political ad.

Sunday, September 21, 2008

Thursday, September 18, 2008

Wednesday, September 17, 2008

Cartoon: Financial Crisis

Monday, March 31, 2008

Mortgage Bailout

A government bailout of the housing market is both fiscally and morally irresponsible; it is an unfair subsidy being paid to the wealthy (bankers), the greedy (mortgage brokers, flippers, and yes some homeowners), and the incautious (some homeowners), with no benefit to those paying the bill (taypayers).

Why should responsible Americans be forced to pay for the mistakes of others?

Labels:

housing bubble,

mortgage bailout,

subprime mortgages

Tuesday, March 18, 2008

The Costs of "Fixing" the Sub-Prime Mess

"The Fed is supposed to make sure the entire economy, and not just the credit markets, run smoothly.

But Fed chairman Ben Bernanke risks fixing the credit crunch at the expense of inflation and the retirement accounts of many hard-working consumers that didn't go out and get some exotic adjustable-rate mortgage to buy a home that cost far more than they could afford."

from CNN

Jim Rogers is right. The Fed has failed. They create moral hazard, bail-out stupidity, and "solve" problems by de-basing the currency and promoting inflation.

Wednesday, December 12, 2007

Friday, November 16, 2007

Sunday, October 28, 2007

Sub-Prime Housing Crisis

"As for the idiots who lent (often without down payments or documents) to the idiots who bought speculative homes, they deserve to lose. People must understand this simple fact."

from: "Making Sense of the Current Capital Markets Disarray"

"Our pressing danger is not that many folks will go broke, but rather that opportunistic politicians will bail them out and insulate them from past and future folly."

from: "House of Pain: Why Failure is Important"

from: "Making Sense of the Current Capital Markets Disarray"

"Our pressing danger is not that many folks will go broke, but rather that opportunistic politicians will bail them out and insulate them from past and future folly."

from: "House of Pain: Why Failure is Important"

Friday, September 7, 2007

Sub-Prime Mortgage Fallout

Subscribe to:

Posts (Atom)